MoneyGram 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

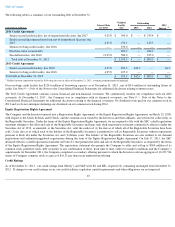

Contractual and Regulatory Capital

Regulatory Capital Requirements

We have capital requirements relating to government regulations in the U.S. and other countries where we operate. Such regulations typically

require us to maintain certain assets in a defined ratio to our payment service obligations. Through our wholly owned subsidiary and licensed

entity, MPSI, we are regulated in the U.S. by various state agencies that generally require us to maintain a pool of liquid assets and investments

in an amount generally equal to the regulatory payment service obligation measure, as defined by each state, for our regulated payment

instruments, namely teller checks, agent checks, money orders and money transfers. The regulatory requirements do not require us to specify

individual assets held to meet our payment service obligations, nor are we required to deposit specific assets into a trust, escrow or other special

account. Rather, we must maintain a pool of liquid assets. Provided we maintain a total pool of liquid assets sufficient to meet the regulatory and

contractual requirements, we are able to withdraw, deposit or sell our individual liquid assets at will, without prior notice, penalty or limitations.

We were in compliance with all state liquidity requirements in 2013 .

We are also subject to regulatory requirements in various countries outside of the U.S., which typically result in a requirement to either prefund

agent settlements or hold minimum required levels of cash within the applicable country. The most material of these requirements is in the

United Kingdom, where our licensed entity, MoneyGram International Limited, is required to maintain cash, cash equivalent and interest-

bearing

investment balances equal to outstanding payment instruments issued in the European Community. This amount fluctuates based on our level of

activity within the European Community, and is likely to increase over time as our business expands in that region. Assets used to meet these

regulatory requirements support our payment service obligations, but are not available to satisfy other liquidity needs. As of

December 31,

2013 , we had approximately $99.7 million of cash deployed outside of the U.S. to meet regulatory requirements.

We were in compliance with all financial regulatory requirements as of December 31, 2013

. We believe that our liquidity and capital resources

will remain sufficient to ensure ongoing compliance with all financial regulatory requirements.

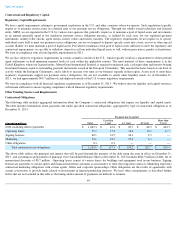

Other Funding Sources and Requirements

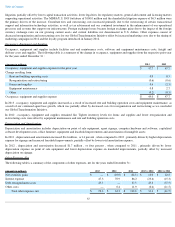

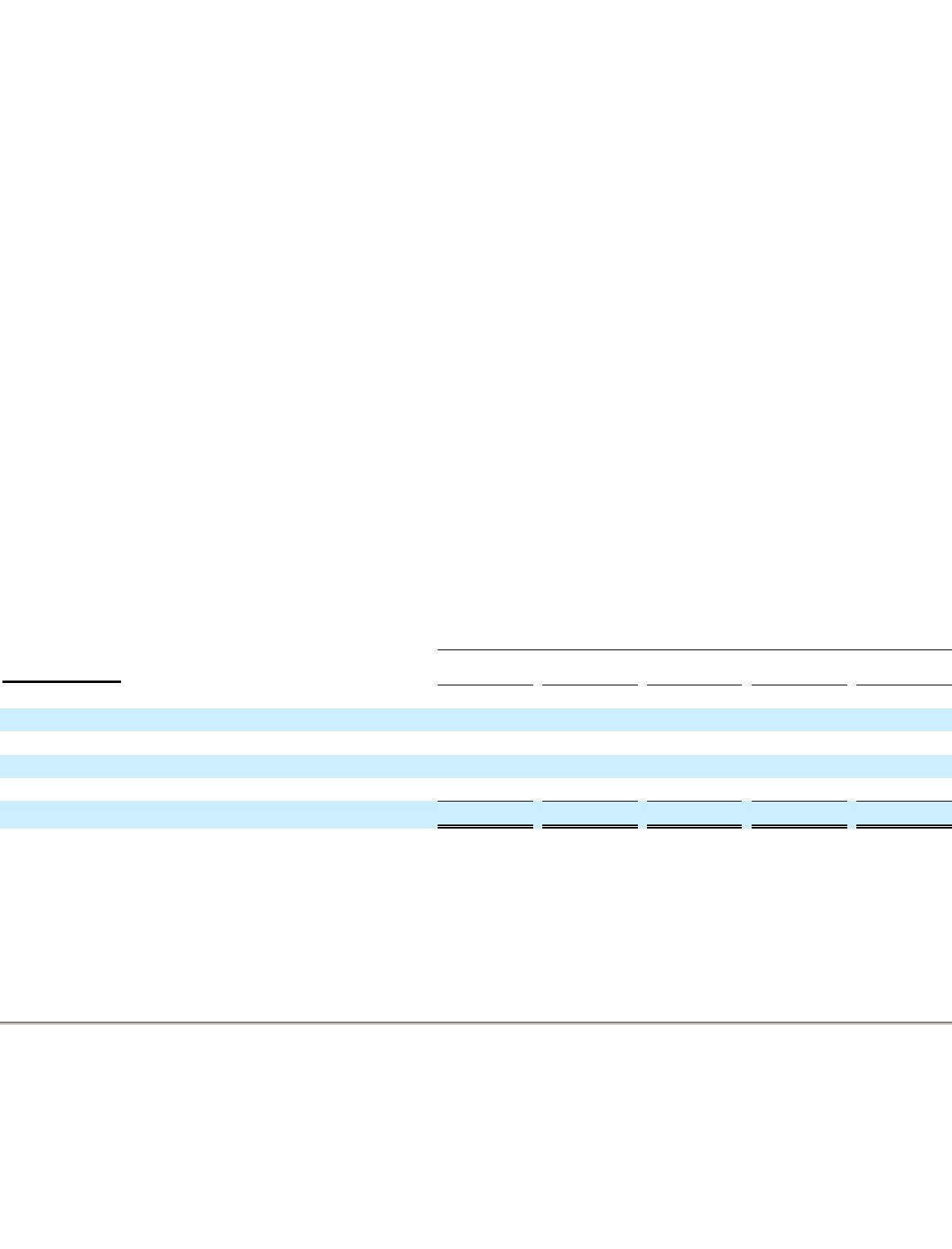

Contractual Obligations

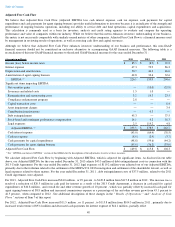

The following table includes aggregated information about the Company’

s contractual obligations that impact our liquidity and capital needs.

The table includes information about payments due under specified contractual obligations, aggregated by type of contractual obligation as of

December 31, 2013 :

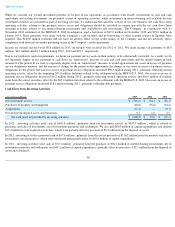

The above table reflects the principal and interest that will be paid through the maturity of the debt using the rates in effect on

December 31,

2013 , and assuming no prepayments of principal. Our Consolidated Balance Sheet at December 31, 2013 includes $842.9 million

of debt, net of

unamortized discounts of $0.7 million

. Operating leases consist of various leases for buildings and equipment used in our business. Signing

bonuses are payments to certain agents and financial institution customers as an incentive to enter into long-

term contracts. Marketing represents

contractual marketing obligations with certain agents, billers and corporate sponsorships. Other obligations are the results of agreements with

certain co-

investors to provide funds related to investments in limited partnership interests. We have other commitments as described further

below that are not included in this table as the timing and/or amount of payments are difficult to estimate.

44

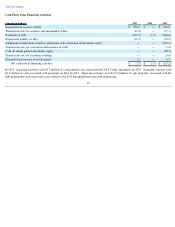

Payments due by period

(Amounts in millions) Total

Less than

1 year

1-3 years

4-5 years

More than

5 years

Debt, including interest payments

$

1,067.3

$

45.4

$

89.7

$

88.5

$

843.7

Operating leases

55.3

15.2

18.0

10.4

11.7

Signing bonuses

62.1

33.5

26.1

2.5

—

Marketing

54.6

22.9

25.4

6.3

—

Other obligations

0.3

0.3

—

—

—

Total contractual cash obligations

$

1,239.6

$

117.3

$

159.2

$

107.7

$

855.4