MetLife 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

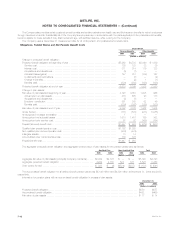

The Company also provides certain postemployment benefits and certain postretirement health care and life insurance benefits for retired employees

through insurance contracts. Substantially all of the Company’s employees may, in accordance with the plans applicable to the postretirement benefits,

become eligible for these benefits if they attain retirement age, with sufficient service, while working for the Company.

The Company uses a December 31 measurement date for all of its pension and postretirement benefit plans.

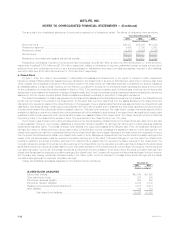

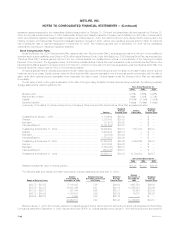

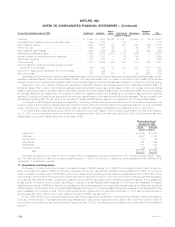

Obligations, Funded Status and Net Periodic Benefit Costs

December 31,

Pension Benefits Other Benefits

2004 2003 2004 2003

(Dollars in millions)

Change in projected benefit obligation:

Projected benefit obligation at beginning of year ***************************************** $5,269 $4,783 $2,090 $ 1,889

Service cost ********************************************************************* 129 123 32 39

Interest cost ********************************************************************* 311 314 119 123

Acquisitions and divestitures ******************************************************** (3) (1) — —

Actuarial losses (gains) ************************************************************ 147 351 (139) 167

Curtailments and terminations******************************************************* — (7) — (4)

Change in benefits**************************************************************** — (2) 1 (1)

Benefits paid********************************************************************* (330) (292) (128) (123)

Projected benefit obligation at end of year ********************************************** 5,523 5,269 1,975 2,090

Change in plan assets:

Fair value of plan assets at beginning of year******************************************** 4,728 4,051 1,005 966

Actual return on plan assets ******************************************************** 416 635 93 113

Acquisitions and divestitures ******************************************************** (3) (1) — —

Employer contribution ************************************************************* 581 335 92 49

Benefits paid********************************************************************* (330) (292) (128) (123)

Fair value of plan assets at end of year************************************************* 5,392 4,728 1,062 1,005

Under funded ********************************************************************** (131) (541) (913) (1,085)

Unrecognized net asset at transition *************************************************** 11——

Unrecognized net actuarial losses ***************************************************** 1,510 1,451 199 362

Unrecognized prior service cost ******************************************************* 67 82 (165) (184)

Prepaid (accrued) benefit cost ******************************************************** $1,447 $ 993 $ (879) $ (907)

Qualified plan prepaid pension cost**************************************************** $1,782 $1,325

Non-qualified plan accrued pension cost *********************************************** (478) (474)

Intangible assets******************************************************************** 13 14

Accumulated other comprehensive loss ************************************************ 130 128

Prepaid benefit cost***************************************************************** $1,447 $ 993

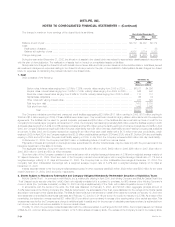

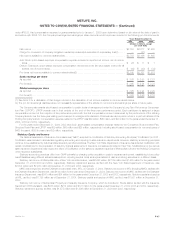

The aggregate projected benefit obligation and aggregate contract value of plan assets for the pension plans were as follows:

Qualified Plan Non-Qualified Plan Total

2004 2003 2004 2003 2004 2003

(Dollars in millions)

Aggregate fair value of plan assets (principally Company contracts) ***** $5,392 $4,728 $ — $ — $5,392 $4,728

Aggregate projected benefit obligation ***************************** 4,999 4,732 524 537 5,523 5,269

Over (under) funded ******************************************** $ 393 $ (4) $(524) $(537) $ (131) $ (541)

The accumulated benefit obligation for all defined benefit pension plans was $5,149 million and $4,899 million at December 31, 2004 and 2003,

respectively.

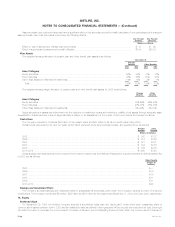

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

December 31,

2004 2003

(Dollars in millions)

Projected benefit obligation ***************************************************************************** $550 $557

Accumulated benefit obligation ************************************************************************** $482 $469

Fair value of plan assets ******************************************************************************* $17 $14

MetLife, Inc.

F-42