MetLife 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

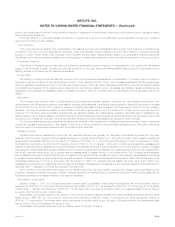

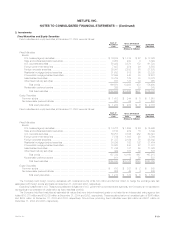

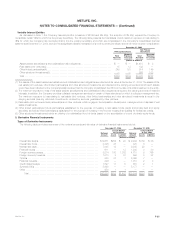

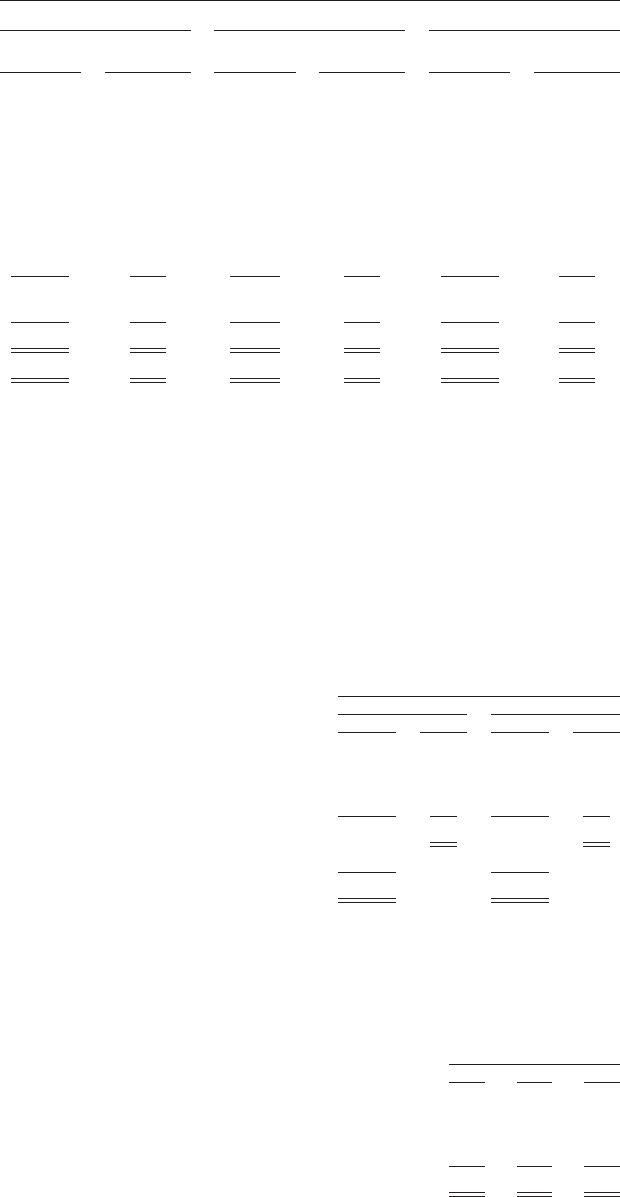

December 31, 2003

Equal to or Greater

Less than 12 Months than 12 Months Total

Gross Gross Gross

Estimated Unrealized Estimated Unrealized Estimated Unrealized

Fair Value Loss Fair Value Loss Fair Value Loss

(Dollars in millions)

U.S. treasury/agency securities************ $ 3,697 $ 26 $ — $ — $ 3,697 $ 26

State and political subdivision securities***** 389 12 38 3 427 15

U.S. corporate securities ***************** 7,214 152 1,056 100 8,270 252

Foreign government securities************* 331 28 2 — 333 28

Foreign corporate securities*************** 2,583 65 355 14 2,938 79

Residential mortgage-backed securities ***** 8,372 98 27 4 8,399 102

Commercial mortgage-backed securities **** 2,449 20 282 2 2,731 22

Asset-backed securities ****************** 2,555 34 861 26 3,416 60

Other fixed maturity securities ************* 130 73 40 10 170 83

Total bonds ******************** 27,720 508 2,661 159 30,381 667

Redeemable preferred stocks ************* 222 62 278 14 500 76

Total fixed maturities ************* $27,942 $570 $2,939 $173 $30,881 $743

Equity securities ************************ $53 $6 $22 $— $75 $6

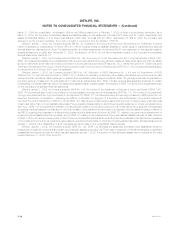

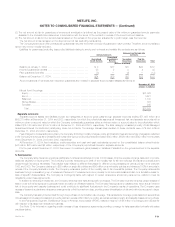

Securities Lending Program

The Company participates in a securities lending program whereby blocks of securities, which are included in investments, are loaned to third

parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the loaned securities to be separately maintained

as collateral for the loans. Securities with a cost or amortized cost of $26,564 million and $25,121 million and an estimated fair value of $27,974 million

and $26,387 million were on loan under the program at December 31, 2004 and 2003, respectively. The Company was liable for cash collateral under

its control of $28,678 million and $27,083 million at December 31, 2004 and 2003, respectively. Security collateral on deposit from customers may not

be sold or repledged and is not reflected in the consolidated financial statements.

Assets on Deposit and Held in Trust

The Company had investment assets on deposit with regulatory agencies with a fair market value of $1,391 million and $1,353 million at

December 31, 2004 and 2003, respectively. Company securities held in trust to satisfy collateral requirements had an amortized cost of $2,473 million

and $2,276 million at December 31, 2004 and 2003, respectively.

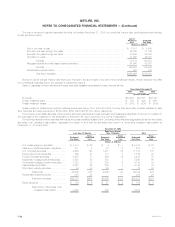

Mortgage and Other Loans

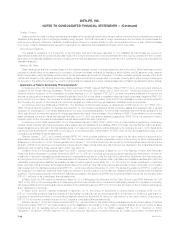

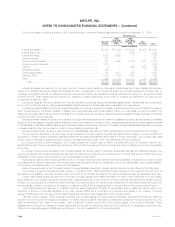

Mortgage and other loans were categorized as follows:

December 31,

2004 2003

Amount Percent Amount Percent

(Dollars in millions)

Commercial mortgage loans********************************************************* $25,139 77% $20,422 78%

Agricultural mortgage loans********************************************************** 5,914 18 5,333 20

Other loans*********************************************************************** 1,510 5 623 2

Total ******************************************************************** 32,563 100% 26,378 100%

Less: Valuation allowances ********************************************************** 157 129

Mortgage and other loans ************************************************** $32,406 $26,249

Mortgage loans are collateralized by properties primarily located throughout the United States. At December 31, 2004, approximately 21%, 11% and

7% of the properties were located in California, New York and Florida, respectively. Generally, the Company (as the lender) requires that a minimum of

one-fourth of the purchase price of the underlying real estate be paid by the borrower.

Certain of the Company’s real estate joint ventures have mortgage loans with the Company. The carrying values of such mortgages were

$641 million and $639 million at December 31, 2004 and 2003, respectively.

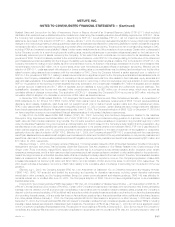

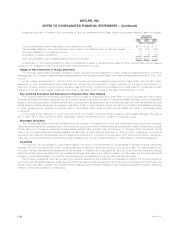

Changes in loan valuation allowances for mortgage and other loans were as follows:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

Balance, beginning of year************************************************************************ $129 $126 $144

Additions ************************************************************************************** 57 52 41

Deductions************************************************************************************* (29) (49) (59)

Balance, end of year***************************************************************************** $157 $129 $126

MetLife, Inc. F-21