MetLife 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

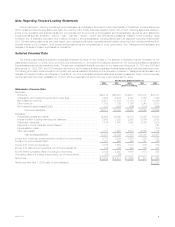

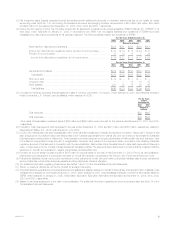

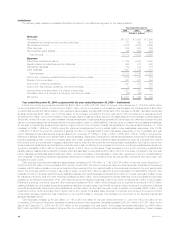

(3) Net investment gains (losses) presented include scheduled periodic settlement payments on derivative instruments that do not qualify for hedge

accounting under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended, of $51 million, $84 million, $32 million

and $24 million for the years ended December 31, 2004, 2003, 2002 and 2001, respectively.

(4) During the third quarter of 2004, the Company entered into an agreement to sell its wholly-owned subsidiary, SSRM Holdings, Inc. (‘‘SSRM’’), to a

third party, which was sold on January 31, 2005. In accordance with SFAS 144, the assets, liabilities and operations of SSRM have been

reclassified into discontinued operations for all periods presented. The following tables present the operations of SSRM:

For the Years Ended December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

Revenues from discontinued operations ************************************ $328 $231 $239 $254 $258

Income from discontinued operations, before provision for income taxes********* $32 $34 $14 $24 $47

Provision for income taxes *********************************************** 13 13 6 7 22

Income from discontinued operations, net of income taxes ****************** $19 $21 $ 8 $17 $25

For the Years Ended December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

General account assets ************************************************* $379 $183 $198 $203 $228

Total assets ********************************************************* $379 $183 $198 $203 $228

Short-term debt ******************************************************** $19$—$—$—$—

Long-term debt ******************************************************** — — 14 14 47

Other liabilities ********************************************************* 221 70 78 80 95

Total liabilities ******************************************************** $240 $ 70 $ 92 $ 94 $142

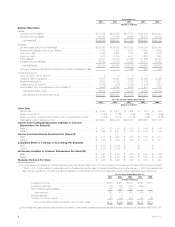

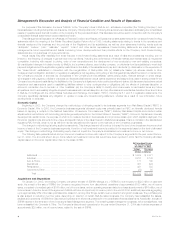

(5) Includes the following combined financial statement data of Conning Corporation (‘‘Conning’’), which was sold in 2001, and MetLife’s interest in

Nvest Companies, L.P. (‘‘Nvest’’) and its affiliates, which was sold in 2000:

For the Years

Ended

December 31,

2001 2000

(Dollars in

millions)

Total revenues********************************************************************************* $32 $605

Total expenses ******************************************************************************** $33 $580

As a result of these sales, investment gains of $25 million and $663 million were recorded for the years ended December 31, 2001 and 2000,

respectively.

(6) Included in total revenues and total expenses for the year ended December 31, 2002 are $421 million and $358 million, respectively, related to

Aseguradora Hidalgo S.A., which was acquired in June 2002.

(7) In July 1998, Metropolitan Life sold a substantial portion of its Canadian operations to Clarica Life Insurance Company (‘‘Clarica Life’’). As part of that

sale, a large block of policies in effect with Metropolitan Life in Canada was transferred to Clarica Life, and the holders of the transferred Canadian

policies became policyholders of Clarica Life. Those transferred policyholders are no longer policyholders of Metropolitan Life and, therefore, were

not entitled to compensation under the plan of reorganization. However, as a result of a commitment made in connection with obtaining Canadian

regulatory approval of that sale and in connection with the demutualization, Metropolitan Life’s Canadian branch made cash payments to those who

were, or were deemed to be, holders of these transferred Canadian policies. The payments were determined in a manner that is consistent with the

treatment of, and fair and equitable to, eligible policyholders of Metropolitan Life.

(8) Provision for income taxes includes a credit of $145 million for surplus taxes for the year ended December 31, 2000. Prior to its demutualization,

Metropolitan Life was subject to surplus tax imposed on mutual life insurance companies under Section 809 of the Internal Revenue Code.

(9) Policyholder liabilities include future policy benefits and other policyholder funds. Life and health policyholder liabilities also include policyholder

account balances, policyholder dividends payable and the policyholder dividend obligation.

(10) For additional information regarding these items, see Notes 1 and 12 to the Consolidated Financial Statements.

(11) Return on equity is defined as net income divided by average total equity.

(12) Includes MetLife’s general account and separate account assets and assets managed on behalf of third parties. Includes $21 billion of assets under

management managed by Conning at December 31, 2000, which was sold in 2001. Includes assets managed on behalf of third parties related to

SSRM, which was sold on January 31, 2005, of $30 billion, $23 billion, $22 billion, $26 billion and $26 billion at December 31, 2004, 2003, 2002,

2001 and 2000, respectively.

(13) Based on earnings subsequent to the date of demutualization. For additional information regarding net income per share data, see Note 14 to the

Consolidated Financial Statements.

MetLife, Inc. 3