MoneyGram 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

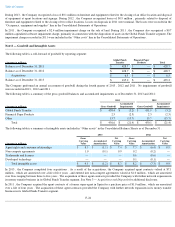

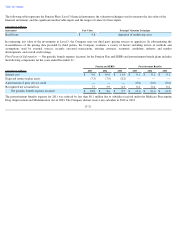

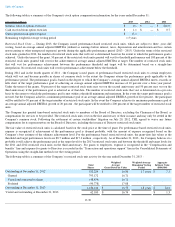

The following tables are a summary of the benefit obligation and plan assets, changes to the benefit obligation and plan assets, and the funded

status of the Pension Plan and SERPs and the postretirement benefit plans as of and for the years ended December 31 :

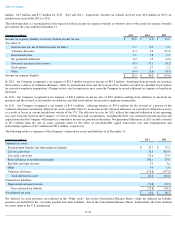

The unfunded status of the pension and SERPs decreased by 22 percent as the benefit obligation decreased $12.1 million

and the fair value of the

pension plan assets increased $15.2 million during the year. The unfunded status of the Pension Plan was $21.9 million and $52.9 million

at

December 31, 2013 and 2012 , respectively, and the unfunded status of the SERPs was $75.1 million and $71.4 million at

December 31, 2013

and 2012 , respectively.

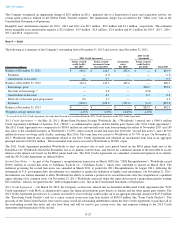

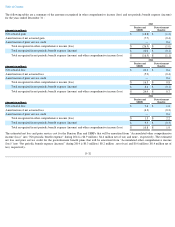

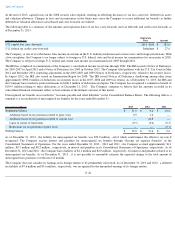

The following table summarizes the components recognized in the Consolidated Balance Sheets relating to the Pension Plan and SERPs and the

postretirement benefit plans as of December 31 :

The following table summarizes the projected benefit obligation and accumulated benefit obligation for the Pension Plan, SERPs and the

postretirement benefit plans in excess of the fair value of plan assets as of December 31 :

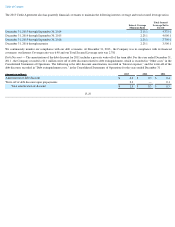

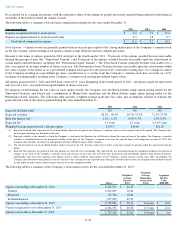

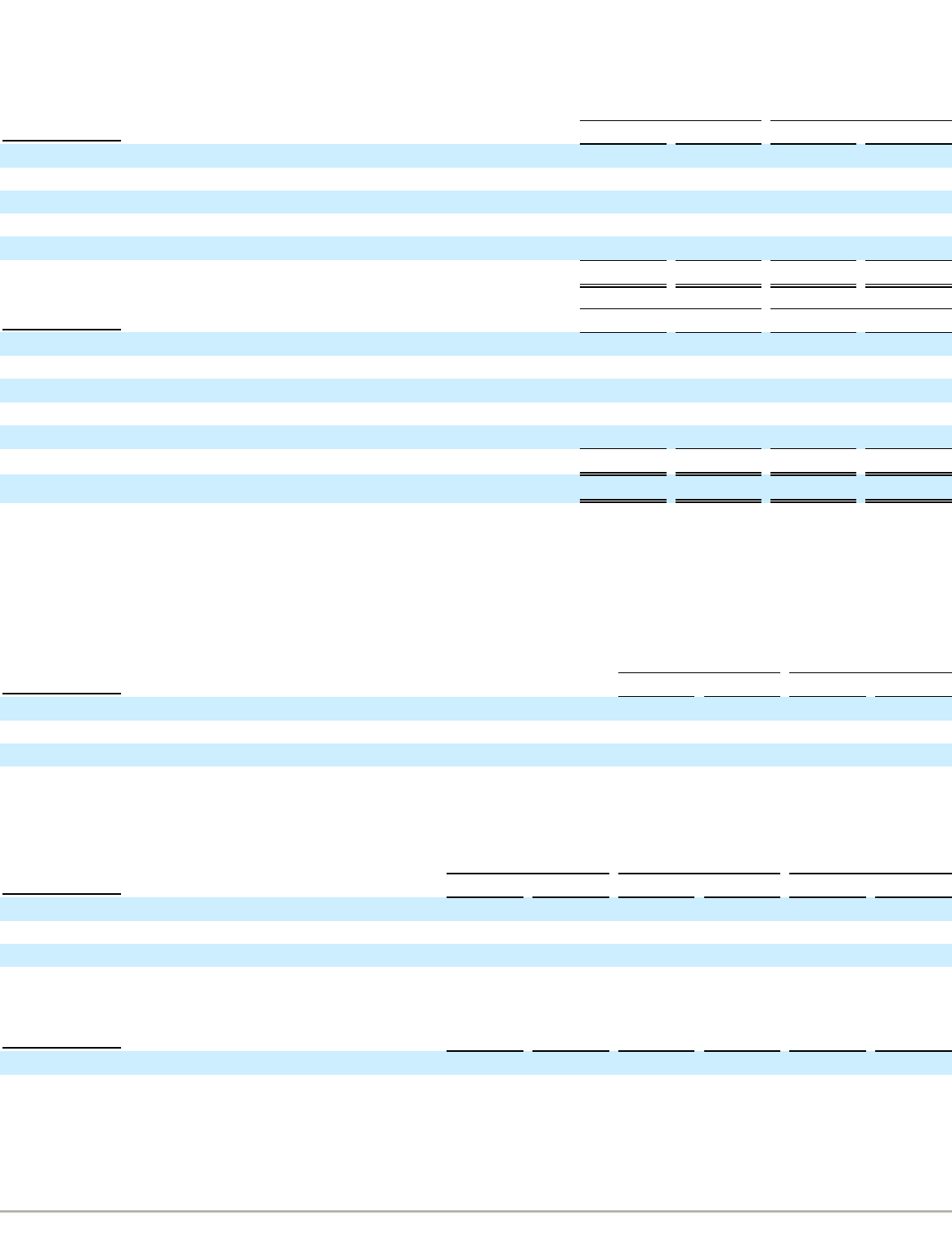

The following table summarizes the estimated future benefit payments for the Pension Plan and SERPs and the postretirement benefit plans for

the years ended December 31 :

The Company has a minimum required contribution of approximately $6.7 million for the Pension Plan in 2014

, and will continue to make

contributions to the SERPs and the postretirement benefit plans to the extent benefits are paid. Aggregate benefits paid for the unfunded plans

are expected to be $7.1 million in 2014 .

F-33

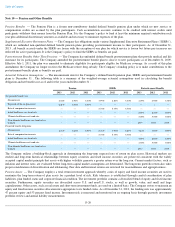

Pension and SERPs

Postretirement Benefits

(Amounts in millions) 2013

2012

2013

2012

Change in benefit obligation:

Benefit obligation at the beginning of the year

$

245.7

$

223.6

$

2.5

$

2.0

Interest cost

9.6

10.6

0.1

0.1

Actuarial (gain) loss

(7.7

)

24.8

(1.2

)

0.6

Benefits paid

(14.0

)

(13.3

)

—

(

0.2

)

Benefit obligation at the end of the year

$

233.6

$

245.7

$

1.4

$

2.5

Pension and SERPs

Postretirement Benefits

(Amounts in millions) 2013

2012

2013

2012

Change in plan assets:

Fair value of plan assets at the beginning of the year

$

121.4

$

110.1

$

—

$

—

Actual return on plan assets

18.4

10.4

—

—

Employer contributions

10.8

14.2

—

0.2

Benefits paid

(14.0

)

(13.3

)

—

(

0.2

)

Fair value of plan assets at the end of the year

$

136.6

$

121.4

$

—

$

—

Unfunded status at the end of the year

$

(97.0

)

$

(124.3

)

$

(1.4

)

$

(2.5

)

Pension and SERPs

Postretirement Benefits

(Amounts in millions) 2013

2012

2013

2012

Pension and other postretirement benefits liability

$

(97.0

)

$

(124.3

)

$

(1.4

)

$

(2.5

)

Accumulated other comprehensive loss:

Unrealized losses for pension and postretirement benefits, net of tax

54.2

70.6

1.8

3.4

Prior service cost (credit) for pension and postretirement benefits, net of tax

0.1

0.1

(2.3

)

(2.9

)

Pension Plan

SERPs

Postretirement Benefits

(Amounts in millions) 2013

2012

2013

2012

2013

2012

Projected benefit obligation

$

158.5

$

174.3

$

75.1

$

71.4

$

1.4

$

2.5

Accumulated benefit obligation

158.5

174.3

71.9

71.4

—

—

Fair value of plan assets

136.6

121.4

—

—

—

—

(Amounts in millions) 2014

2015

2016

2017

2018

2019-2023

Pension and SERPs

$

17.1

$

22.7

$

15.0

$

15.0

$

16.1

$

75.4

Postretirement benefits

0.2

0.1

0.1

0.1

0.1

0.4