MoneyGram 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other Matters —

The Company is involved in various other government inquiries and other matters that arise from time to time. Management

does not believe that after final disposition any of these other matters is likely to have a material adverse impact on the Company’

s financial

condition, results of operations and cash flows.

Actions Commenced by the Company:

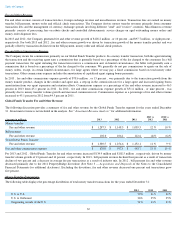

CDO Litigation —

In March 2012, the Company initiated an arbitration proceeding before the Financial Industry Regulatory Authority against

Goldman Sachs & Co., or Goldman Sachs. The arbitration relates to MoneyGram’

s purchase of Residential Mortgage Backed Securities and

Collateral Debt Obligations that Goldman Sachs sold to MoneyGram during the 2005 through 2007 time frame. The Company alleges, among

other things, that Goldman Sachs made material misrepresentations and omissions in connection with the sale of these products, ultimately

causing significant losses to the Company for which the Company is currently seeking damages. Goldman Sachs owns, together with certain of

its affiliates, approximately 19 percent of the shares of the Company’

s common stock on a diluted basis, assuming conversion of the D Stock

currently owned by Goldman Sachs and its affiliates.

Tax Litigation — On May 14, 2012 and December 17, 2012, the Company filed petitions in the U.S. Tax Court challenging the 2005-

2007 and

2009 Notices of Deficiency, respectively, pursuant to which the IRS determined that the Company owes additional corporate income taxes

because certain deductions relating to securities losses were capital in nature, rather than ordinary losses. The Company asserts that it properly

deducted its securities losses and that, consequently, no additional corporate income taxes are owed. The IRS filed its responses to the

Company’s petitions in July 2012 and February 2013 reasserting its original position relating to the years 2005-

2007 and 2009. The cases have

been consolidated before the U.S. Tax Court. In December 2013, the IRS filed a motion with the court for partial summary judgment in the case,

and in February 2014 the Company filed its response to that motion which included the Company's request for partial summary judgment.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

24