MetLife 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In December 1999, a federal court approved a settlement resolving sales practices claims on behalf of a class of owners of permanent life insurance

policies and annuity contracts or certificates issued pursuant to individual sales in the United States by Metropolitan Life, Metropolitan Insurance and

Annuity Company or Metropolitan Tower Life Insurance Company between January 1, 1982 and December 31, 1997. The class includes owners of

approximately six million in-force or terminated insurance policies and approximately one million in-force or terminated annuity contracts or certificates.

Similar sales practices class actions against New England Mutual, with which Metropolitan Life merged in 1996, and General American, which was

acquired in 2000, have been settled. In October 2000, a federal court approved a settlement resolving sales practices claims on behalf of a class of

owners of permanent life insurance policies issued by New England Mutual between January 1, 1983 through August 31, 1996. The class includes

owners of approximately 600,000 in-force or terminated policies. A federal court has approved a settlement resolving sales practices claims on behalf of

a class of owners of permanent life insurance policies issued by General American between January 1, 1982 through December 31, 1996. An appellate

court has affirmed the order approving the settlement. The class includes owners of approximately 250,000 in-force or terminated policies.

Certain class members have opted out of the class action settlements noted above and have brought or continued non-class action sales practices

lawsuits. In addition, other sales practices lawsuits have been brought. As of December 31, 2004, there are approximately 328 sales practices lawsuits

pending against Metropolitan Life; approximately 49 sales practices lawsuits pending against New England Mutual, New England Life Insurance

Company, and New England Securities Corporation (collectively, ‘‘New England’’); and approximately 54 sales practices lawsuits pending against

General American. Metropolitan Life, New England and General American continue to defend themselves vigorously against these lawsuits. Some

individual sales practices claims have been resolved through settlement, won by dispositive motions, or, in a few instances, have gone to trial. Most of

the current cases seek substantial damages, including in some cases punitive and treble damages and attorneys’ fees. Additional litigation relating to the

Company’s marketing and sales of individual life insurance may be commenced in the future.

The Metropolitan Life class action settlement did not resolve two putative class actions involving sales practices claims filed against Metropolitan Life

in Canada, and these actions remain pending.

The Company believes adequate provision has been made in its consolidated financial statements for all probable and reasonably estimable losses

for sales practices claims against Metropolitan Life, New England and General American.

Regulatory authorities in a small number of states have had investigations or inquiries relating to Metropolitan Life’s, New England’s, or General

American’s sales of individual life insurance policies or annuities. Over the past several years, these and a number of investigations by other regulatory

authorities were resolved for monetary payments and certain other relief. The Company may continue to resolve investigations in a similar manner.

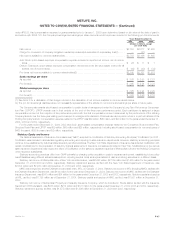

Asbestos-Related Claims

Metropolitan Life is also a defendant in thousands of lawsuits seeking compensatory and punitive damages for personal injuries allegedly caused by

exposure to asbestos or asbestos-containing products. Metropolitan Life has never engaged in the business of manufacturing, producing, distributing or

selling asbestos or asbestos-containing products nor has Metropolitan Life issued liability or workers’ compensation insurance to companies in the

business of manufacturing, producing, distributing or selling asbestos or asbestos-containing products. Rather, these lawsuits principally have been

based upon allegations relating to certain research, publication and other activities of one or more of Metropolitan Life’s employees during the period from

the 1920’s through approximately the 1950’s and have alleged that Metropolitan Life learned or should have learned of certain health risks posed by

asbestos and, among other things, improperly publicized or failed to disclose those health risks. Metropolitan Life believes that it should not have legal

liability in such cases.

Legal theories asserted against Metropolitan Life have included negligence, intentional tort claims and conspiracy claims concerning the health risks

associated with asbestos. Although Metropolitan Life believes it has meritorious defenses to these claims, and has not suffered any adverse monetary

judgments in respect of these claims, due to the risks and expenses of litigation, almost all past cases have been resolved by settlements. Metropolitan

Life’s defenses (beyond denial of certain factual allegations) to plaintiffs’ claims include that: (i) Metropolitan Life owed no duty to the plaintiffs — it had no

special relationship with the plaintiffs and did not manufacture, produce, distribute or sell the asbestos products that allegedly injured plaintiffs; (ii) plaintiffs

cannot demonstrate justifiable detrimental reliance; and (iii) plaintiffs cannot demonstrate proximate causation. In defending asbestos cases, Metropolitan

Life selects various strategies depending upon the jurisdictions in which such cases are brought and other factors which, in Metropolitan Life’s judgment,

best protect Metropolitan Life’s interests. Strategies include seeking to settle or compromise claims, motions challenging the legal or factual basis for

such claims or defending on the merits at trial. In 2002, 2003 or 2004, trial courts in California, Utah, Georgia, New York, Texas, and Ohio granted

motions dismissing claims against Metropolitan Life on some or all of the above grounds. Other courts have denied motions brought by Metropolitan Life

to dismiss cases without the necessity of trial. There can be no assurance that Metropolitan Life will receive favorable decisions on motions in the future.

Metropolitan Life intends to continue to exercise its best judgment regarding settlement or defense of such cases, including when trials of these cases

are appropriate.

Metropolitan Life continues to study its claims experience, review external literature regarding asbestos claims experience in the United States and

consider numerous variables that can affect its asbestos liability exposure, including bankruptcies of other companies involved in asbestos litigation and

legislative and judicial developments, to identify trends and to assess their impact on the recorded asbestos liability.

Bankruptcies of other companies involved in asbestos litigation, as well as advertising by plaintiffs’ asbestos lawyers, may be resulting in an increase

in the cost of resolving claims and could result in an increase in the number of trials and possible adverse verdicts Metropolitan Life may experience.

Plaintiffs are seeking additional funds from defendants, including Metropolitan Life, in light of such bankruptcies by certain other defendants. In addition,

publicity regarding legislative reform efforts may result in an increase or decrease in the number of claims.

MetLife, Inc. F-37