MetLife 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note Regarding Forward-Looking Statements

This Annual Report, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains statements

which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to

trends in the operations and financial results and the business and the products of the Registrant and its subsidiaries, as well as other statements

including words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘plan,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend’’ and other similar expressions. ‘‘MetLife’’ or the ‘‘Company’’ refers

to MetLife, Inc., a Delaware corporation (the ‘‘Holding Company’’), and its subsidiaries, including Metropolitan Life Insurance Company (‘‘Metropolitan

Life’’). Forward-looking statements are made based upon management’s current expectations and beliefs concerning future developments and their

potential effects on the Company. Such forward-looking statements are not guarantees of future performance. See ‘‘Management’s Discussion and

Analysis of Financial Condition and Results of Operations.’’

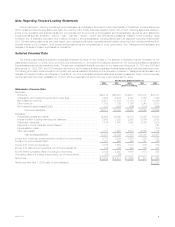

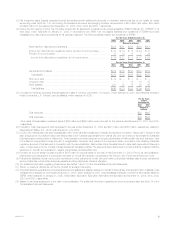

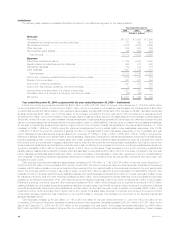

Selected Financial Data

The following table sets forth selected consolidated financial information for the Company. The selected consolidated financial information for the

years ended December 31, 2004, 2003, and 2002, and at December 31, 2004 and 2003 has been derived from the Company’s audited consolidated

financial statements included elsewhere herein. The selected consolidated financial information for the years ended December 31, 2001 and 2000 and

at December 31, 2002, 2001 and 2000 has been derived from the Company’s audited consolidated financial statements not included elsewhere herein.

The following information should be read in conjunction with and is qualified in its entirety by the information contained in ‘‘Management’s Discussion and

Analysis of Financial Condition and Results of Operations,’’ and the consolidated financial statements appearing elsewhere herein. Some previously

reported amounts have been reclassified to conform with the presentation at and for the year ended December 31, 2004.

For the Years Ended December 31,

2004 2003 2002 2001 2000

(Dollars in millions)

Statements of Income Data

Revenues:

Premiums ************************************************************* $22,316 $20,673 $19,077 $17,212 $16,317

Universal life and investment-type product policy fees ************************ 2,900 2,496 2,147 1,889 1,820

Net investment income(1) ************************************************ 12,418 11,539 11,183 11,101 10,886

Other revenues ******************************************************** 1,198 1,199 1,166 1,340 2,070

Net investment gains (losses)(1)(2)(3) ************************************** 182 (582) (892) (713) (444)

Total revenues(4)(5)(6) ********************************************* 39,014 35,325 32,681 30,829 30,649

Expenses:

Policyholder benefits and claims ****************************************** 22,662 20,665 19,373 18,295 16,934

Interest credited to policyholder account balances *************************** 2,998 3,035 2,950 3,084 2,935

Policyholder dividends*************************************************** 1,814 1,975 1,942 2,086 1,919

Payments to former Canadian policyholders(7)******************************* ————327

Demutualization costs *************************************************** ————230

Other expenses(1) ****************************************************** 7,761 7,091 6,813 6,835 7,112

Total expenses(4)(5)(6)(7)******************************************* 35,235 32,766 31,078 30,300 29,457

Income from continuing operations before provision for income taxes ************* 3,779 2,559 1,603 529 1,192

Provision for income taxes(1)(4)(8) ******************************************* 1,071 660 490 191 376

Income from continuing operations ****************************************** 2,708 1,899 1,113 338 816

Income from discontinued operations, net of income taxes(1)(4) ****************** 136 344 492 135 137

Income before cumulative effect of a change in accounting********************** 2,844 2,243 1,605 473 953

Cumulative effect of a change in accounting, net of income taxes **************** (86) (26) — — —

Net income************************************************************** $ 2,758 $ 2,217 $ 1,605 $ 473 $ 953

Net income after April 7, 2000 (date of demutualization)************************* $ 1,173

MetLife, Inc. 1