MetLife 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

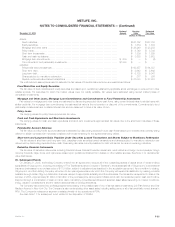

Insurance regulatory approval of the extraordinary dividend was received on October 15, 2004 and the extraordinary dividend was paid on October 25,

2004. For the year ended December 31, 2003, Metropolitan Property and Casualty Insurance Company paid to MetLife, Inc. $75 million in dividends for

which prior insurance regulatory clearance was not required. As of December 31, 2004, the maximum amount of the dividend which may be paid to the

Holding Company from Metropolitan Property and Casualty Insurance Company in 2005, without prior regulatory approval, is $187 million for dividends

with a scheduled date of payment subsequent to November 16, 2005. Any dividend payment prior to November 16, 2005 will be considered

extraordinary requiring prior insurance regulatory clearance.

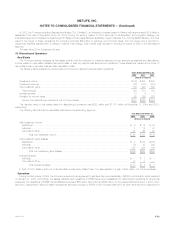

Stock Compensation Plans

Under the MetLife, Inc. 2000 Stock Incentive Plan, as amended, (the ‘‘Stock Incentive Plan’’), awards granted may be in the form of non-qualified or

incentive stock options qualifying under Section 422A of the Internal Revenue Code. Under the MetLife, Inc. 2000 Directors Stock Plan, as amended (the

‘‘Directors Stock Plan’’), awards granted may be in the form of stock awards, non-qualified stock options, or a combination of the foregoing to outside

Directors of the Company. The aggregate number of options to purchase shares of stock that may be awarded under the Stock Incentive Plan and the

Directors Stock Plan is subject to a maximum limit of 37,823,333, of which no more than 378,233 may be awarded under the Directors Stock Plan. The

Directors Stock Plan has a maximum limit of 500,000 stock awards.

All options granted have an exercise price equal to the fair market value price of the Company’s common stock on the date of grant, and an option’s

maximum term is ten years. Certain options under the Stock Incentive Plan become exercisable over a three year period commencing with the date of

grant, while other options become exercisable three years after the date of grant. Options issued under the Directors Stock Plan are exercisable

immediately.

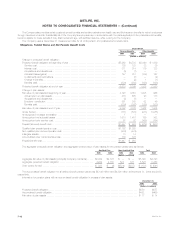

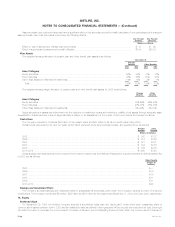

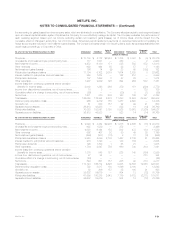

The fair value of each option grant is estimated on the date of the grant using the Black-Scholes options-pricing model with the following weighted

average assumptions used for grants for the:

Years Ended December 31,

2004 2003 2002

Dividend yield ******************************************************************************* 0.70% 0.68% 0.68%

Risk-free rate of return ************************************************************************ 3.69% 5.07% 5.71%

Volatility ************************************************************************************ 34.85% 37.39% 31.62%

Expected duration**************************************************************************** 6 years 6 years 6 years

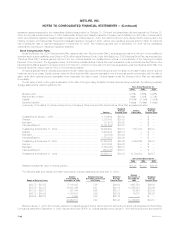

A summary of the status of options included in the Company’s Stock Incentive Plan and Directors Stock Plan is presented below:

Weighted Weighted

Average Options Average

Options Exercise Price Exercisable Exercise Price

Outstanding at January 1, 2002 *************************************** 11,116,684 $29.93 — $ —

Granted *********************************************************** 7,275,855 $30.35 — $ —

Exercised ********************************************************** (11,401) $29.95 — $ —

Canceled/Expired *************************************************** (2,121,508) $30.07 — $ —

Outstanding at December 31, 2002 *********************************** 16,259,630 $30.10 1,357,034 $30.01

Granted *********************************************************** 5,634,439 $26.13 — $ —

Exercised ********************************************************** (20,054) $30.02 — $ —

Canceled/Expired *************************************************** (1,578,987) $29.45 — $ —

Outstanding at December 31, 2003 *********************************** 20,295,028 $29.05 4,566,265 $30.15

Granted *********************************************************** 5,074,206 $35.28 — $ —

Exercised ********************************************************** (1,464,865) $29.70 — $ —

Canceled/Expired *************************************************** (642,268) $30.27 — $ —

Outstanding at December 31, 2004 *********************************** 23,262,101 $30.33 12,736,500 $29.57

Years Ended December 31,

2004 2003 2002

Weighted average fair value of options granted **************************************************** $13.25 $10.41 $10.48

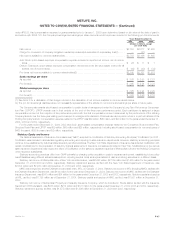

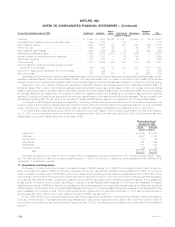

The following table summarizes information about stock options outstanding at December 31, 2004:

Number

Number Weighted Average Weighted Exercisable at Weighted

Outstanding at Remaining Contractual Average December 31, Average

Range of Exercise Prices December 31, 2004 Life (Years) Exercise Price 2004 Exercise Price

$23.75 – $27.55 5,116,385 7.95 $26.02 1,697,554 $26.05

$27.55 – $31.35 13,061,369 6.31 $30.13 10,956,828 $30.09

$31.35 – $35.15 287,844 6.69 $33.31 62,840 $32.94

$35.15 – $38.95 4,788,503 8.92 $35.28 19,278 $35.26

$38.95 – $40.38 8,000 9.92 $40.16 — $ —

23,262,101 7.22 $30.34 12,736,500 $29.57

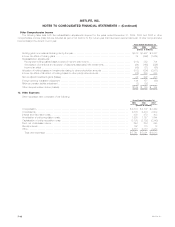

Effective January 1, 2003, the Company elected to prospectively apply the fair value method of accounting for stock options granted by the Holding

Company subsequent to December 31, 2002. As permitted under SFAS 148, options granted prior to January 1, 2003 will continue to be accounted for

MetLife, Inc.

F-46