MoneyGram 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

million , $2.9 million and $3.7 million for 2013 , 2012 and 2011 , respectively. Income tax refunds received were $0.8 million

in 2013; no

refunds were received for 2012 or 2011.

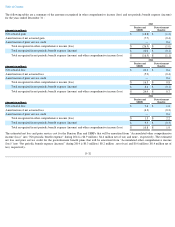

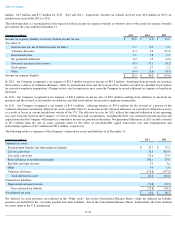

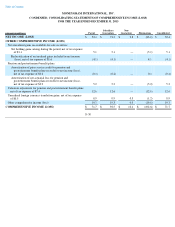

The following table is a reconciliation of the expected federal income tax expense (benefit) at statutory rates to the actual tax expense (benefit)

provided for the years ended in December 31 :

In 2013 , the Company recognized a tax expense of $32.9 million on pre-tax income of $85.3 million

, benefiting from proceeds on securities

that result in a release of valuation allowance, offset by international taxes and the reversal of tax benefits recorded on cancelled stock options

for executive employee terminations. Changes in facts and circumstances may cause the Company to record additional tax expense or benefits in

the future.

In 2012 , the Company recognized a tax expense of $40.4 million on pre-tax loss of $8.9 million

resulting from additions to uncertain tax

positions and the reversal of tax benefits recorded on cancelled stock options for executive employee terminations.

In 2011 , the Company recognized a tax benefit of $19.6 million , reflecting benefits of $34.0 million

for the reversal of a portion of the

valuation allowance on domestic deferred tax assets, partially offset by an increase in the valuation allowance on a portion of deferred tax assets

as a result of losses in certain jurisdictions outside of the U.S. The effective tax rate for 2011 reflects the expected utilization of net operating

loss carry-forwards based on the Company’

s review of current facts and circumstances, including the three year cumulative income position and

expectations that the Company will maintain a cumulative income tax position in the future. Net permanent differences in 2011 include a benefit

of $9.7 million from the sale of assets, partially offset by the effect of non-

deductible capital transaction costs and reorganization and

restructuring expenses of $2.1 million and $0.9 million , respectively.

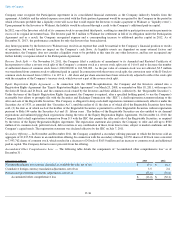

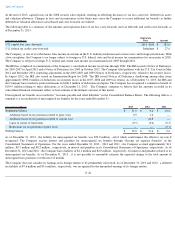

The following table is a summary of the Company’s deferred tax assets and liabilities as of December 31 :

Net deferred tax asset positions are reflected in the

“Other assets”

line in the Consolidated Balance Sheets, while net deferred tax liability

positions are included in the “Accounts payable and other liabilities” line in the Consolidated Balance Sheets. Substantially

all of the deferred

tax assets relate to the U.S. jurisdiction.

F-41

(Amounts in millions) 2013

2012

2011

Income tax expense (benefit) at statutory federal income tax rate

$

29.8

$

(3.1

)

$

13.9

Tax effect of:

State income tax, net of federal income tax effect

1.7

0.9

1.9

Valuation allowance

(2.7

)

0.6

(31.4

)

International taxes

3.2

1.8

1.3

Net permanent difference

0.2

1.0

(6.0

)

(Decrease) increase in tax reserve

(0.5

)

37.1

(0.2

)

Stock options

1.6

3.7

1.3

Other

(0.4

)

(1.6

)

(0.4

)

Income tax expense (benefit)

$

32.9

$

40.4

$

(19.6

)

(Amounts in millions) 2013

2012

Deferred tax assets:

Postretirement benefits and other employee benefits

$

39.7

$

57.3

Tax loss carryovers

76.3

415.0

Tax credit carryovers

27.6

27.9

Basis difference in revalued investments

106.1

87.9

Bad debt and other reserves

3.5

3.6

Other

5.0

1.9

Valuation allowance

(174.8

)

(477.0

)

Total deferred tax asset

83.4

116.6

Deferred tax liabilities:

Depreciation and amortization

(72.8

)

(70.3

)

Gross deferred tax liability

(72.8

)

(70.3

)

Net deferred tax asset

$

10.6

$

46.3