MoneyGram 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

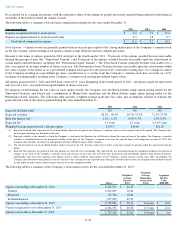

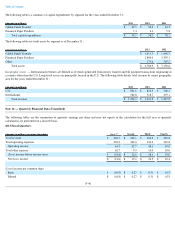

2012 Fiscal Quarters:

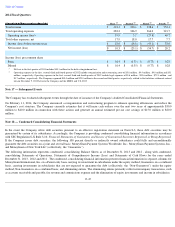

Note 17 — Subsequent Events

The Company has evaluated subsequent events through the date of issuance of the Company's Audited Consolidated Financial Statements.

On February 11, 2014, the Company announced a reorganization and restructuring program to enhance operating efficiencies and reduce the

Company's cost structure. The Company currently estimates that it will incur cash outlays over the next two years of approximately

$30.0

million to $40.0 million in connection with these actions and generate an annual estimated pre-tax cost savings of $15.0 million to

$20.0

million .

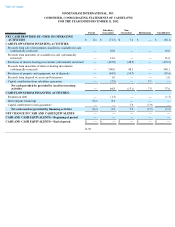

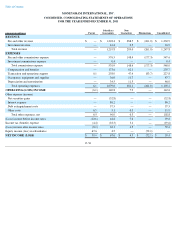

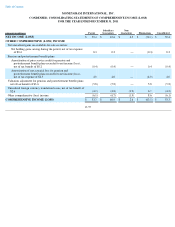

Note 18 — Condensed Consolidating Financial Statements

In the event the Company offers debt securities pursuant to an effective registration statement on Form S-

3, these debt securities may be

guaranteed by certain of its subsidiaries. Accordingly, the Company is providing condensed consolidating financial information in accordance

with SEC Regulation S-X Rule 3-10,

Financial Statements of Guarantors and Issuers of Guaranteed Securities Registered or Being Registered.

If the Company issues debt securities, the following 100 percent

directly or indirectly owned subsidiaries could fully and unconditionally

guarantee the debt securities on a joint and several basis: MoneyGram Payment Systems Worldwide, Inc.; MoneyGram Payment Systems, Inc.;

and MoneyGram of New York LLC (collectively, the “Guarantors”).

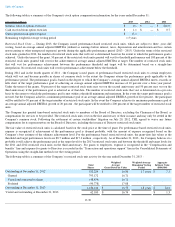

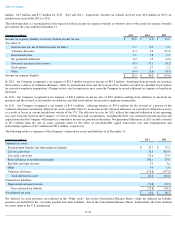

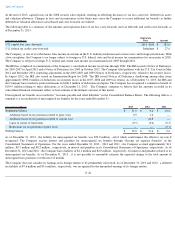

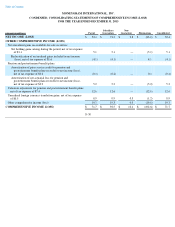

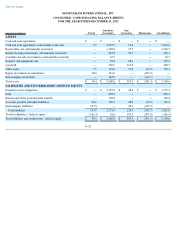

The following information represents condensed, consolidating Balance Sheets as of December 31, 2013 and 2012

, along with condensed,

consolidating Statements of Operations, Statements of Comprehensive Income (Loss) and Statements of Cash Flows for the years ended

December 31, 2013 , 2012 and 2011

. The condensed, consolidating financial information presents financial information in separate columns for

MoneyGram International, Inc. on a Parent-

only basis carrying its investment in subsidiaries under the equity method; Guarantors on a combined

basis, carrying investments in subsidiaries that are not expected to guarantee the debt (collectively, the “Non-Guarantors”)

under the equity

method; Non-

Guarantors on a combined basis; and eliminating entries. The eliminating entries primarily reflect intercompany transactions, such

as accounts receivable and payable, fee revenue and commissions expense and the elimination of equity investments and income in subsidiaries.

F-47

(Amounts in millions, except per share data)

First

(2)

Second

(2)

Third

(2)

Fourth

(2)

Total revenue

$

318.1

$

330.1

$

338.6

$

354.4

Total operating expenses

282.2

326.9

366.0

313.7

Operating income (loss)

35.9

3.2

(27.4

)

40.7

Total other expenses, net

17.9

18.0

17.7

7.7

Income (loss) before income taxes

$

18.0

$

(14.8

)

$

(45.1

)

$

33.0

Net income (loss)

$

10.3

$

(25.1

)

$

(54.7

)

$

20.2

Income (loss) per common share

Basic

$

0.14

$

(0.35

)

$

(0.77

)

$

0.28

Diluted

$

0.14

$

(0.35

)

$

(0.77

)

$

0.28

(1)

Net loss in the first quarter of

2013 includes $45.3 million

for the debt extinguishment loss.

(2)

Operating expenses in the first, second, third and fourth quarter of 2012 include reorganization and restructuring costs of $5.8 million , $4.4 million , $4.0 million and

$5.1

million , respectively. Operating expenses in the first, second, third and fourth quarter of 2012 include legal expenses of $3.6 million , $39.6 million , $72.3 million

, and

$3.7 million , respectively. The Company expensed $30.0 million and $70.0 million

in the second and third quarter, respectively, related to the forfeiture settlement entered

into on November 9, 2012 between the Company and the MDPA and U.S. DOJ.