MoneyGram 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

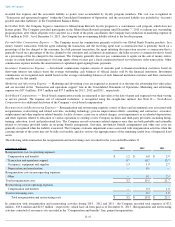

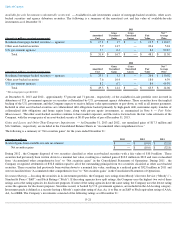

Assets and Liabilities

, (“ASU 2011-11”) and in January 2013, a clarification ASU No. 2013-01

Balance Sheet (Topic 210): Clarifying the Scope

of Disclosures about Offsetting Assets and Liabilities , (“ASU 2013-01”) was issued. ASU 2011-

11 provides for additional disclosures of both

gross and net information about both instruments and transactions eligible for offset in the statement of financial position and instruments and

transactions subject to an agreement similar to a master netting arrangement. ASU 2013-01 clarifies that ASU 2011-

11 should apply only to

derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions that are

offset. The Company adopted ASU 2011-11 and ASU 2013-

01 on January 1, 2013, which resulted in additional disclosures on offsetting

derivative contract assets and liabilities. See Note 6 — Derivative Financial Instruments for additional disclosure.

In February 2013, the FASB issued ASU No. 2013-02,

Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income

, (“ASU 2013-02”). ASU 2013-

02 requires presentation (either on the face of the statement where

net income is presented or in the notes) of the effects on the line items of net income of significant amounts reclassified out of accumulated other

comprehensive income, but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same

reporting period. The Company adopted ASU 2013-

02 on January 1, 2013, which resulted in additional disclosures on movements in "Other

comprehensive income." See Note 11 — Stockholders' Deficit for additional disclosure.

In July 2013, the FASB issued ASU No. 2013-11,

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a

Similar Tax Loss, or a Tax Credit Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (EITF Issue 13-

C; "ASC 740"). These

changes to ASC 740 require an entity to present an unrecognized tax benefit as a liability in the financial statements if (i) a net operating loss

carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date under the tax law of the applicable jurisdiction

to settle any additional income taxes that would result from the disallowance of a tax position, or (ii) the tax law of the applicable jurisdiction

does not require the entity to use, and the entity does not intend to use, the deferred tax asset to settle any additional income taxes that would

result from the disallowance of a tax position. Otherwise, an unrecognized tax benefit is required to be presented in the financial statements as a

reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward. Previously, there was

diversity in practice as no explicit guidance existed. Management has determined that the adoption of these changes will not have a significant

impact on the Consolidated Financial Statements.

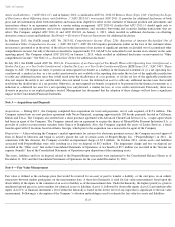

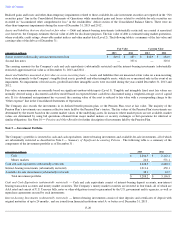

Note 3 — Acquisitions and Disposals

Acquisitions

— During 2013 , the Company completed four acquisitions for total cash payments, net of cash acquired, of $15.4 million

. The

Company entered into an asset purchase agreement with Nexxo Financial, acquiring approximately 200

kiosks primarily located in California,

Illinois and Texas. The Company also entered into a share purchase agreement with Advanced ChronoCash Services S.A., a super-

agent which

had been an agent of the Company. The Company entered into an agreement to acquire the shares of MoneyGlobe Payment Institution S.A., a

provider of cash-to-

account money transfers from Greece to Bangladesh. Also, the Company acquired the assets of Latino Services, a funds

transfer agent with 10 locations based in Atlanta, Georgia, which prior to the acquisition was a non-exclusive agent of the Company.

Disposition

— After evaluating the Company’

s market opportunity for certain of its electronic payment services, the Company received approval

from its Board of Directors and began to actively pursue the sale of certain assets of PropertyBridge, Inc. (“PropertyBridge”) in 2011

. In

connection with this decision, the Company recorded an impairment charge of $2.3 million

. In October 2011, certain assets and liabilities

associated with PropertyBridge were sold, resulting in a loss on disposal of $0.3 million

. The impairment charge and loss on disposal are

recorded in the “Other costs” line in the Consolidated Statements of Operations. A tax benefit of $9.7 million

was recorded in the "Income tax

expense (benefit)" line of the Consolidated Statements of Operations upon disposition of the remaining assets.

The assets, liabilities and loss on disposal related to the PropertyBridge transaction were immaterial to the Consolidated Balance Sheets as of

December 31, 2011 and the Consolidated Statements of Operations for the year ended December 31, 2011 .

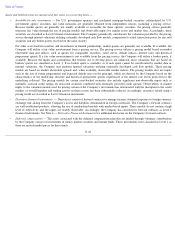

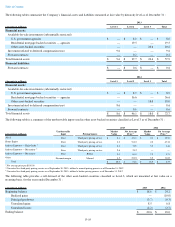

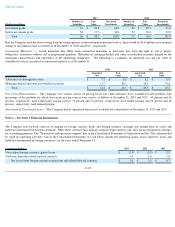

Note 4 — Fair Value Measurement

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability, or the exit price, in an orderly

transaction between market participants on the measurement date. A three-

level hierarchy is used for fair value measurements based upon the

observability of the inputs to the valuation of an asset or liability as of the measurement date. Under the hierarchy, the highest priority is given to

unadjusted quoted prices in active markets for identical assets or liabilities (Level 1), followed by observable inputs (Level 2) and unobservable

inputs (Level 3). A financial instrument’

s level within the hierarchy is based on the lowest level of any input that is significant to the fair value

measurement. Following is a description of the Company’s valuation methodologies used to estimate the fair value for assets and liabilities:

F-17