MoneyGram 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

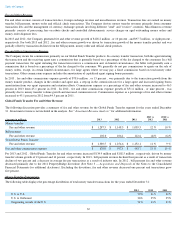

GAAP Measures —

We utilize certain financial measures prepared in accordance with GAAP to assess the Company's overall performance.

These measures include, but are not limited to: fee and other revenue, fee and other commission expense, fee and other revenue less

commissions, operating income and operating margin. Due to our regulatory capital requirements, we deem the following payment service

assets, in their entirety, to be substantially restricted: cash and cash equivalents, receivables, net, interest-bearing investments and available-for-

sale investments. Assets in excess of payment service obligations is our payment service assets less our payment service obligations. We use

assets in excess of payment service obligations when assessing capital resources and liquidity. See Note 2 —

Summary of Significant Accounting

Policies

of the Notes to the Consolidated Financial Statements for additional disclosure.

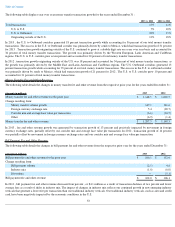

Non

-GAAP Measures — Generally, a non-

GAAP financial measure is a numerical measure of financial performance, financial position, or cash

flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented

in accordance with GAAP. The non-

GAAP financial measures should be viewed as a supplement to, and not a substitute for, financial measures

presented in accordance with GAAP. We strongly encourage investors and stockholders to review our financial statements and publicly-

filed

reports in their entirety and not to rely on any single financial measure. While we believe that these metrics enhance investors' understanding of

our business, these metrics are not necessarily comparable with similarly named metrics of other companies. The following non-

GAAP financial

measures include:

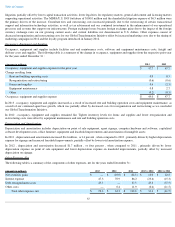

We believe that EBITDA, Adjusted EBITDA and Adjusted Free Cash Flow enhance investors' understanding of our business and performance.

We use EBITDA and Adjusted EBITDA to review results of operations, forecast and budget, assess cash flow and allocate capital resources. We

use Adjusted Free Cash Flow to assess our cash flow and capital resources. Since these are non-

GAAP measures, the Company believes it is

more appropriate to disclose these metrics after discussion and analysis of the GAAP financial measures.

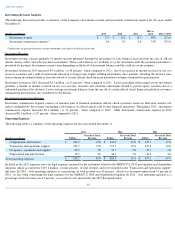

Non-Financial Measures

We also use certain non-

financial measures to assess our overall performance. These measures include, but are not limited to, transaction growth

and money transfer agent base.

30

•

EBITDA

(earnings before interest, taxes, depreciation and amortization, including agent signing bonus amortization)

•

Adjusted EBITDA

(EBITDA adjusted for significant items)

•

Adjusted Free Cash Flow

(Adjusted EBITDA less cash interest expense, cash tax expense, cash payments for capital expenditures and

cash payments for agent signing bonuses)