MoneyGram 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

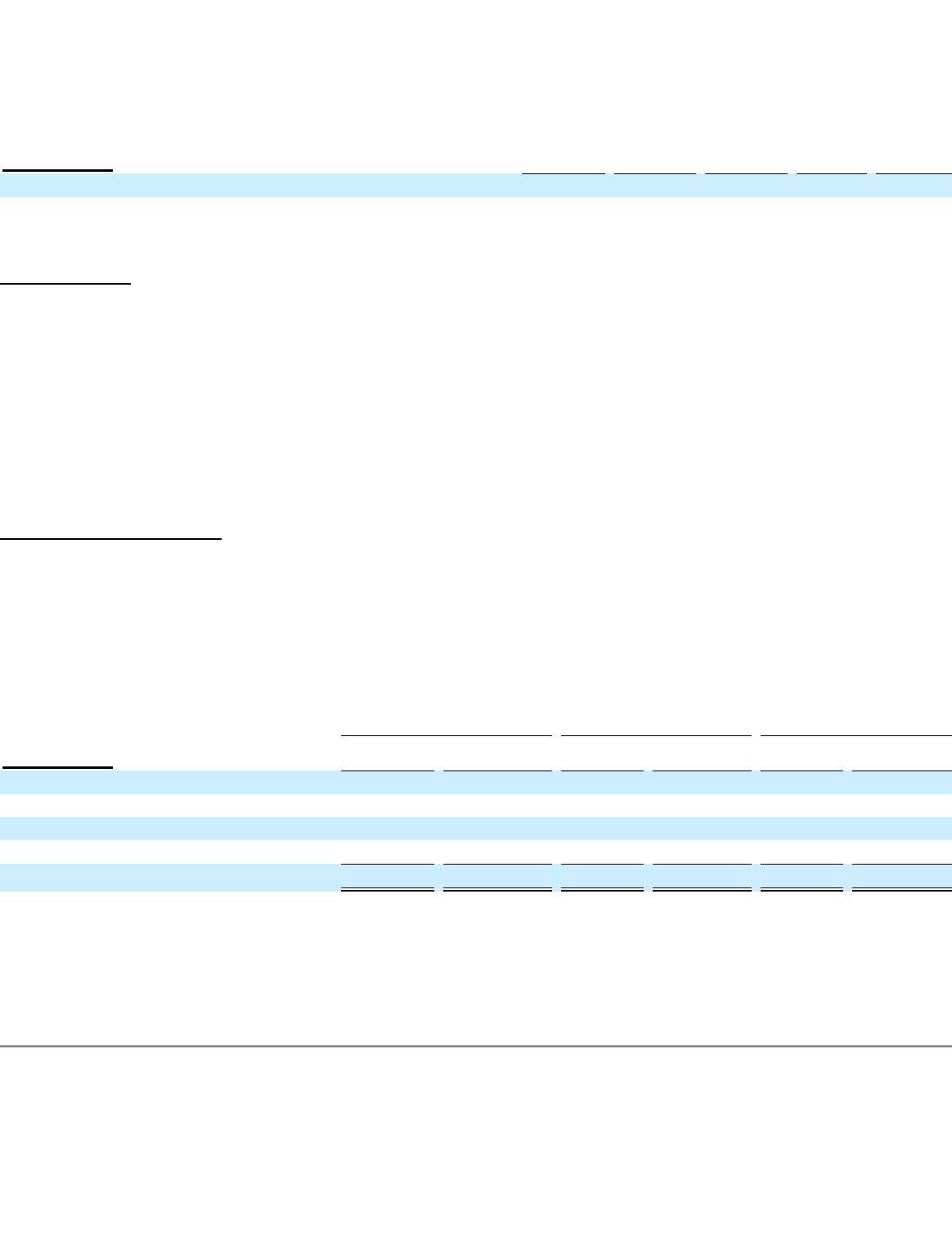

Investment Revenue Analysis

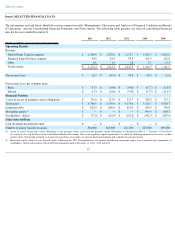

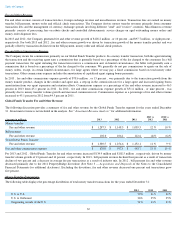

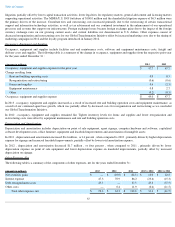

The following discussion provides a summary of the Company's investment revenue and investment commission expense for the years ended

December 31 :

(1)

Commissions are generated from the average outstanding cash balances of official checks sold.

Investment Revenue

Investment revenue consists primarily of interest income generated through the investment of cash balances received from the sale of official

checks, money orders and other payment instruments. These cash balances are available to us for investment until the payment instrument is

presented for payment. Investment revenue varies depending on the level of investment balances and the yield on our investments.

Investment revenue in 2013 increased $5.0 million , or 40 percent , when compared to 2012

, due to an increase in income received on our cost

recovery securities and a shift in investment allocation to longer term, higher yielding investments. Also partially offsetting the increase were

lower average investment balances from the run-off of certain official check financial institution customers terminated in prior periods.

Investment revenue in 2012 decreased $4.3 million , or 25 percent , when compared to 2011

. Lower prevailing yields earned on our investment

portfolio, a decline in income received on our cost recovery securities and valuation adjustments related to private equity securities drove a

substantial portion of the decrease. Lower average investment balances from the run-

off of certain official check financial institution customers

terminated in prior periods also contributed to the decline.

Investment Commissions Expense

Investment commissions expense consists of amounts paid to financial institution official check customers based on short-

term interest rate

indices multiplied by the average outstanding cash balances of official checks sold by that financial institution. Throughout 2013

, investment

commissions expense increased $0.1 million , or 33 percent , when compared to 2012 , while investment commissions expense in

2012

decreased $0.1 million , or 25 percent , when compared to 2011 .

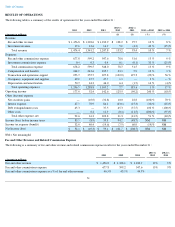

Operating Expenses

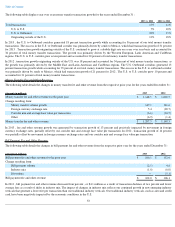

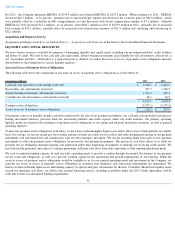

The following table is a summary of the operating expenses for the years ended December 31 :

Included in the 2012

expenses were the legal expenses incurred for the settlement related to the MDPA/U.S. DOJ investigation and shareholder

litigation, which accounted for $119.2 million , or nine percent

, of total revenue, and were recorded in the "Transaction and operations support"

line item. In 2013 , total operating expenses as a percentage of total revenue was 42 percent , which was an improvement from 51 percent

in

2012 , or flat, when considering the legal expenses for the MDPA/U.S. DOJ and shareholder litigation. In 2011

, total operating expenses as a

percentage of total revenue was 45 percent , as a result of costs incurred for the 2011 Recapitalization.

35

(Dollars in millions) 2013

2012

2011

2013 vs

2012

2012 vs 2011

Investment revenue

$

17.6

$

12.6

$

16.9

40

%

(25

)%

Investment commissions expense

(1)

0.4

0.3

0.4

33

%

(25

)%

2013

2012

2011

(Dollars in millions) Dollars

Percent of Total

Revenue

Dollars

Percent of Total

Revenue

Dollars

Percent of Total

Revenue

Compensation and benefits

$

264.9

18

%

$

241.6

18

%

$

235.7

19

%

Transaction and operations support

253.7

17

%

355.7

27

%

227.8

18

%

Occupancy, equipment and supplies

49.0

3

%

47.7

3

%

47.7

4

%

Depreciation and amortization

50.7

4

%

44.3

3

%

46.0

4

%

Total operating expenses

$

618.3

42

%

$

689.3

51

%

$

557.2

45

%