MetLife 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

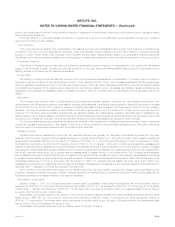

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

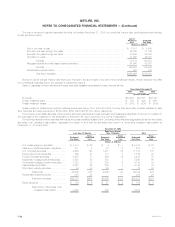

Cash and Cash Equivalents

The Company considers all investments purchased with an original maturity of three months or less to be cash equivalents.

Property, Equipment, Leasehold Improvements and Computer Software

Property, equipment and leasehold improvements, which are included in other assets, are stated at cost, less accumulated depreciation and

amortization. Depreciation is determined using either the straight-line or sum-of-the-years-digits method over the estimated useful lives of the assets. The

estimated life for company occupied real estate property is generally 40 years. Estimated lives generally range from five to ten years for leasehold

improvements and three to five years for all other property and equipment. Accumulated depreciation and amortization of property, equipment and

leasehold improvements was $566 million and $530 million at December 31, 2004 and 2003, respectively. Related depreciation and amortization

expense was $112 million, $117 million and $81 million for the years ended December 31, 2004, 2003 and 2002, respectively.

Computer software, which is included in other assets, is stated at cost, less accumulated amortization. Purchased software costs, as well as internal

and external costs incurred to develop internal-use computer software during the application development stage, are capitalized. Such costs are

amortized generally over a four-year period using the straight-line method. Accumulated amortization of capitalized software was $552 million and

$434 million at December 31, 2004 and 2003, respectively. Related amortization expense was $139 million, $154 million and $154 million for the years

ended December 31, 2004, 2003 and 2002, respectively.

Deferred Policy Acquisition Costs

The costs of acquiring new and renewal insurance business that vary with, and are primarily related to, the production of that business are deferred.

Such costs, which consist principally of commissions, agency and policy issue expenses, are amortized with interest over the expected life of the

contract for participating traditional life, universal life and investment-type products. Generally, DAC is amortized in proportion to the present value of

estimated gross margins or profits from investment, mortality, expense margins and surrender charges. Interest rates used to compute the present value

of estimated gross margins and profits are based on rates in effect at the inception or acquisition of the contracts.

Actual gross margins or profits can vary from management’s estimates resulting in increases or decreases in the rate of amortization. Management

utilizes the reversion to the mean assumption, a common industry practice, in its determination of the amortization of DAC. This practice assumes that the

expectation for long-term equity investment appreciation is not changed by minor short-term market fluctuations, but that it does change when large

interim deviations have occurred. Management periodically updates these estimates and evaluates the recoverability of DAC. When appropriate,

management revises its assumptions of the estimated gross margins or profits of these contracts, and the cumulative amortization is re-estimated and

adjusted by a cumulative charge or credit to current operations.

DAC for non-participating traditional life, non-medical health and annuity policies with life contingencies is amortized in proportion to anticipated

premiums. Assumptions as to anticipated premiums are made at the date of policy issuance or acquisition and are consistently applied during the lives of

the contracts. Deviations from estimated experience are included in operations when they occur. For these contracts, the amortization period is typically

the estimated life of the policy.

Policy acquisition costs related to internally replaced contracts are expensed at the date of replacement.

DAC for property and casualty insurance contracts, which is primarily comprised of commissions and certain underwriting expenses, are deferred

and amortized on a pro rata basis over the applicable contract term or reinsurance treaty.

VOBA, included as part of DAC, represents the present value of estimated future profits to be generated from existing insurance contracts in-force at

the date of acquisition and is amortized over the expected policy or contract duration in relation to the estimated gross profits or premiums from such

policies and contracts.

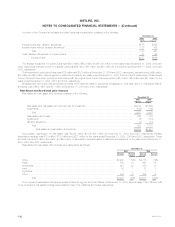

Sales Inducements

The Company has two different types of sales inducements: (i) the policyholder receives a bonus whereby the policyholder’s initial account balance

is increased by an amount equal to a specified percentage of the customer’s deposit and (ii) the policyholder receives a higher interest rate using a dollar

cost averaging method than would have been received based on the normal general account interest rate credited. The Company defers sales

inducements and amortizes them over the life of the policy using the same methodology and assumptions used to amortize DAC.

Goodwill

The excess of cost over the fair value of net assets acquired (‘‘goodwill’’) is included in other assets. On January 1, 2002, the Company adopted the

provisions of SFAS No. 142, Goodwill and Other Intangible Assets, (‘‘SFAS 142’’). In accordance with SFAS 142, goodwill is not amortized but is tested

for impairment at least annually to determine whether a writedown of the cost of the asset is required. Impairments are recognized in operating results

when the carrying amount of goodwill exceeds its implied fair value. Prior to the adoption of SFAS 142, goodwill was amortized on a straight-line basis

over a period ranging from 10 to 30 years and impairments were recognized in operating results when permanent diminution in value was deemed to

have occurred.

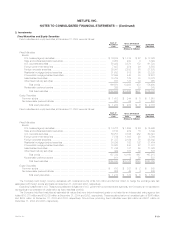

Changes in net goodwill were as follows:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

Balance, beginning of year *********************************************************************** $628 $ 750 $609

Acquisitions************************************************************************************ 4 3 166

Impairment losses******************************************************************************* — — (8)

Disposition and other **************************************************************************** 1 (125) (17)

Balance, end of year **************************************************************************** $633 $ 628 $750

MetLife, Inc. F-13