MetLife 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(2) The net amount at risk for guarantees of amounts at annuitization is defined as the present value of the minimum guaranteed annuity payments

available to the contractholder determined in accordance with the terms of the contract in excess of the current account balance.

(3) The net amount at risk for two tier annuities is based on the excess of the upper tier, adjusted for a profit margin, less the lower tier.

The net amount at risk is based on the direct amount at risk (excluding reinsurance).

The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the amounts listed

above may not be mutually exclusive.

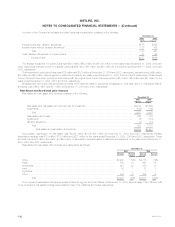

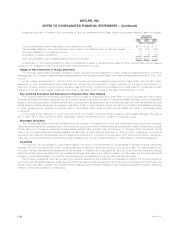

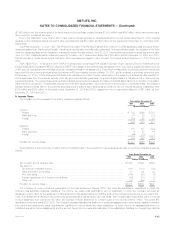

Liabilities for guarantees (excluding base policy liabilities) relating to annuity and universal and variable life contracts are as follows:

Universal and Variable Life

Annuity Contracts Contracts

Guaranteed

Guaranteed Annuitization Secondary Paid Up

Death Benefits Benefits Guarantees Guarantees Total

(Dollars in millions)

Balance at January 1, 2004 *********************************** $ 9 $17 $ 6 $25 $ 57

Incurred guaranteed benefits *********************************** 23 2 4 4 33

Paid guaranteed benefits ************************************** (8) — (4) — (12)

Balance at December 31, 2004 ******************************** $24 $19 $ 6 $29 $ 78

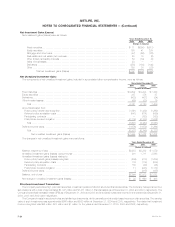

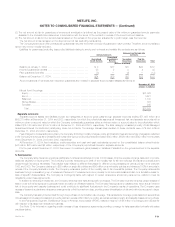

Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows at:

December 31, 2004

(Dollars in millions)

Mutual Fund Groupings

Equity*********************************************************************************************** $31,829

Bond *********************************************************************************************** 3,621

Balanced ******************************************************************************************** 1,730

Money Market**************************************************************************************** 383

Specialty ******************************************************************************************** 245

Total ********************************************************************************************** $37,808

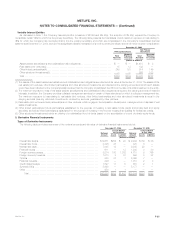

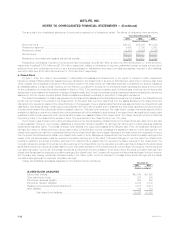

Separate Accounts

Separate account assets and liabilities include two categories of account types: pass-through separate accounts totaling $71,623 million and

$59,278 million at December 31, 2004 and 2003, respectively, for which the policyholder assumes all investment risk, and separate accounts with a

minimum return or account value for which the Company contractually guarantees either a minimum return or account value to the policyholder which

totaled $15,146 million and $16,478 million at December 31, 2004 and 2003, respectively. The latter category consisted primarily of Met Managed

Guaranteed Interest Contracts and participating close-out contracts. The average interest rates credited on these contracts were 4.7% and 4.5% at

December 31, 2004 and 2003, respectively.

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reflected

in the Company’s revenues as universal life and investment-type product policy fees and totaled $843 million, $626 million and $542 million for the years

ended December 31, 2004, 2003 and 2002, respectively.

At December 31, 2004, fixed maturities, equity securities, and cash and cash equivalents reported on the consolidated balance sheet include

$47 million, $20 million and $2 million, respectively, of the Company’s proportional interest in separate accounts.

For the year ended December 31, 2004, there were no investment gains (losses) on transfers of assets from the general account to the separate

accounts.

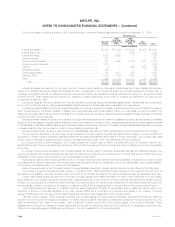

5. Reinsurance

The Company’s life insurance operations participate in reinsurance activities in order to limit losses, minimize exposure to large risks, and to provide

additional capacity for future growth. The Company currently reinsures up to 90% of the mortality risk for all new individual life insurance policies that it

writes through its various franchises. This practice was initiated by different franchises for different products starting at various points in time between

1992 and 2000. The Company retains up to $25 million on single life policies and $30 million on survivorship policies and reinsures 100% of amounts in

excess of the Company’s retention limits. The Company reinsures a portion of the mortality risk on its universal life policies. The Company reinsures its

business through a diversified group of reinsurers. Placement of reinsurance is done primarily on an automatic basis and also on a facultative basis for

risks of specific characteristics. The Company is contingently liable with respect to ceded reinsurance should any reinsurer be unable to meet its

obligations under these agreements.

In addition to reinsuring mortality risk, the Company reinsures other risks and specific coverages. The Company routinely reinsures certain classes of

risks in order to limit its exposure to particular travel, avocation and lifestyle hazards. The Company has exposure to catastrophes, which are an inherent

risk of the property and casualty business and could contribute to significant fluctuations in the Company’s results of operations. The Company uses

excess of loss and quota share reinsurance arrangements to limit its maximum loss, provide greater diversification of risk and minimize exposure to larger

risks.

The Company has also protected itself through the purchase of combination risk coverage. This reinsurance coverage pools risks from several lines

of business and includes individual and group life claims in excess of $2 million per policy, as well as excess property and casualty losses, among others.

In the Reinsurance Segment, Reinsurance Group of America, Incorporated (‘‘RGA’’), retains a maximum of $6 million of coverage per individual life

with respect to its assumed reinsurance business.

See Note 10 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales

practices claims.

MetLife, Inc. F-31