MoneyGram 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Receivables

—

We have credit exposure to receivables from our agents through the money transfer and money order settlement process. These

receivables originate from independent agents who collect funds from consumers who are transferring money or buying money orders, and

agents who receive proceeds from us in anticipation of payment to the recipients of money transfers. Agents typically have from one to three

days to remit the funds, with longer remittance schedules granted to certain agents on a limited basis. The Company has a credit risk

management function that conducts the underwriting of credit on new agents as well as conducting credit surveillance on all agents to monitor

their financial health and the history of settlement activity with us. The Company’

s credit risk management function also maintains daily contact

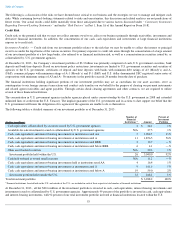

with agents, and performs a collection function. For the twelve months ended December 31, 2013

, our annual credit losses from agents, as a

percentage of total fee and other revenue, was less than 1 percent . As of December 31, 2013

, we had credit exposure to our agents of

approximately $484.1 million in the aggregate spread across 11,355 agents, of which three agents owed us in excess of $15.0 million.

We also have credit exposure to receivables from our financial institution customers for business conducted by the Financial Paper Products

segment. Financial institutions will collect proceeds for official checks and money orders and remit those proceeds to us. We actively monitor

the credit risk associated with financial institutions such as banks and credit unions, and have not incurred any losses associated with the failure

or merger of any bank or non-bank financial institution customer. As of December 31, 2013

, we had a credit exposure to our official check

financial institution customers of approximately $282.0 million in the aggregate spread across 1,103 financial institutions, of which one

owed us

in excess of $15.0 million.

With respect to our credit union customers, our credit exposure is partially mitigated by National Credit Union Administration insurance.

However, as our credit union customers were not insured by a Temporary Liquidity Guarantee Program—

equivalent program, we have required

certain credit union customers to provide us with larger balances on deposit and/or to issue cashier’

s checks only. While the value of these assets

are not at risk in a disruption or collapse of a counterparty financial institution, the delay in accessing our assets could adversely affect our

liquidity and potentially our earnings depending upon the severity of the delay and corrective actions we may need to take.

While the extent of credit risk may vary by product, the process for mitigating risk is similar. We assess the creditworthiness of each potential

agent before accepting them into our distribution network. This underwriting process includes not only a determination of whether to accept a

new agent, but also the remittance schedule and volume of transactions that the agent will be allowed to perform in a given timeframe. We

actively monitor the credit risk of our existing agents by conducting periodic financial reviews and cash flow analyses of our agents that average

high volumes of transactions and monitoring remittance patterns versus reported sales on a daily basis.

The timely remittance of funds by our agents and financial institution customers is an important component of our liquidity. If the timing of the

remittance of funds were to deteriorate, it would alter our pattern of cash flows and could require us to liquidate investments or utilize our

revolving credit facility to settle payment service obligations. To manage this risk, we closely monitor the remittance patterns of our agents and

financial institution customers and act quickly if we detect deterioration or alteration in remittance timing or patterns. If deemed appropriate, we

have the ability to immediately deactivate an agent’

s equipment at any time, thereby preventing the initiation or issuance of further money

transfers and money orders.

Credit risk management is complemented through functionality within our point of sale system, which can enforce credit limits on a real-

time

basis and monitor for suspicious and unauthorized transactions. The system also permits us to remotely disable an agent’

s terminals and cause a

cessation of transactions.

Derivative Financial Instruments

—

Credit risk related to our derivative financial instruments relates to the risk that we are unable to collect

amounts owed to us by the counterparties to our derivative agreements. Our derivative financial instruments are used to manage exposures to

fluctuations in foreign currency exchange rates. If the counterparties to any of our derivative financial instruments were to default on payments,

it could result in a delay or interruption of payments to our agents. We manage credit risk related to derivative financial instruments by entering

into agreements with only major banks and regularly monitoring the credit ratings of these banks.

Interest Rate Risk

Interest rate risk represents the risk that our operating results are negatively impacted, and our investment portfolio declines in value, due to

changes in interest rates. Given the short maturity profile of the investment portfolio and the low level of interest rates, we believe there is an

extremely low risk that the value of these securities would decline such that we would have a material adverse change in our operating results.

As of December 31, 2013 , the Company held $1,039.3 million , or 32 percent , of the investment portfolio in fixed rate investments.

At December 31, 2013 , the Company’s other asset-backed securities are priced on average at five percent

of face value for a total fair value of

$20.6 million . Included in other asset-backed securities are collateralized debt obligations backed primarily by high-

grade debt, mezzanine

equity tranches of collateralized debt obligations and home equity loans, along with private equity investments. Any resulting adverse movement

in our stockholders’

deficit or assets in excess of payment service obligations from declines in investments would not result in regulatory or

contractual compliance exceptions.

54