MetLife 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

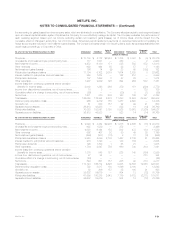

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

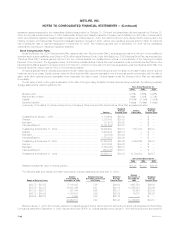

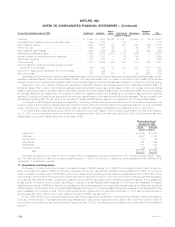

Notional Carrying Estimated

December 31, 2003 Amount Value Fair Value

(Dollars in millions)

Assets:

Fixed maturities********************************************************************** $167,752 $167,752

Equity securities ********************************************************************* $ 1,584 $ 1,584

Mortgage and other loans ************************************************************* $ 26,249 $ 28,259

Policy loans************************************************************************* $ 8,749 $ 8,749

Short-term investments *************************************************************** $ 1,809 $ 1,809

Cash and cash equivalents************************************************************ $ 3,683 $ 3,683

Mortgage loan commitments*********************************************************** $ 679 $ — $ (4)

Commitments to fund partnership investments ******************************************** $1,380 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 63,957 $ 64,837

Short-term debt ********************************************************************* $ 3,642 $ 3,642

Long-term debt********************************************************************** $ 5,703 $ 6,041

Shares subject to mandatory redemption ************************************************ $ 277 $ 336

Payable under securities loaned transactions ********************************************* $ 27,083 $ 27,083

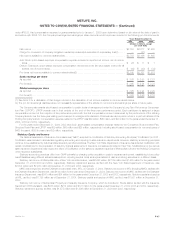

The methods and assumptions used to estimate the fair values of financial instruments are summarized as follows:

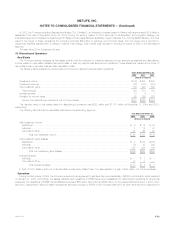

Fixed Maturities and Equity Securities

The fair value of fixed maturities and equity securities are based upon quotations published by applicable stock exchanges or received from other

reliable sources. For securities for which the market values were not readily available, fair values were estimated using quoted market prices of

comparable investments.

Mortgage and Other Loans, Mortgage Loan Commitments and Commitments to Fund Partnership Investments

Fair values for mortgage and other loans are estimated by discounting expected future cash flows, using current interest rates for similar loans with

similar credit risk. For mortgage loan commitments, the estimated fair value is the net premium or discount of the commitments. Commitments to fund

partnership investments have no stated interest rate and are assumed to have a fair value of zero.

Policy Loans

The carrying values for policy loans approximate fair value.

Cash and Cash Equivalents and Short-term Investments

The carrying values for cash and cash equivalents and short-term investments approximated fair values due to the short-term maturities of these

instruments.

Policyholder Account Balances

The fair value of policyholder account balances is estimated by discounting expected future cash flows based upon interest rates currently being

offered for similar contracts with maturities consistent with those remaining for the agreements being valued.

Short-term and Long-term Debt, Payables Under Securities Loaned Transactions and Shares Subject to Mandatory Redemption

The fair values of short-term and long-term debt, payables under securities loaned transactions and shares subject to mandatory redemption are

determined by discounting expected future cash flows using risk rates currently available for debt with similar terms and remaining maturities.

Derivative Financial Instruments

The fair value of derivative instruments, including financial futures, financial forwards, interest rate, credit default and foreign currency swaps, foreign

currency forwards, caps, floors, and options are based upon quotations obtained from dealers or other reliable sources. See Note 3 for derivative fair

value disclosures.

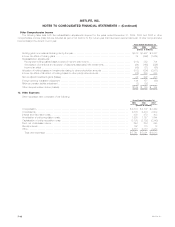

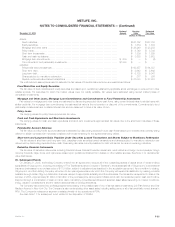

20. Subsequent Events

On January 31, 2005, the Holding Company entered into an agreement to acquire all of the outstanding shares of capital stock of certain indirect

subsidiaries of Citigroup Inc., including the majority of The Travelers Insurance Company (‘‘Travelers’’), and substantially all of Citigroup Inc.’s international

insurance businesses for a purchase price of $11.5 billion, subject to adjustment as described in the acquisition agreement. As a condition to closing,

Citigroup Inc. and the Holding Company will enter into ten-year agreements under which the Company will expand its distribution by making products

available through certain Citigroup distribution channels, subject to appropriate suitability and other standards. The transaction is expected to close in the

summer of 2005. Approximately $1 billion to $3 billion of the purchase price will be paid in MetLife stock with the remainder paid in cash which will be

financed through a combination of cash on hand, debt, mandatorily convertible securities and selected asset sales depending on market conditions,

timing, valuation considerations and the relative attractiveness of funding alternatives.

The Company has entered into brokerage agreements relating to the possible sale of two of its real estate investments, 200 Park Avenue and One

Madison Avenue in New York City. The Company is also contemplating other asset sales, including selling some or all of its beneficially owned shares in

RGA. The Company’s reinsurance segment consists primarily of the operations of RGA.

See also Note 17 for subsequent event related to the disposition of SSRM.

MetLife, Inc. F-55