MetLife 2004 Annual Report Download - page 14

Download and view the complete annual report

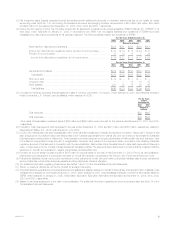

Please find page 14 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are predominately attributable to the business growth discussed in the revenue discussion above. The increases in group life and the non-medical

health & other businesses include the impact of the acquisition of certain businesses from John Hancock and TIAA/CREF of $11 million and $39 million,

respectively. Also included in the increase is the impact of less favorable claim experience, primarily in the non-medical health & other business. Interest

credited to policyholder account balances increased by $45 million over the prior year period primarily as a result of the impact of growth in guaranteed

interest contracts within the retirement & savings business. Other operating expenses increased $123 million. The largest component of this expense

growth is an increase of $97 million related to increases in direct business support expenses. In addition, non-deferrable commissions and premium

taxes increased by $25 million. This is net of a $49 million reduction in a premium tax liability in the second quarter of 2004. Excluding this item,

non-deferrable commissions and premium taxes increased by $74 million, which is commensurate with the aforementioned revenue growth. In addition,

the Company incurred infrastructure improvement costs of $34 million and expenses of $12 million related to the closing of one of the Company’s

disability claims centers which were partially offset by a decline of $45 million primarily relating to expenses incurred in the prior year for office closures

and consolidations and an impairment of related assets.

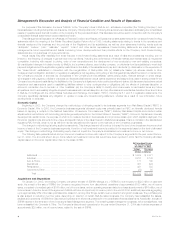

Year ended December 31, 2003 compared with the year ended December 31, 2002 — Institutional

Income from continuing operations increased by $206 million, or 33%, to $838 million for the year ended December 31, 2003 from $632 million for

the comparable 2002 period. Revenue growth combined with favorable underwriting results and interest margins contributed to the year over year

increase. Lower net investment losses in 2003 versus 2002 contributed $124 million, net of income taxes, to the year over year increase. Favorable

underwriting experience was partially offset by an increase in expenses associated with office closures and other consolidations, as well as an increase in

pension and postretirement benefit costs. In addition, the prior year period includes a $20 million, net of income taxes, benefit from the reduction of a

previously established liability for the Company’s 2001 business realignment initiatives and a $17 million, net of income taxes, benefit from the reduction

of a previously established liability for disability insurance-related losses from the September 11, 2001 tragedies.

Total revenues, excluding net investment gains and losses, increased by $961 million, or 7%, to $14,348 million for the year ended December 31,

2003 from $13,387 million for the comparable 2002 period. The increase is attributable to both the group insurance and the retirement & savings product

lines. Within group insurance, life insurance premiums and fees increased by $248 million, or 5%, which is in line with management’s expectations. This

increase is attributable primarily to higher sales and favorable persistency. The late 2003 acquisition of the John Hancock block of group life business

contributed $72 million to this increase. In addition, the long-term care, dental, and disability products experienced continued growth at a combined rate

of approximately 14%, which is in line with management’s expectations. Retirement & savings revenues increased approximately 12% primarily due to

higher sales in the structured settlement products partially offset by the impact of a sale of a significant, single premium contract in the second quarter of

2002. Premiums and fees from retirement and saving products are significantly influenced by large transactions and, as a result, can fluctuate from year

to year. These increases were partially offset by a decrease in revenues primarily due to a decline in retirement & savings administrative fees from the

Company’s 401(k) business. This decline resulted from the exit from the large market 401(k) business in late 2001. Consequently, revenue decreased as

business was transferred to other carriers throughout 2002.

Total expenses increased by $817 million, or 7%, to $12,740 million for the year ended December 31, 2003 from $11,923 million for the

comparable 2002 period. Policyholder-related expenses increased $564 million primarily as a function of the growth in business. The increase in

expenses is offset by favorable underwriting results in the term life insurance, dental, long-term care, and retirement & savings products. The term life

mortality incurred loss ratio, which represents actual life claims as a percentage of assumed claims incurred used in the determination of future policy

benefits, was 92% for 2003 as compared to 93.6% in 2002. Underwriting results declined in disability as the morbidity incurred loss ratio, which

represents actual disability claims as a percentage of assumed claims incurred used in the determination of future policy benefits, increased to 98.5% in

2003 from 97.9% in the prior year. The 2003 ratio was within management’s expected range. In addition, the 2002 period includes a $28 million release

of a previously established liability for disability insurance-related losses from the September 11, 2001 tragedies. Other expenses increased by

$253 million over the prior year period. Group insurance and retirement & savings expenses increased $115 million primarily due to an increase in non-

deferrable expenses associated with the aforementioned revenue growth, $77 million from an increase in pension and postretirement benefit expense,

and a $33 million increase in expenses associated with office closures and other consolidations. In addition, the prior year period includes a $30 million

reduction of a previously established liability for the Company’s 2001 business realignment initiatives.

MetLife, Inc. 11