MoneyGram 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lien notes and for general corporate purposes. The Revolving Credit Facility includes a sub-

facility that permits the Company to request the

issuance of letters of credit up to an aggregate amount of $50.0 million , with borrowings available for general corporate purposes.

The 2013 Credit Agreement is secured by substantially all of the non-

financial assets of the Company and its material domestic subsidiaries that

guarantee the payment and performance of the Company’s obligations under the 2013 Credit Agreement.

The Company may elect an interest rate under the 2013 Credit Agreement at each reset period based on the BOA prime bank rate or the

Eurodollar rate. The interest rate election may be made individually for the Term Credit Facility and each draw under the Revolving Credit

Facility. The interest rate will be either the “alternate base rate” (calculated in part based on the BOA prime rate) plus either 200 or 225

basis

points (depending on the Company's secured leverage ratio or total leverage ratio, as applicable, at such time) or the Eurodollar rate plus either

300 or 325

basis points (depending on the Company's secured leverage ratio or total leverage ratio, as applicable, at such time). In connection

with the initial funding under the 2013 Credit Agreement, the Company elected the Eurodollar rate as its primary interest basis. Under the terms

of the 2013 Credit Agreement, the minimum interest rate applicable to Eurodollar borrowings under the Term Credit Facility is 100

basis points

plus the applicable margins previously referred to in this paragraph.

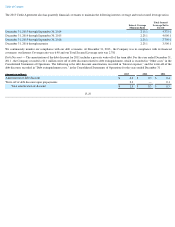

Fees on the daily unused availability under the Revolving Credit Facility are 50 basis points. As of December 31, 2013 , the Company had

$0.4

million of outstanding letters of credit and no borrowings under the Revolving Credit Facility, leaving $124.6 million of availability thereunder.

2013 Note Repurchase — In connection with the Company's entry into the 2013 Credit Agreement, the Company purchased all

$325.0 million

of the outstanding second lien notes for a purchase price equal to 106.625 percent

of the principal amount purchased, plus accrued and unpaid

interest, which was funded with a portion of the net proceeds from the 2013 Credit Agreement described above. Following the closing of the

transaction, the second lien notes were canceled, and no second lien notes remain outstanding.

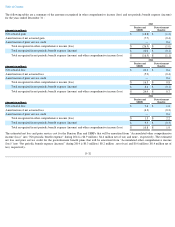

The entry into the 2013 Credit Agreement and the purchase of the second lien notes was accounted for principally as a debt extinguishment with

a partial modification of debt, in accordance with ASC 470 — Debt . Under debt extinguishment accounting, the Company expensed the pro-

rata

portion of deferred financing costs and debt discount costs related to the extinguished debt balance. For the debt balance classified as a

modification, the Company was required to amortize the pro-

rata portion of the deferred financing costs and unamortized debt discount from the

2011 Credit Agreement over the terms of the 2013 Credit Agreement. Additionally, the Company expensed the pro-

rata portion of the financing

costs related to the 2013 Credit Agreement as third party costs in connection with the modification of debt.

Debt Covenants and Other Restrictions

—

Borrowings under the 2013 Credit Agreement are subject to various limitations that restrict the

Company’

s ability to: incur additional indebtedness; create or incur additional liens; effect mergers and consolidations; make certain acquisitions

or investments; sell assets or subsidiary stock; pay cash dividends and other restricted payments; and effect loans, advances and certain other

transactions with affiliates.

The terms of our debt agreements place significant limitations on the amount of restricted payments we may make, including dividends on our

common stock. With certain exceptions, we may only make restricted payments in an aggregate amount not to exceed $50.0 million

, subject to

an incremental build-up based on our consolidated net income in future periods.

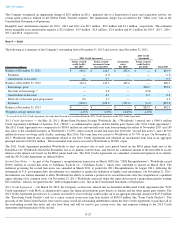

The 2013 Credit Agreement contains various financial and non-

financial covenants. A violation of these covenants could negatively impact the

Company's liquidity by restricting the Company's ability to borrow under the revolving credit facility and/or causing acceleration of amounts due

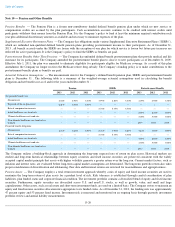

under the credit facilities. The financial covenants in the 2013 Credit Agreement measure leverage, interest coverage and liquidity. Leverage is

measured through a senior secured debt ratio calculated as consolidated indebtedness to consolidated EBITDA, adjusted for certain items such as

net securities gains, stock-

based compensation expense, certain legal settlements and asset impairments, among other items, also referred to as

adjusted EBITDA. This measure is similar, but not identical, to the measure discussed under EBITDA and Adjusted EBITDA .

Interest coverage

is calculated as adjusted EBITDA to net cash interest expense.

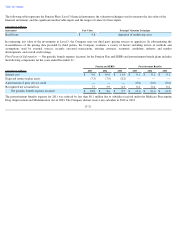

The Company is required to maintain Asset Coverage greater than its payment service obligations. Assets used in the determination of the Asset

Coverage covenant are cash and cash equivalents, cash and cash equivalents (substantially restricted), receivables, net (substantially restricted),

interest-bearing investments (substantially restricted) and available-for-

sale investments (substantially restricted). The Asset Coverage is the

same calculation used for the Assets in Excess of Payment Service Obligations. See Note 2 — Summary of Significant Accounting Policies

for

details of the Assets in Excess of Payment Service Obligations calculation as of December 31, 2013 .

F-26