MoneyGram 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

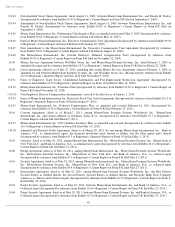

Table of Contents

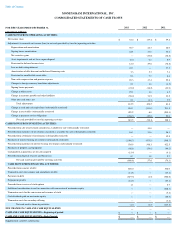

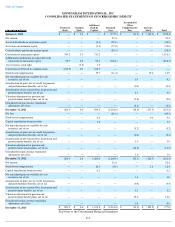

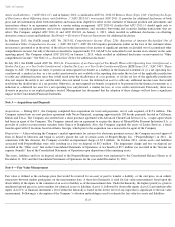

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2013

2012

2011

(Amounts in millions)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income (loss)

$

52.4

$

(49.3

)

$

59.4

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

Depreciation and amortization

50.7

44.3

46.0

Signing bonus amortization

42.8

33.6

32.6

Net securities gains —

(

10.0

)

(32.8

)

Asset impairments and net losses upon disposal

(0.4

)

0.5

6.9

Provision for deferred income taxes

12.0

29.8

(72.8

)

Loss on debt extinguishment

45.3

—

37.5

Amortization of debt discount and deferred financing costs

3.3

5.7

7.4

Provision for uncollectible receivables

9.6

7.5

6.6

Non-cash compensation and pension expense

20.3

17.4

25.8

Changes in foreign currency translation adjustments

0.9

1.6

(4.2

)

Signing bonus payments

(45.0

)

(36.2

)

(33.0

)

Change in other assets

29.2

3.6

4.5

Change in accounts payable and other liabilities

(58.4

)

31.5

33.2

Other non-cash items, net

2.2

(1.1

)

3.9

Total adjustments

112.5

128.2

61.6

Change in cash and cash equivalents (substantially restricted)

454.7

(111.0

)

291.8

Change in receivables (substantially restricted)

429.2

6.0

(245.3

)

Change in payment service obligations

(438.3

)

(30.0

)

20.6

Net cash provided by (used in) operating activities

610.5

(56.1

)

188.1

CASH FLOWS FROM INVESTING ACTIVITIES:

Proceeds from sale of investment classified as available-for-sale (substantially restricted) —

10.0

—

Proceeds from maturities of investments classified as available-for-sale (substantially restricted)

16.5

31.6

56.3

Proceeds from settlement of investments (substantially restricted) —

—

32.8

Purchases of interest-bearing investments (substantially restricted)

(1,098.7

)

(473.5

)

(540.3

)

Proceeds from maturities of interest-bearing investments (substantially restricted)

536.9

548.1

422.5

Purchases of property and equipment

(48.8

)

(59.6

)

(44.2

)

Cash paid for acquisitions, net of cash acquired

(15.4

)

—

(

0.1

)

Proceeds from disposal of assets and businesses

0.7

1.0

2.7

Net cash (used in) provided by investing activities

(608.8

)

57.6

(70.3

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of debt

850.0

—

536.0

Transaction costs for issuance and amendment of debt

(11.8

)

—

(

17.1

)

Payments on debt

(819.5

)

(1.5

)

(366.6

)

Prepayment penalty

(21.5

)

—

(

23.2

)

Proceeds from exercise of stock options

1.1

—

0.7

Additional consideration issued in connection with conversion of mezzanine equity —

—

(

218.3

)

Transaction costs for the conversion and issuance of stock —

—

(

5.4

)

Cash dividends paid on mezzanine equity —

—

(

20.5

)

Transaction costs for secondary offering —

—

(

3.4

)

Net cash used in financing activities

(1.7

)

(1.5

)

(117.8

)

NET CHANGE IN CASH AND CASH EQUIVALENTS —

—

—

CASH AND CASH EQUIVALENTS—Beginning of period

$

—

$

—

$

—

CASH AND CASH EQUIVALENTS—End of period

$

—

$

—

$

—

Supplemental cash flow information: