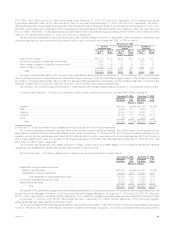

MetLife 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

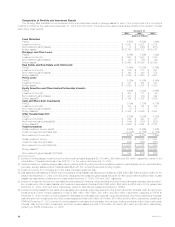

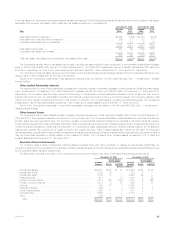

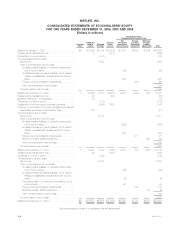

Variable Interest Entities

The Company has adopted the provisions of FIN 46 and FIN 46(r). See ‘‘— Application of Recent Accounting Pronouncements.’’ The adoption of

FIN 46(r) required the Company to consolidate certain VIEs for which it is the primary beneficiary. The following table presents the total assets of and

maximum exposure to loss relating to VIEs for which the Company has concluded that (i) it is the primary beneficiary and which are consolidated in the

Company’s consolidated financial statements at December 31, 2004, and (ii) it holds significant variable interests but it is not the primary beneficiary and

which have not been consolidated:

December 31, 2004

Primary Not Primary

Beneficiary Beneficiary

Maximum Maximum

Total Exposure Total Exposure

Assets(1) to Loss(2) Assets(1) to Loss(2)

(Dollars in millions)

Asset-backed securitizations and collateralized debt obligations ****************************** $ — $ — $1,418 $ 3

Real estate joint ventures(3) ************************************************************ 15 13 132 —

Other limited partnerships(4)************************************************************ 249 191 914 146

Other structured investments(5) ********************************************************* — — 856 103

Total ***************************************************************************** $264 $204 $3,320 $252

(1) The assets of the asset-backed securitizations and collateralized debt obligations are reflected at fair value at December 31, 2004. The assets of the

real estate joint ventures, other limited partnerships and other structured investments are reflected at the carrying amounts at which such assets

would have been reflected on the Company’s balance sheet had the Company consolidated the VIE from the date of its initial investment in the entity.

(2) The maximum exposure to loss of the asset-backed securitizations and collateralized debt obligations is equal to the carrying amounts of retained

interests. In addition, the Company provides collateral management services for certain of these structures for which it collects a management fee.

The maximum exposure to loss relating to real estate joint ventures, other limited partnerships and other structured investments is equal to the

carrying amounts plus any unfunded commitments, reduced by amounts guaranteed by other partners.

(3) Real estate joint ventures include partnerships and other ventures, which engage in the acquisition, development, management and disposal of real

estate investments.

(4) Other limited partnerships include partnerships established for the purpose of investing in real estate funds, public and private debt and equity

securities, as well as limited partnerships established for the purpose of investing in low-income housing that qualifies for federal tax credits.

(5) Other structured investments include an offering of a collateralized fund of funds based on the securitization of a pool of private equity funds.

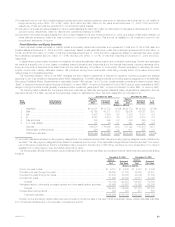

Securities Lending

The Company participates in a securities lending program whereby blocks of securities, which are included in investments, are loaned to third

parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the loaned securities to be separately maintained

as collateral for the loans. Securities with a cost or amortized cost of $26,564 million and $25,121 million and an estimated fair value of $27,974 million

and $26,387 million were on loan under the program at December 31, 2004 and 2003, respectively. The Company was liable for cash collateral under

its control of $28,678 million and $27,083 million at December 31, 2004 and 2003, respectively. Security collateral on deposit from customers may not

be sold or repledged and is not reflected in the consolidated financial statements.

Separate Accounts

The Company had $86.8 billion and $75.8 billion held in its separate accounts, for which the Company generally does not bear investment risk, as

of December 31, 2004 and 2003, respectively. The Company manages each separate account’s assets in accordance with the prescribed investment

policy that applies to that specific separate account. The Company establishes separate accounts on a single client and multi-client commingled basis in

compliance with insurance laws. Effective with the adoption of SOP 03-1, on January 1, 2004, the Company reports separately, as assets and liabilities,

investments held in separate accounts and liabilities of the separate accounts if (i) such separate accounts are legally recognized; (ii) assets supporting

the contract liabilities are legally insulated from the Company’s general account liabilities; (iii) investments are directed by the contractholder; and (iv) all

investment performance, net of contract fees and assessments, is passed through to the contractholder. The Company reports separate account assets

meeting such criteria at their fair value. Investment performance (including investment income, net investment gains (losses) and changes in unrealized

gains (losses)) and the corresponding amounts credited to contractholders of such separate accounts are offset within the same line in the consolidated

statements of income. In connection with the adoption of SOP 03-1, separate account assets with a fair value of $1.7 billion were reclassified to general

account investments with a corresponding transfer of separate account liabilities to future policy benefits and policyholder account balances. See

‘‘— Application of Recent Accounting Pronouncements.’’

The Company’s revenues reflect fees charged to the separate accounts, including mortality charges, risk charges, policy administration fees,

investment management fees and surrender charges. Separate accounts not meeting the above criteria are combined on a line-by-line basis with the

Company’s general account assets, liabilities, revenues and expenses.

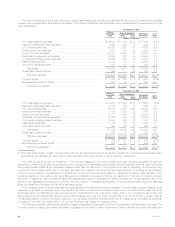

Off-Balance Sheet Arrangements

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were approximately $1,324 million and $1,380 million at December 31, 2004 and 2003, respectively. The Company anticipates that these

amounts will be invested in the partnerships over the next three to five years.

Mortgage Loan Commitments

The Company commits to lend funds under mortgage loan commitments. The amounts of these mortgage loan commitments were $1,189 million

and $679 million, respectively, at December 31, 2004 and 2003.

Guarantees

In the course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which it may

be required to make payments now or in the future.

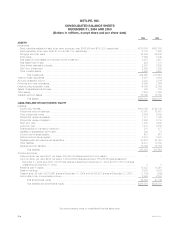

MetLife, Inc.

36