MoneyGram 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

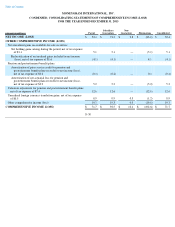

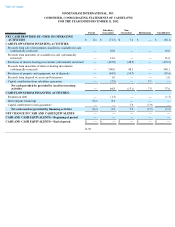

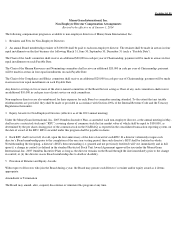

MONEYGRAM INTERNATIONAL, INC.

CONDENSED, CONSOLIDATING STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

FOR THE YEAR ENDED DECEMBER 31, 2012

F-54

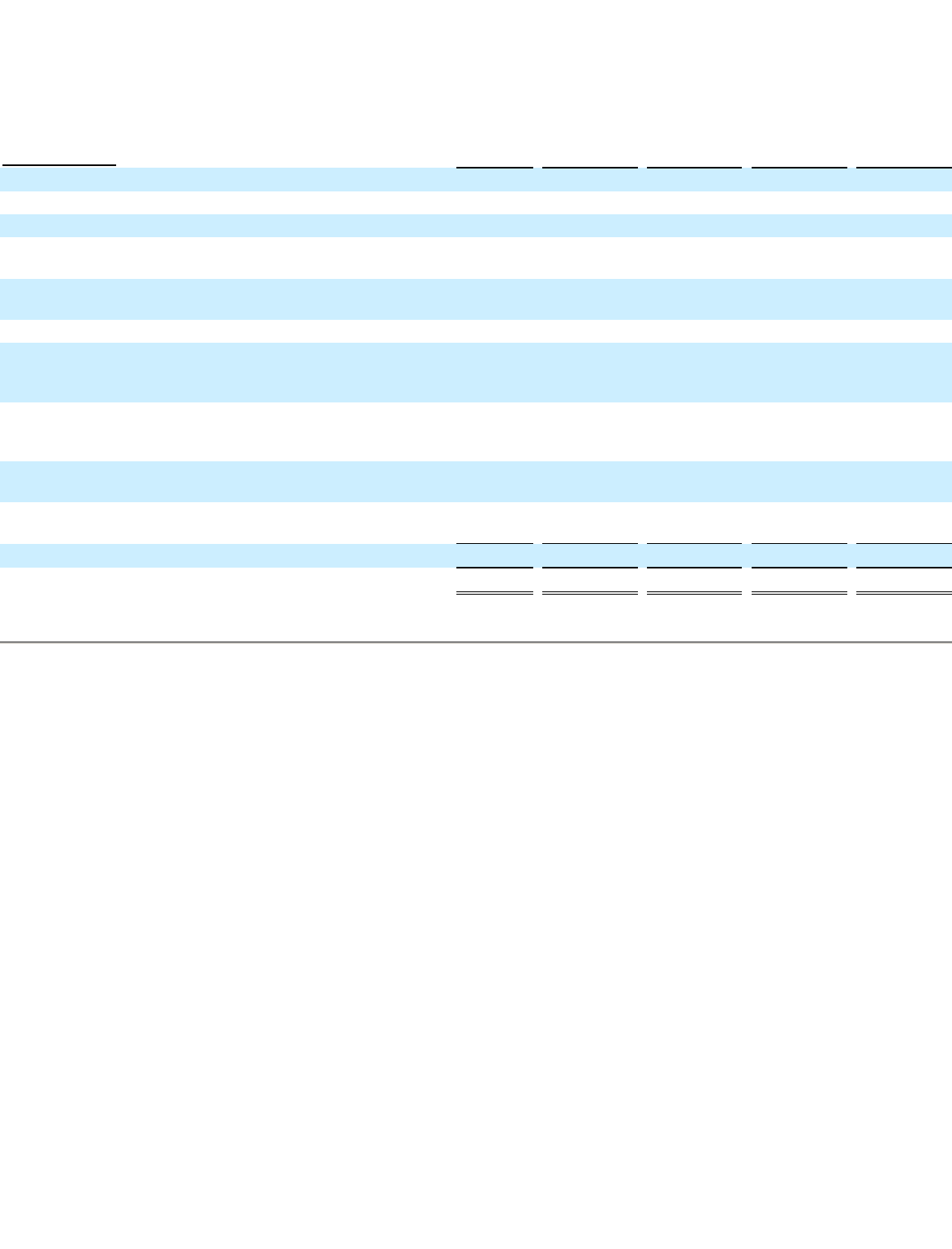

(Amounts in millions) Parent

Subsidiary

Guarantors

Non-

Guarantors

Eliminations

Consolidated

NET (LOSS) INCOME

$

(49.3

)

$

(44.7

)

$

(6.1

)

$

50.8

$

(49.3

)

OTHER COMPREHENSIVE (LOSS) INCOME

Net unrealized gains on available-for-sale securities:

Net holding (losses) gains arising during the period, net of tax

expense of $1.4

(5.2

)

4.8

—

5.2

4.8

Reclassification adjustment for net realized gains included in

net (loss) income, net of tax expense of $0.0

—

(

10.0

)

—

—

(

10.0

)

Pension and postretirement benefit plans:

Amortization of prior service credit for pension and

postretirement benefit plans recorded to net (loss) income,

net of tax benefit of $0.2

(0.4

)

(0.4

)

—

0.4

(0.4

)

Amortization of net actuarial loss for pension and

postretirement benefit plans recorded to net (loss) income,

net of tax expense of $2.4

3.9

3.9

—

(

3.9

)

3.9

Valuation adjustment for pension and postretirement benefit plans,

net of tax benefit of $8.7

(14.2

)

(14.2

)

—

14.2

(14.2

)

Unrealized foreign currency translation gains, net of tax expense

of $1.0

1.6

0.1

1.8

(1.9

)

1.6

Other comprehensive (loss) income

(14.3

)

(15.8

)

1.8

14.0

(14.3

)

COMPREHENSIVE (LOSS) INCOME

$

(63.6

)

$

(60.5

)

$

(4.3

)

$

64.8

$

(63.6

)