MoneyGram 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Risks Related to Ownership of Our Stock

THL owns a substantial percentage of our common stock, and its interests may differ from the interests of our other common stockholders.

As of December 31, 2013

, THL held approximately 62.8 percent of our common shares outstanding. On a fully diluted basis, they held

approximately 50.9 percent of the Company. As a result, THL is able to determine the outcome of matters put to a stockholder vote, including

the ability to elect our directors, determine our corporate and management policies, including compensation of our executives, and determine,

without the consent of our other stockholders, the outcome of any corporate action submitted to our stockholders for approval, including

potential mergers, acquisitions, asset sales and other significant corporate transactions. THL also has sufficient voting power to amend our

organizational documents. We cannot provide assurance that the interests of THL will coincide with the interests of other holders of our common

stock. THL’

s concentration of ownership may discourage, delay or prevent a change in control of our Company, which could deprive our

stockholders of an opportunity to receive a premium for their common stock as part of a sale of our Company and might reduce our share price.

In view of their significant ownership stake in the Company, THL has appointed three members to our Board of Directors. Our current Board

consists of nine directors, three of which have been appointed by THL, one of which is our Chief Executive Officer, and five of which are

independent. Our Certificate of Incorporation provides that, as long as the Investors have a right to designate directors to our Board, THL shall

have the right to designate two to four directors who shall each have equal votes and who shall have such number of votes equal to the number

of directors as is proportionate to the Investors’ common stock ownership, calculated on a fully-

converted basis, as if all of the shares of D Stock

were converted to common shares. Therefore, each director designated by THL will have multiple votes and each other director will have one

vote.

We have significant overhang of salable common stock and D Stock held by the Investors relative to the public float of our common stock.

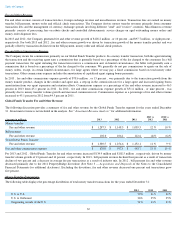

The trading market for our common stock was first established in June 2004. The public float in that market now consists of approximately

62.3

million shares issued and 58.0 million shares outstanding as of December 31, 2013

. In accordance with the terms of the Registration Rights

Agreement entered into between us and the Investors at the closing of the 2008 Recapitalization, we have an effective registration statement on

Form S-

3 that permits the offer and sale by the Investors of all of the common stock or D Stock currently held by the Investors. The Investors

have sold 10.9 million shares of common stock pursuant to this registration statement, which leaves the Investors with 50.0 million shares of

common stock that can still be sold pursuant to the registration statement. The registration statement also permits us to offer and sell up to

$500

million

of our common stock, preferred stock, debt securities or any combination of these securities, from time to time, subject to market

conditions and our capital needs. Sales of a substantial number of shares of our common stock, or the perception that significant sales could

occur (particularly if sales are concentrated in time or amount), may depress the trading price of our common stock.

Our charter documents and Delaware law contain provisions that could delay or prevent an acquisition of the Company, which could inhibit

your ability to receive a premium on your investment from a possible sale of the Company.

Our charter documents contain provisions that may discourage third parties from seeking to acquire the Company. These provisions and specific

provisions of Delaware law relating to business combinations with interested stockholders may have the effect of delaying, deterring or

preventing certain business combinations, including a merger or change in control of the Company. Some of these provisions may discourage a

future acquisition of the Company even if stockholders would receive an attractive value for their shares or if a significant number of our

stockholders believed such a proposed transaction to be in their best interests. As a result, stockholders who desire to participate in such a

transaction may not have the opportunity to do so.

Our board of directors has the power to issue series of preferred stock and to designate the rights and preferences of those series, which

could adversely affect the voting power, dividend, liquidation and other rights of holders of our common stock.

Under our certificate of incorporation, our board of directors has the power to issue series of preferred stock and to designate the rights and

preferences of those series. Therefore, our board of directors may designate a new series of preferred stock with the rights, preferences and

privileges that the board of directors deems appropriate, including special dividend, liquidation and voting rights. The creation and designation

of a new series of preferred stock could adversely affect the voting power, dividend, liquidation and other rights of holders of our common stock

and, possibly, any other class or series of stock that is then in existence.

22