MoneyGram 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

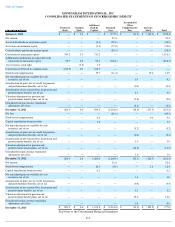

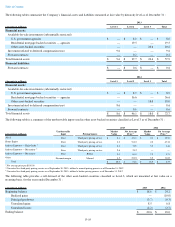

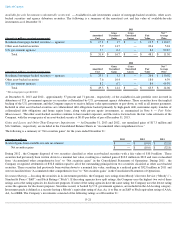

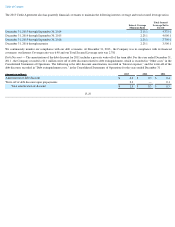

The following tables summarize the Company’s financial assets and liabilities measured at fair value by hierarchy level as of December 31 :

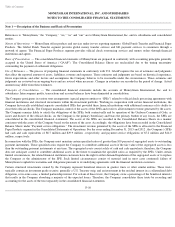

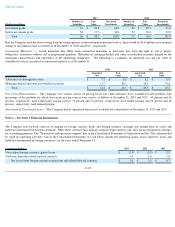

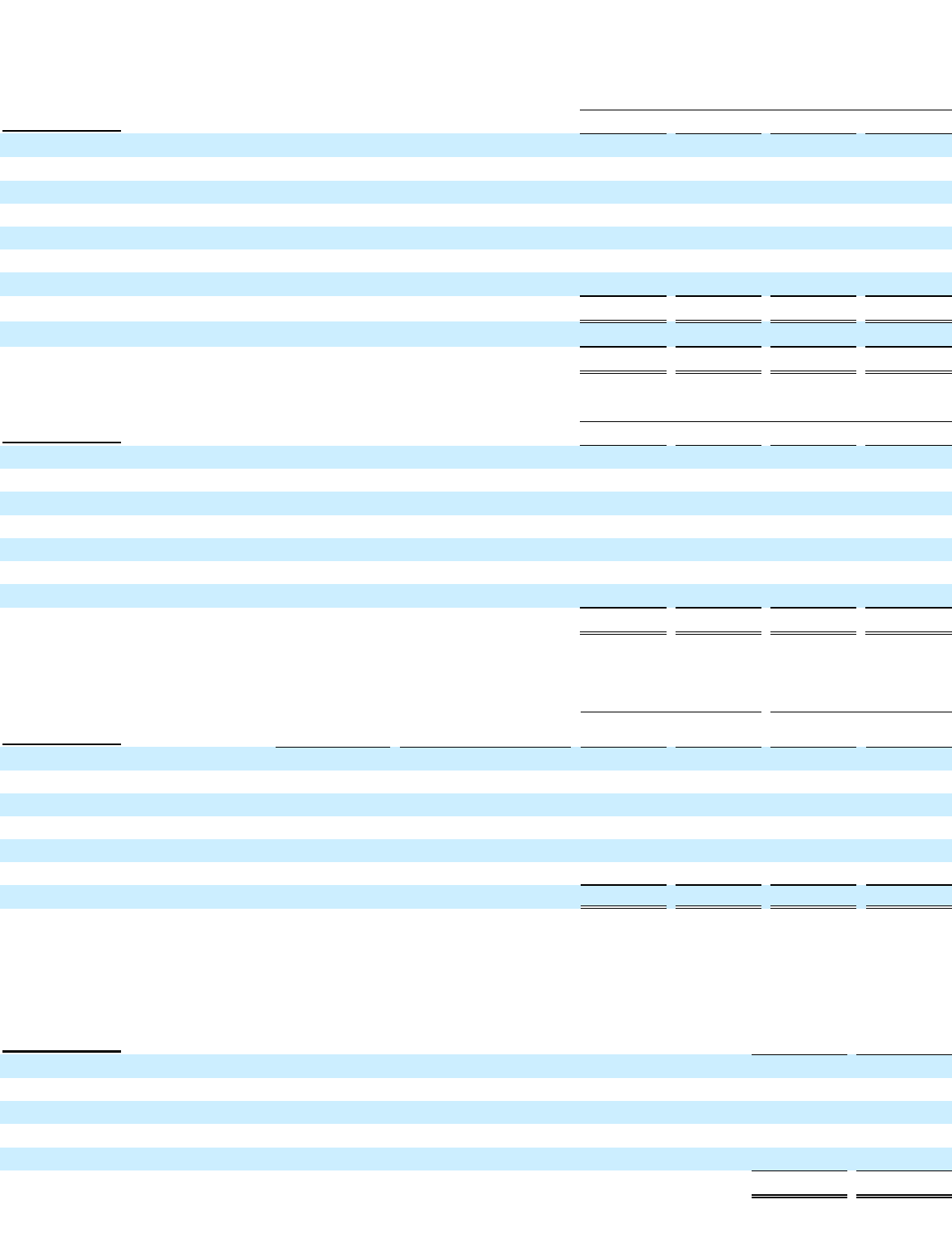

The following table is a summary of the unobservable inputs used in other asset-backed securities classified as Level 3 as of December 31 :

(1)

Net average price per $100.00

(2)

Converted to a third party pricing service as of September 30, 2013; utilized a manual pricing process as of December 31, 2012

(3)

Converted to a third party pricing service as of September 30, 2013; utilized a broker pricing process as of December 31, 2012

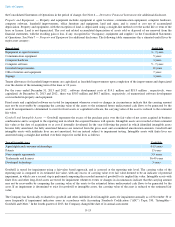

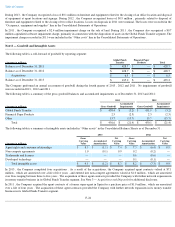

The following table provides a roll-forward of the other asset-

backed securities classified as Level 3, which are measured at fair value on a

recurring basis, for the years ended December 31 :

F-19

2013

(Amounts in millions) Level 1

Level 2

Level 3

Total

Financial assets:

Available-for-sale investments (substantially restricted):

U.S. government agencies

$

—

$

8.0

$

—

$

8.0

Residential mortgage-backed securities — agencies

—

19.5

—

19.5

Other asset-backed securities

—

—

20.6

20.6

Investment related to deferred compensation trust

9.6

—

—

9.6

Forward contracts

—

0.2

—

0.2

Total financial assets

$

9.6

$

27.7

$

20.6

$

57.9

Financial liabilities:

Forward contracts

$

—

$

0.6

$

—

$

0.6

2012

(Amounts in millions) Level 1

Level 2

Level 3

Total

Financial assets:

Available-for-sale investments (substantially restricted):

U.S. government agencies

$

—

$

8.9

$

—

$

8.9

Residential mortgage-backed securities — agencies

—

36.6

—

36.6

Other asset-backed securities

—

—

18.0

18.0

Investment related to deferred compensation trust

8.6

—

—

8.6

Forward contracts

—

0.6

—

0.6

Total financial assets

$

8.6

$

46.1

$

18.0

$

72.7

2013

2012

(Amounts in millions) Unobservable

Input

Pricing Source

Market

Value

Net Average

Price

(1)

Market

Value

Net Average

Price

(1)

Alt-A Price

Third party pricing service

$

0.1

$

17.01

$

0.1

$

12.50

Home Equity Price

Third party pricing service

0.2

51.87

0.2

47.30

Indirect Exposure — High Grade

(2)

Price

Third party pricing service

8.2

7.90

3.9

3.46

Indirect Exposure — Mezzanine

(3)

Price

Third party pricing service

2.6

2.12

—

—

Indirect Exposure — Mezzanine Price

Broker

5.0

6.01

7.9

3.71

Other Discount margin

Manual

4.5

23.85

5.9

31.69

Total

$

20.6

$

5.24

$

18.0

$

4.39

(Amounts in millions) 2013

2012

Beginning balance

$

18.0

$

24.2

Realized gains

—

(

10.0

)

Principal paydowns

(3.7

)

(0.3

)

Unrealized gains

8.5

6.8

Unrealized losses

(2.2

)

(2.7

)

Ending balance

$

20.6

$

18.0