MetLife 2004 Annual Report Download - page 30

Download and view the complete annual report

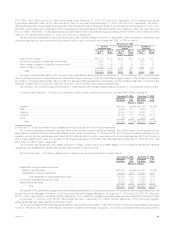

Please find page 30 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company’s consolidated financial statements other than the presentation as discontinued operations of net investment income and net investment gains

related to operations of real estate on which the Company initiated disposition activities subsequent to January 1, 2002 and the classification of such real

estate as held-for-sale on the consolidated balance sheets.

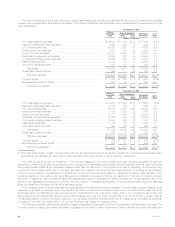

Effective January 1, 2002, the Company adopted SFAS No. 142, Goodwill and Other Intangible Assets, (‘‘SFAS 142’’). SFAS 142 eliminates the

systematic amortization and establishes criteria for measuring the impairment of goodwill and certain other intangible assets by reporting unit. There was

no impairment of identified intangibles or significant reclassifications between goodwill and other intangible assets at January 1, 2002. Amortization of

other intangible assets was not material for the years ended December 31, 2004, 2003 and 2002.

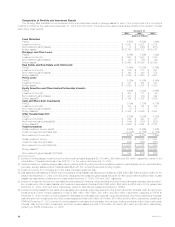

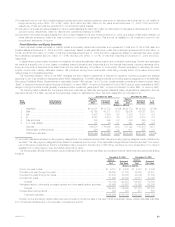

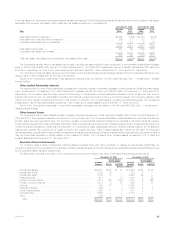

Investments

The Company’s primary investment objective is to optimize, net of income taxes, risk-adjusted investment income and risk-adjusted total return while

ensuring that assets and liabilities are managed on a cash flow and duration basis. The Company is exposed to three primary sources of investment risk:

)Credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and interest;

)Interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates; and

)Market valuation risk.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real estate

properties. The Company also manages credit risk and market valuation risk through industry and issuer diversification and asset allocation. For real

estate and agricultural assets, the Company manages credit risk and valuation risk through geographic, property type and product type diversification and

asset allocation. The Company manages interest rate risk as part of its asset and liability management strategies, product design, such as the use of

market value adjustment features and surrender charges, and proactive monitoring and management of certain non-guaranteed elements of its products,

such as the resetting of credited interest and dividend rates for policies that permit such adjustments.

MetLife, Inc. 27