MoneyGram 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

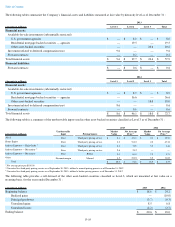

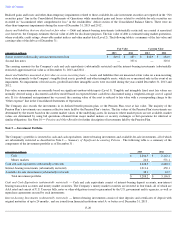

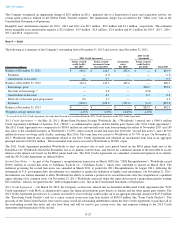

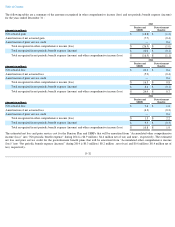

As of December 31, 2013 and 2012 , the Company had $129.0 million and $173.0 million

, respectively, of outstanding notional amounts

relating to its forward contracts. As of December 31, 2013 and 2012

, the Company reflected the following fair values of derivative forward

contract instruments in its Consolidated Balance Sheets:

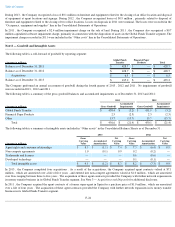

The Company's forward contracts are primarily executed with counterparties governed by an International Swaps and Derivatives Association

agreement that generally include standard netting arrangements. Hence, asset and liability positions from forward contracts and all other foreign

exchange transactions with the same counterparty are net settled upon maturity.

The Company is exposed to credit loss in the event of non-

performance by counterparties to its derivative contracts. The Company actively

monitors its exposure to credit risk through the use of credit approvals and credit limits, and by selecting major international banks and financial

institutions as counterparties. Collateral generally is not required of the counterparties or of the Company. In the unlikely event the counterparty

fails to meet the contractual terms of the derivative contract, the Company’

s risk is limited to the fair value of the instrument. The Company has

not had any historical instances of non-performance by any counterparties, nor does it anticipate any future instances of non-performance.

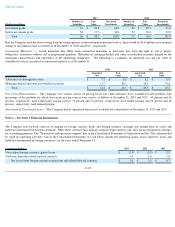

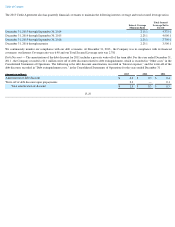

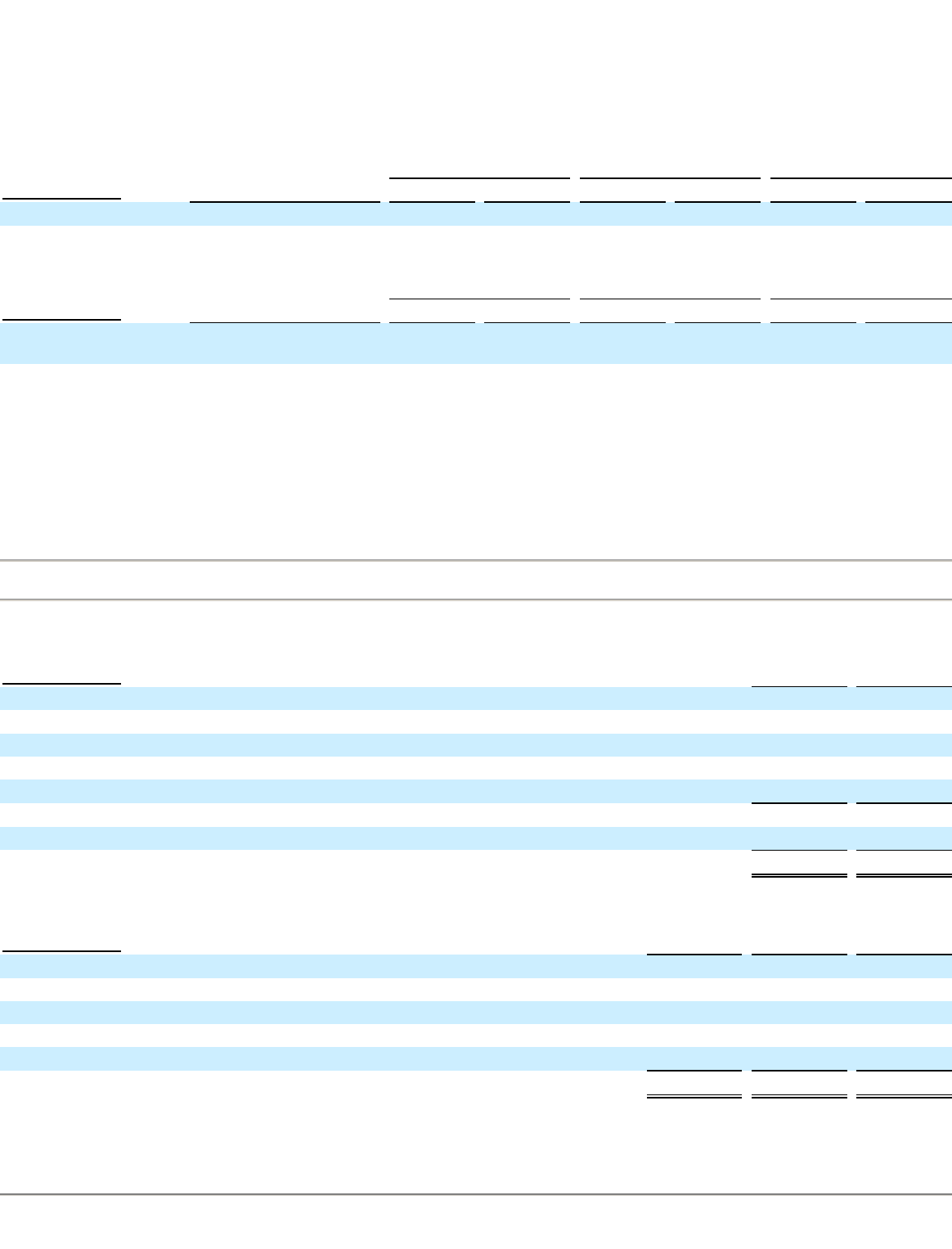

Note 7 — Property and Equipment

The following table is a summary of property and equipment as of December 31 :

The following table is a summary of depreciation expense for the years ended December 31 :

At December 31, 2013 and 2012 , there was $14.9 million and $7.0 million

, respectively, of property and equipment that had been received by

the Company and included in “Accounts payable and other liabilities” in the Consolidated Balance Sheets.

F-23

Gross Amount of Recognized

Assets

Gross Amount of Offset

Net Amount of Assets

Presented in the Consolidated

Balance Sheets

(Amounts in millions) Balance Sheet Location

2013

2012

2013

2012

2013

2012

Forward contracts Other assets

$

0.4

$

0.7

$

(0.2

)

$

(0.1

)

$

0.2

$

0.6

Gross Amount of Recognized

Liabilities

Gross Amount of Offset

Net Amount of Liabilities

Presented in the Consolidated

Balance Sheets

(Amounts in millions) Balance Sheet Location

2013

2012

2013

2012

2013

2012

Forward contracts Accounts payable and other

liabilities

$

(0.8

)

$

(0.1

)

$

0.2

$

0.1

$

(0.6

)

$

—

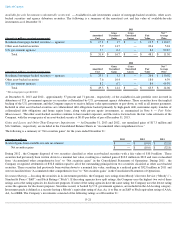

(Amounts in millions) 2013

2012

Computer hardware and software

$

215.8

$

204.5

Signage

90.6

94.5

Equipment at agent locations

74.8

72.1

Office furniture and equipment

33.0

37.5

Leasehold improvements

28.5

26.4

Total property and equipment

442.7

435.0

Accumulated depreciation

(307.9

)

(307.1

)

Total property and equipment, net

$

134.8

$

127.9

(Amounts in millions) 2013

2012

2011

Computer hardware and software

$

23.2

$

20.8

$

21.1

Signage

14.9

12.1

9.6

Equipment at agent locations

4.6

4.3

6.5

Office furniture and equipment

3.8

3.7

4.0

Leasehold improvements

3.5

2.5

3.7

Total depreciation expense

$

50.0

$

43.4

$

44.9