MoneyGram 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

be accounted for as a change in estimate, with the cumulative effect of the change on periods previously reported being reflected in the financial

statements of the period in which the change is made.

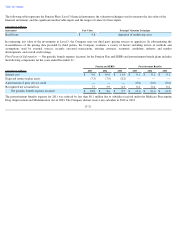

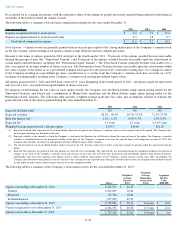

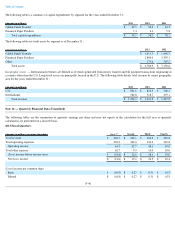

The following table is a summary of stock-based compensation expense for the years ended December 31 :

Stock Options —Option awards are generally granted with an exercise price equal to the closing market price of the Company’

s common stock

on the date of grant. All outstanding stock options contain certain forfeiture and non-compete provisions.

Pursuant to the terms of options granted in 2010 and prior to the fourth quarter 2011 , 50 percent

of the options awarded become exercisable

through the passage of time (the “Time-based Tranche”) and 50 percent

of the options awarded become exercisable upon the achievement of

certain market and performance conditions (the “Performance-based Tranche”). The Time-

based Tranche generally becomes exercisable over a

four -year period in an equal number of shares each year. The Performance-

based Tranche becomes exercisable upon the achievement within

five years of grant of the earlier of (a) a pre-defined common stock price for any period of 20

consecutive trading days, (b) a change in control

of the Company resulting in a pre-defined per share consideration or (c) in the event the Company’

s common stock does not trade on a U.S.

exchange or trading market, resulting in the Company’s common stock meeting pre-defined equity values.

All options granted in 2011 , 2012 and 2013 have a term of 10 years. Beginning in the fourth quarter of 2011 , all options issued are time-

based

and vest over a four -year period in an equal number of shares each year.

For purposes of determining the fair value of stock option awards, the Company uses the Black-

Scholes single option pricing model for the

Time-based Tranches and awards and a combination of Monte-Carlo simulation and the Black-

Scholes single option pricing model for the

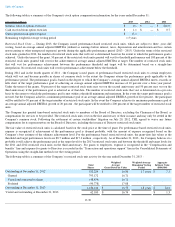

Performance-based Tranches. The following table provides weighted-average grant-

date fair value and assumptions utilized to estimate the

grant-date fair value of the options granted during the years ended December 31 :

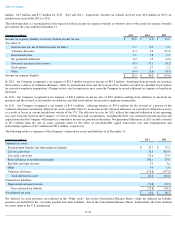

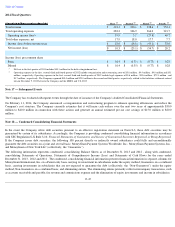

The following table is a summary of the Company’s stock option activity for the year ended December 31, 2013 :

F-38

(Amounts in millions) 2013

2012

2011

Expense recognized related to stock options

$

6.7

$

7.4

$

15.6

Expense recognized related to restricted stock units

4.5

1.8

0.7

Stock-based compensation expense

$

11.2

$

9.2

$

16.3

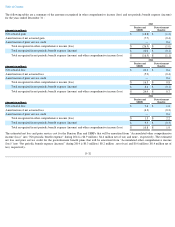

2013

2012

2011

Expected dividend yield

(1)

0%

0%

0%

Expected volatility

(2)

68.2% - 69.0%

69.7%-71.8%

71.3%-72.9%

Risk-free interest rate

(3)

1.1% - 1.2%

0.9%-1.5%

1.3%-2.9%

Expected life

(4)

6.3 years

6.3 years

6.3-6.5 years

Weighted-average grant-date fair value per option $10.51

$10.60

$16.23

(1) Expected dividend yield represents the level of dividends expected to be paid on the Company’

s common stock over the expected term of the option. The Company does

not anticipate declaring any dividends at this time.

(2) Expected volatility is the amount by which the Company’s stock price has fluctuated or will fluctuate during the expected term of the option. The Company’

s expected

volatility is calculated based on the historical volatility of the price of the Company’s common stock since the spin-

off from Viad Corporation on June 30, 2004. The

Company also considers any known or anticipated factors that will likely impact future volatility.

(3) The risk-free interest rate for the Black-

Scholes model is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the

option.

(4)

Expected life represents the period of time that options are expected to be outstanding. The expected life was determined using the simplified method as the pattern of

changes in the value of the Company’

s common stock and exercise activity since late 2007 has been inconsistent and substantially different from historical patterns.

Additionally, there have been minimal stock option exercises which would be representative of the Company’

s normal exercise activity since 2007. Accordingly, the

Company does not believe that historical terms are relevant to the assessment of the expected term of the grant. Based on these factors, the Company does not believe that it

has the ability to make a more refined estimate than the use of the simplified method.

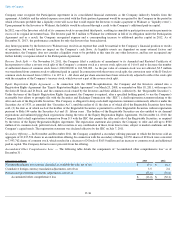

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

($000,000)

Options outstanding at December 31, 2012

4,412,076

$

22.10

Granted

1,012,805

16.84

Exercised

(57,782

)

18.44

Forfeited/Expired

(575,095

)

29.59

Options outstanding at December 31, 2013

4,792,004

$

20.14

6.8 years

$

13.0

Vested or expected to vest at December 31, 2013

4,654,151

$

20.20

6.7 years

$

12.6

Options exercisable at December 31, 2013

1,707,410

$

21.01

5.8 years

$

5.6