MetLife 2004 Annual Report Download - page 12

Download and view the complete annual report

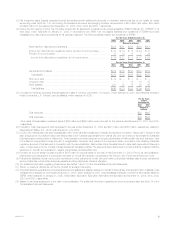

Please find page 12 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sold in 2004 as compared to the prior year. For the years ended December 31, 2004 and 2003, the Company recognized $139 million and $420 million

of net investment gains, respectively, from discontinued operations related to real estate properties sold or held-for-sale.

During the year ended December 31, 2004, the Company recorded an $86 million charge, net of income taxes, for a cumulative effect of a change

in accounting in accordance with SOP 03-1, which provides guidance on (i) the classification and valuation of long-duration contract liabilities; (ii) the

accounting for sales inducements; and (iii) separate account presentation and valuation. This charge is primarily related to those long-duration contract

liabilities where the amount of the liability is indexed to the performance of a target portfolio of investment securities. During the year ended December 31,

2003, the Company recorded a $26 million charge, net of income taxes, for a cumulative effect of a change in accounting in accordance with Issue B36.

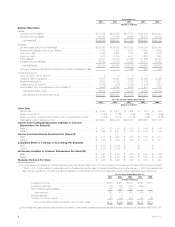

Year ended December 31, 2003 compared with the year ended December 31, 2002 — The Company

Income from continuing operations increased by $786 million, or 71%, to $1,899 million for the year ended December 31, 2003 from $1,113 million

in the comparable 2002 period. Income from continuing operations for the years 2003 and 2002 includes the impact of certain transactions or events

that result in net income not being indicative of future earnings, which are described in the applicable segment’s results of operations discussions. These

items contributed a benefit of $159 million, net of income taxes, in 2003 and a charge of $150 million, net of income taxes, in 2002. Excluding the impact

of these items, income from continuing operations increased by $477 million in 2003 compared to the prior year. Declines in net investment losses

account for $197 million, net of income taxes, of this increase with the balance being contributed by the Company’s operations. The decline in net

investment losses is largely attributable to less credit-related losses, which is consistent with the U.S. financial market environment.

Premiums, fees and other revenues increased 9% over the prior year primarily as a result of growth in the annuities, retirement & savings and variable

and universal life product lines. This increase stems in part from policy fee income earned on annuity deposits, which were $11.2 billion in 2003,

increasing 42% from the prior year. In addition, the annuity separate account balance was $28.7 billion at December 31, 2003, up 57% versus the prior

year end. Growth in retirement & savings is primarily attributable to higher sales in structured settlement products. Fee income from variable and universal

life products increased 12% over the prior year primarily as a result of a 25% growth in separate account balances. In addition, the coinsurance

agreement with Allianz Life in the Reinsurance segment contributed approximately 1% to the year over year increase. Partially offsetting these increases is

a decline in traditional life premiums, which is largely attributable to run off in the Company’s closed block of business.

Investment margins, which represent the spread between net investment income and interest credited to policyholder account balances, remained

favorable in 2003 as the Company took appropriate crediting rate reductions in most products in an effort to keep pace with the market environment. In

several product lines, where investment margins are a substantial part of earnings, the Company still has a reasonable amount of flexibility to reduce

crediting rates further if portfolio yields were to decline from year-end 2003 levels. Investment margins in 2003 did benefit from higher than expected

levels of prepayments.

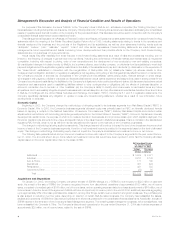

Underwriting results varied in 2003. The group life mortality ratio continues to be favorable at 92%. The Individual life mortality ratio was also solid at

88%, which includes the impact of several large claims in the variable and universal product line, some of which had lower levels of reinsurance. Group

disability’s morbidity ratio increased to 98.5%, from 97.9% in the prior year but is still within management’s expected range. The Auto & Home combined

ratio, which is a measure of both the loss and loss adjustment expense ratio, as well as the expense ratio, remained favorable at 97.1% excluding

catastrophes. The Company’s International segment increased its loss recognition reserve in Taiwan as a result of low interest rates relative to product

guarantees. This action resulted in a $19 million charge, net of income taxes.

Other expenses increased 4% over the prior year period primarily as a result of an increase of $133 million in pension and postretirement expenses.

As a result of contributions made to the pension plan in late 2003 and early 2004, which totaled approximately $750 million, and the stronger

performance of the pension plan assets in 2003, the Company anticipates the pension and postretirement expenses to moderate in 2004. Other

expenses in 2003 also include the impact of several actions taken by management in the fourth quarter, including lease terminations, office consolida-

tions and closures, and asset impairments. In addition, severance costs and expenses associated with strategic initiatives at New England Financial

contributed to the increase in expenses year over year. Also, there was an increase in many of the product lines’ volume-related expenses, which are in

line with 2003 business growth.

Net investment losses decreased by $310 million, or 35%, to $582 million for the year ended December 31, 2003 from $892 million for the

comparable 2002 period. This improvement is primarily due to lower credit-related losses.

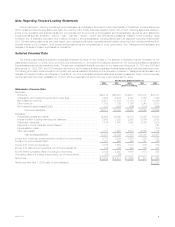

Income tax expense for the year ended December 31, 2003 was $660 million, or 26% of income from continuing operations before provision for

income taxes and cumulative effect of change in accounting, compared with $490 million, or 31%, for the comparable 2002 period. The 2003 effective

tax rate differs from the corporate tax rate of 35% primarily due to the impact of non-taxable investment income, tax credits for investments in low income

housing, a recovery of prior year tax overpayments on tax-exempt bonds, and an adjustment consisting primarily of a revision in the estimate of income

taxes for 2002. In addition, the 2003 effective tax rate includes a reduction of the deferred tax valuation allowance related to certain foreign net operating

loss carryforwards, and tax benefits related to the sale and merger of foreign subsidiaries reflected in the International segment. The 2002 effective tax

rate differs from the corporate tax rate of 35% primarily due to the impact of non-taxable investment income, partially offset by the inability to utilize tax

benefits on certain foreign capital losses.

The income from discontinued operations is comprised of the operations of SSRM and net investment income and net investment gains related to

real estate properties that the Company has classified as available-for-sale. The Company sold SSRM on January 31, 2005.

Income from discontinued operations declined $148 million, or 30%, to $344 million for the year ended December 31, 2003 from $492 million in the

comparable prior year period. The decrease is primarily due to lower recognized net investment gains from real estate properties sold in 2003 as

compared to the prior year. For the years ended December 31, 2003 and 2002, the Company recognized $420 million and $582 million of net

investment gains, respectively, from discontinued operations related to real estate properties sold or held-for-sale.

The Company changed its method of accounting for embedded derivatives in certain insurance products as required by new accounting guidance

which became effective on October 1, 2003, and recorded the impact as a cumulative effect of a change in accounting principle.

MetLife, Inc. 9