MetLife 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

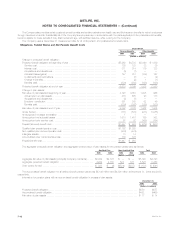

December 31,

2004 2003

(Dollars in millions)

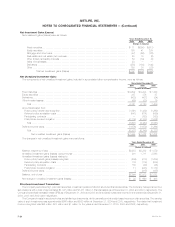

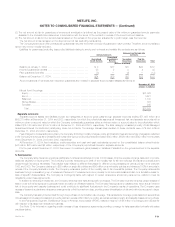

ASSETS DESIGNATED TO THE CLOSED BLOCK

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $27,757 and $30,381, respectively) **** 29,766 32,348

Equity securities, at fair value (cost: $898 and $217, respectively)********************************* 979 250

Mortgage loans on real estate *************************************************************** 8,165 7,431

Policy loans ****************************************************************************** 4,067 4,036

Short-term investments********************************************************************* 101 123

Other invested assets********************************************************************** 221 108

Total investments******************************************************************** 43,299 44,296

Cash and cash equivalents ******************************************************************* 325 531

Accrued investment income******************************************************************* 511 527

Deferred income taxes *********************************************************************** 1,002 1,043

Premiums and other receivables *************************************************************** 103 164

Total assets designated to the closed block ********************************************* 45,240 46,561

Excess of closed block liabilities over assets designated to the closed block************************** 4,785 5,037

Amounts included in accumulated other comprehensive loss:

Net unrealized investment gains, net of deferred income tax of $752 and $730, respectively ********** 1,338 1,270

Unrealized derivative gains (losses), net of deferred income tax benefit of ($31) and ($28), respectively ** (55) (48)

Allocated from policyholder dividend obligation, net of deferred income tax benefit of ($763) and ($778),

respectively **************************************************************************** (1,356) (1,352)

(73) (130)

Maximum future earnings to be recognized from closed block assets and liabilities********************* $ 4,712 $ 4,907

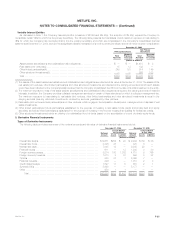

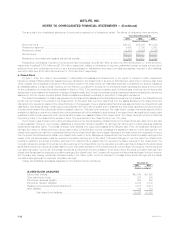

Information regarding the policyholder dividend obligation is as follows:

Years Ended December 31

2004 2003 2002

(Dollars in millions)

Balance at beginning of year ******************************************************************* $2,130 $1,882 $ 708

Impact on revenues, net of expenses and income taxes ******************************************** 124 — —

Change in unrealized investment and derivative gains (losses) *************************************** (11) 248 1,174

Balance at end of year ************************************************************************ $2,243 $2,130 $1,882

Closed block revenues and expenses were as follows:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

REVENUES

Premiums *********************************************************************************** $3,156 $3,365 $3,551

Net investment income and other revenues******************************************************* 2,504 2,554 2,568

Net investment gains (losses) ****************************************************************** (19) (128) 11

Total revenues *********************************************************************** 5,641 5,791 6,130

EXPENSES

Policyholder benefits and claims **************************************************************** 3,480 3,660 3,770

Policyholder dividends************************************************************************* 1,458 1,509 1,573

Change in policyholder dividend obligation******************************************************** 124 — —

Other expenses ****************************************************************************** 275 297 310

Total expenses*********************************************************************** 5,337 5,466 5,653

Revenues net of expenses before income taxes*************************************************** 304 325 477

Income taxes ******************************************************************************** 109 118 173

Revenues net of expenses and income taxes ***************************************************** $ 195 $ 207 $ 304

MetLife, Inc. F-33