MetLife 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

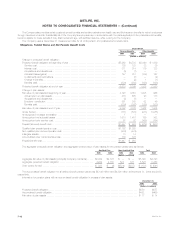

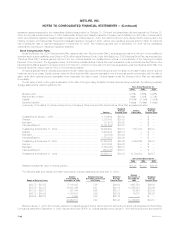

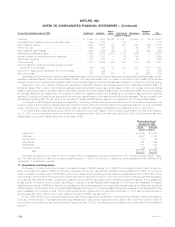

14. Earnings Per Share

The following presents the weighted average shares used in calculating basic earnings per share and those used in calculating diluted earnings per

share for each income category presented below:

For the Years Ended December 31,

2004 2003 2002

(Dollars in millions, except share and per share data)

Weighted average common stock outstanding for basic earnings per share *********** 749,695,661 737,903,107 704,599,115

Incremental shares from assumed:

Conversion of forward purchase contracts ************************************* — 8,293,269 24,596,950

Exercise of stock options**************************************************** 4,053,813 68,111 5,233

Issuance under deferred stock compensation*********************************** 1,083,970 579,810 —

Weighted average common stock outstanding for diluted earnings per share ********** 754,833,444 746,844,297 729,201,298

Income from continuing operations ***************************************** $ 2,708 $ 1,899 $ 1,113

Charge for conversion of company-obligated mandatorily redeemable

securities of a subsidiary trust(1) ***************************************** — (21) —

Income from continuing operations available to common shareholders per

share******************************************************************** $ 2,708 $ 1,878 $ 1,113

Basic ******************************************************************** $ 3.61 $ 2.55 $ 1.58

Diluted ******************************************************************* $ 3.59 $ 2.51 $ 1.53

Income from discontinued operations, net of income taxes, available to

common shareholders per share ***************************************** $ 136 $ 344 $ 492

Basic ******************************************************************** $ 0.18 $ 0.47 $ 0.70

Diluted ******************************************************************* $ 0.18 $ 0.46 $ 0.67

Cumulative effect of change in accounting, net of income taxes, per share *** $ (86) $ (26) $ —

Basic ******************************************************************** $ (0.11) $ (0.04) $ —

Diluted ******************************************************************* $ (0.11) $ (0.03) $ —

Net Income**************************************************************** $ 2,758 $ 2,217 $ 1,605

Charge for conversion of company-obligated mandatorily redeemable

securities of a subsidiary trust(1) ***************************************** — (21) —

Net income available to common shareholders per share ******************** $ 2,758 $ 2,196 $ 1,605

Basic ******************************************************************** $ 3.68 $ 2.98 $ 2.28

Diluted ******************************************************************* $ 3.65 $ 2.94 $ 2.20

(1) See Note 8 for a discussion of this charge included in the calculation of net income available to common shareholders.

MetLife, Inc. F-49