MoneyGram 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

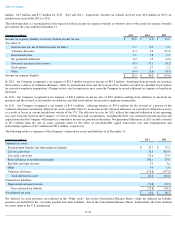

segment. However, investment revenue is allocated to each segment based on the average investable balances generated by that segment’

s sale

of payment instruments during the period. Net securities gains are not allocated to the segments as the investment portfolio is managed at a

consolidated level. While the derivatives portfolio is also managed on a consolidated level, each derivative instrument is utilized in a manner that

can be identified to a particular segment.

Also excluded from net operating income for Global Funds Transfer and Financial Paper Products are interest and other expenses related to the

Company’s credit agreements, items related to the Company’s preferred stock, operating income from businesses categorized as “Other,”

certain

pension and benefit obligation expenses, director deferred compensation plan expenses, executive severance and related costs, certain legal and

corporate costs not related to the performance of the segments.

Unallocated expenses in 2013 include $2.5 million

of legal expenses for the settlement in connection with MDPA/U.S. DOJ investigation and

the shareholder litigation, $1.5 million of severance and related costs from executive terminations as well as other net corporate costs of

$11.6

million not allocated to the segments. Unallocated expenses in 2012 include $119.2 million

of legal expenses for the settlement in connection

with MDPA/U.S. DOJ investigation and the shareholder litigation, $1.0 million

of severance and related costs from executive terminations as

well as other net corporate costs of $7.6 million not allocated to the segments. Unallocated expenses in 2011 include $4.8 million

of legal

settlements and related costs for securities litigation associated with the Company's 2011 Recapitalization, $0.3 million

of asset impairments and

other net corporate costs of $4.8 million not allocated to the segments.

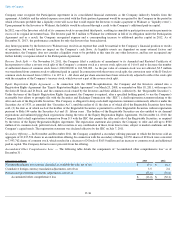

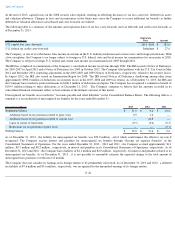

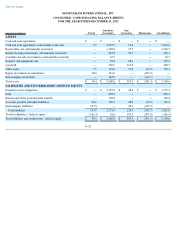

The following table is a summary of the total revenue by segment for the years ended December 31 :

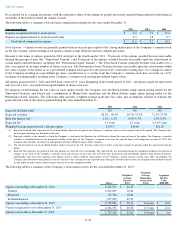

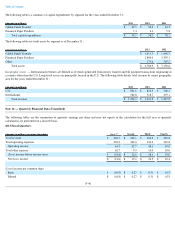

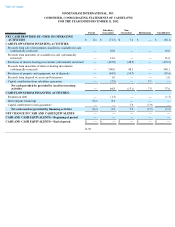

The following table is a summary of the operating income by segment and detail of income (loss) before income taxes for the years ended

December 31 :

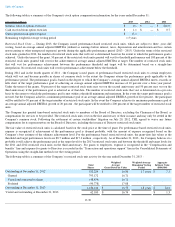

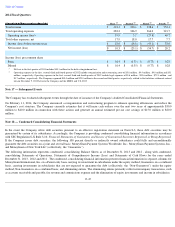

The following table is a summary of depreciation and amortization expense by segment for the years ended December 31 :

F-45

(Amounts in millions) 2013

2012

2011

Global Funds Transfer revenue

Money transfer revenue

$

1,287.8

$

1,149.1

$

1,040.1

Bill payment revenue

102.0

106.1

112.6

Total Global Funds Transfer revenue

1,389.8

1,255.2

1,152.7

Financial Paper Products revenue

Money order revenue

55.1

57.5

60.4

Official check revenue

28.9

27.0

32.9

Total Financial Paper Products revenue

84.0

84.5

93.3

Other revenue

0.6

1.5

1.8

Total revenue

$

1,474.4

$

1,341.2

$

1,247.8

(Amounts in millions) 2013

2012

2011

Global Funds Transfer operating income

$

162.6

$

149.6

$

124.8

Financial Paper Products operating income

30.9

32.7

29.2

Total segment operating income

193.5

182.3

154.0

Other operating loss

(15.6

)

(129.9

)

(11.4

)

Total operating income

177.9

52.4

142.6

Net securities gains —

(

10.0

)

(32.8

)

Interest expense

47.3

70.9

86.2

Debt extinguishment costs

45.3

—

37.5

Other costs —

0.4

11.9

Income (loss) before income taxes

$

85.3

$

(8.9

)

$

39.8

(Amounts in millions) 2013

2012

2011

Global Funds Transfer

$

46.5

$

40.7

$

40.5

Financial Paper Products

3.9

3.5

5.4

Other

0.3

0.1

0.1

Total depreciation and amortization

$

50.7

$

44.3

$

46.0