MoneyGram 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

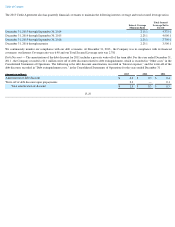

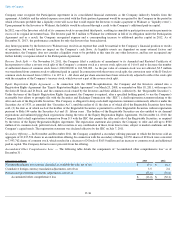

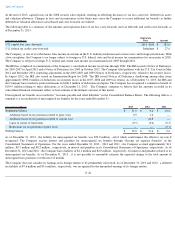

The following table is a summary of the activity of the Company’s stock authorized, issued and outstanding as of December 31 :

On September 27, 2011, the Company filed a Certificate of Elimination to eliminate the Company’

s Series A Junior Participating Preferred

Stock, par value $0.01 per share (the “Series A shares”),

which results in the shares resuming their status as undesignated preferred stock of the

Company. There were no Series A shares issued or outstanding in 2013 , 2012 or 2011 .

2011 Recapitalization —

Following shareholder approval on May 18, 2011, the Company completed its recapitalization transaction in

accordance with the Recapitalization Agreement (the “Recapitalization Agreement”),

dated as of March 7, 2011, as amended, by and among the

Company, affiliates and co-investors of Thomas H. Lee Partners, L.P. (“THL”)

and affiliates of Goldman Sachs (collectively with THL, the

“Investors”).

Pursuant to the Recapitalization Agreement, (i) THL converted all of its shares of Series B Participating Convertible Preferred

Stock, par value $0.01 per share (the “B Stock”), into 35.8 million

shares of common stock and (ii) Goldman Sachs converted all of its shares of

Series B-1 Participating Convertible Preferred Stock, par value $0.01 per share (the “B-1 Stock,” and collectively with the B Stock, the “

Series B

Stock”), into 157,686 shares of D Stock, and (iii) THL received 3.5 million additional shares of common stock and $140.8 million

in cash, and

Goldman Sachs received 15,503 additional shares of D Stock and $77.5 million

in cash. Collectively, these transactions are referred to as the

“2011 Recapitalization”.

Under the 2011 Recapitalization, the Investors received a cash dividend payment for amounts earned under the terms of

the Series B Stock for the period from March 26, 2011 through May 18, 2011. As a result of the 2011 Recapitalization, all amounts included in

mezzanine equity were converted into components of stockholders’ equity. During 2011, the Company recognized $5.4 million

for transaction

costs related to the 2011 Recapitalization, which are recorded in the “Other” line in the Consolidated Statements of Operations.

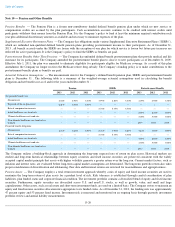

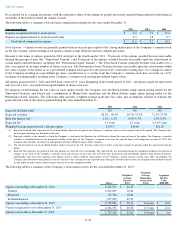

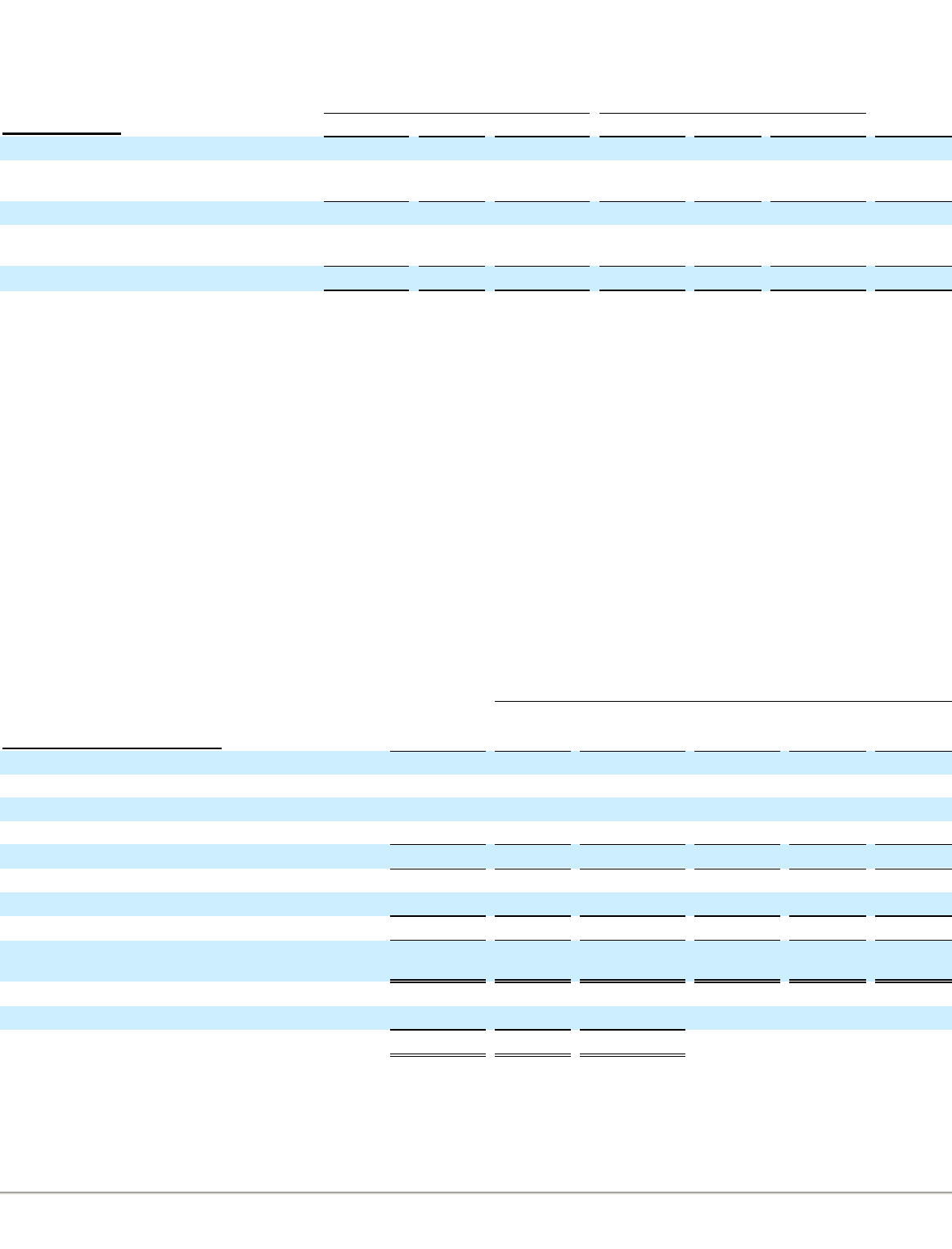

The following table is a summary of the transactional components of the 2011 Recapitalization and their corresponding impacts to Mezzanine

Equity and the components of Stockholders’ Deficit in the Consolidated Balance Sheets:

Participation Agreement between the Investors and Wal

-Mart Stores, Inc. — The Investors have a Participation Agreement with Wal-

Mart

Stores, Inc. (“Walmart”),

under which the Investors are obligated to pay Walmart certain percentages of any accumulated cash payments

received by the Investors in excess of the Investors’

original investment in the Company. While the Company is not a party to, and has no

obligations to Walmart or additional obligations to the Investors under, the Participation Agreement, the

F-35

D Stock

Common Stock

Treasury

Stock

(Shares in thousands) Authorized

Issued

Outstanding

Authorized

Issued

Outstanding

December 31, 2011

200

109

109

162,500

62,264

57,835

(4,429

)

Stock option exercised and release of

restricted stock units

—

—

—

—

—

22

22

December 31, 2012

200

109

109

162,500

62,264

57,857

(4,407

)

Stock option exercised and release of

restricted stock units

—

—

—

—

—

106

106

December 31, 2013

200

109

109

162,500

62,264

57,963

(4,301

)

2011 Stockholders’ Deficit

(Amounts in millions, except share data) Mezzanine

Equity

Preferred

Stock

Common

Stock

Additional

Paid-in

Capital

Retained

Loss

Total

Activity

Conversion of B Stock to common stock

$

(716.1

)

$

—

$

2.9

$

713.2

$

—

$

—

Conversion of B-1 Stock to D Stock

(394.2

)

394.2

—

—

—

—

Accretion of unamortized mezzanine equity discounts

76.1

—

—

—

(

76.1

)

—

Additional stock consideration paid

—

52.7

0.3

95.5

(148.5

)

—

Non-cash activity

(1,034.2

)

446.9

3.2

808.7

(224.6

)

—

Additional cash consideration paid

—

—

—

—

(

218.3

)

(218.3

)

Cash dividends paid on mezzanine equity

—

—

—

—

(

20.5

)

(20.5

)

Cash activity

(238.8

)

(238.8

)

Total 2011 Recapitalization impact to Mezzanine Equity

and Stockholders’ Deficit

$

(1,034.2

)

$

446.9

$

3.2

$

808.7

$

(463.4

)

$

(238.8

)

Shares issued upon conversion

—

157,686

35,804,796

Additional stock consideration paid

—

15,503

3,520,358

Total new shares issued under the 2011 Recapitalization

—

173,189

39,325,154