MetLife 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

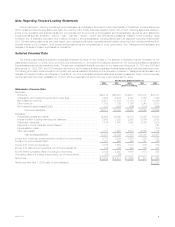

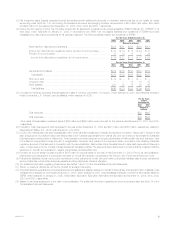

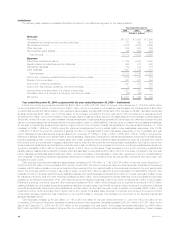

At December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

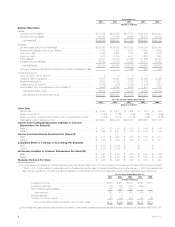

Balance Sheet Data

Assets:

General account assets******************************************** $270,039 $251,085 $217,733 $194,256 $183,912

Separate account assets******************************************* 86,769 75,756 59,693 62,714 70,250

Total assets(4) ************************************************** $356,808 $326,841 $277,426 $256,970 $254,162

Liabilities:

Life and health policyholder liabilities(9) ******************************* $190,847 $176,628 $162,569 $148,395 $140,040

Property and casualty policyholder liabilities**************************** 3,180 2,943 2,673 2,610 2,559

Short-term debt ************************************************** 1,445 3,642 1,161 355 1,085

Long-term debt*************************************************** 7,412 5,703 4,411 3,614 2,353

Other liabilities **************************************************** 44,331 41,020 28,269 21,964 20,396

Separate account liabilities ***************************************** 86,769 75,756 59,693 62,714 70,250

Total liabilities(4)************************************************* 333,984 305,692 258,776 239,652 236,683

Company-obligated mandatorily redeemable securities of subsidiary trusts** — — 1,265 1,256 1,090

Stockholders’ Equity:

Common stock, at par value(10) ************************************ 88888

Additional paid-in capital(10) **************************************** 15,037 14,991 14,968 14,966 14,926

Retained earnings(10)********************************************** 6,608 4,193 2,807 1,349 1,021

Treasury stock, at cost(10) ***************************************** (1,785) (835) (2,405) (1,934) (613)

Accumulated other comprehensive income (loss)(10) ******************* 2,956 2,792 2,007 1,673 1,047

Total stockholders’ equity***************************************** 22,824 21,149 17,385 16,062 16,389

Total liabilities and stockholders’ equity ***************************** $356,808 $326,841 $277,426 $256,970 $254,162

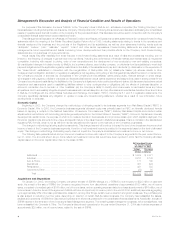

At or for the Years Ended December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

Other Data

Net income ****************************************************** $ 2,758 $ 2,217 $ 1,605 $ 473 $ 953

Return on equity(11)*********************************************** 12.5% 11.5% 9.6% 2.9% 6.3%

Return on equity, excluding accumulated other comprehensive income **** 14.4% 13.1% 10.8% 3.2% 12.1%

Total assets under management(12)********************************** $386,951 $350,235 $299,187 $282,486 $301,325

Income from Continuing Operations Available to Common

Shareholders Per Share(13)

Basic *********************************************************** $ 3.61 $ 2.55 $ 1.58 $ 0.46 $ 1.41

Diluted ********************************************************** $ 3.59 $ 2.51 $ 1.53 $ 0.45 $ 1.39

Income from Discontinued Operations Per Share(13)

Basic *********************************************************** $ 0.18 $ 0.47 $ 0.70 $ 0.18 $ 0.11

Diluted ********************************************************** $ 0.18 $ 0.46 $ 0.67 $ 0.18 $ 0.11

Cumulative Effect of a Change in Accounting Per Share(13)

Basic *********************************************************** $ (0.11) $ (0.04) $ — $ — $ —

Diluted ********************************************************** $ (0.11) $ (0.03) $ — $ — $ —

Net Income Available to Common Shareholders Per Share(13)

Basic *********************************************************** $ 3.68 $ 2.98 $ 2.28 $ 0.64 $ 1.52

Diluted ********************************************************** $ 3.65 $ 2.94 $ 2.20 $ 0.62 $ 1.49

Dividends Declared Per Share ************************************* $ 0.46 $ 0.23 $ 0.21 $ 0.20 $ 0.20

(1) In accordance with Statement of Financial Accounting Standards (‘‘SFAS’’) No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets

(‘‘SFAS 144’’), income related to real estate sold or classified as held-for-sale for transactions initiated on or after January 1, 2002 is presented as

discontinued operations. The following table presents the components of income from discontinued real estate operations (see footnote 4):

For the Years Ended December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

Investment income ************************************************ $136 $ 231 $ 530 $ 525 $177

Investment expense *********************************************** (82) (138) (351) (339) —

Net investment gains (losses) *************************************** 139 420 582 — —

Total revenues************************************************** 193 513 761 186 177

Interest expense ************************************************** 13 4 1 — —

Provision for income taxes****************************************** 63 186 276 68 65

Income from discontinued operations, net of income taxes************* $117 $ 323 $ 484 $ 118 $112

(2) Net investment gains (losses) exclude amounts related to real estate operations reported as discontinued operations in accordance with SFAS 144.

MetLife, Inc.

2