MetLife 2004 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To MetLife’s Shareholders:

MetLife is widely respected as a company that is financially strong and committed to meeting its long-

term obligations: we deliver on the guarantees and promises we make. At the same time, our company

has, for 137 years, demonstrated something equally important and compelling—that MetLife builds

financial freedom for everyone. This commitment and the execution of our business plans in 2004

resulted in record results for MetLife’s shareholders—the owners of this great organization.

For the third year in a row, MetLife delivered record net income. We did this by keeping a strong

focus on effectively managing and further growing the businesses where we are a leader. Today, we’re

leveraging the vast knowledge and thought leadership within MetLife to develop new and innovative

solutions that will enhance and complement our current product portfolio. And with MetLife’s diverse offerings and strong financial

ratings, our multiple distribution systems continue to successfully and effectively help our clients prepare for their financial future.

Maintaining a focus on both product development and distribution is crucial because, even though we already serve tens of millions of

customers, there are many more who can benefit from the financial solutions MetLife offers.

In addition to a focus on business results, the entire management team at MetLife is committed to maintaining our high standards for

corporate governance and strong ethics and compliance programs. Executive bonuses are tied directly to return on equity growth and

we have stock ownership guidelines at every level of management from vice president and above to ensure that every officer has a stake

in the future of MetLife.

HGrowth and Record Results

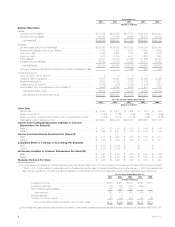

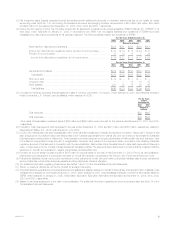

In 2004, MetLife’s total revenues rose 10% to $39 billion. For the year, net income grew 24% to $2.76 billion; total premiums, fees

and other revenues were up 8% to $26.4 billion; annuity deposits increased slightly; and assets under management grew 9%.

In addition to maintaining a focus on financial performance, each of MetLife’s core businesses grew their top-line results.

Institutional Business net income increased by 50% for the year, generated double-digit growth in the small, mid-sized and large

group markets, achieved record structured settlement sales, launched a new annuity series in Retirement & Savings, and continued to

introduce group product and service innovations. In addition, Institutional Business also launched a pilot program for MetLife’s new

critical illness business. This new product initiative is a perfect example of our ability to leverage our expertise, market-leading position

and strong ratings to develop a new offering in the marketplace.

During the year, Individual Business net income increased by 45% over 2003 results. MetLife’s Individual Business organization is

putting comprehensive plans in place to keep the company at the forefront of our industry by strengthening our retail distribution

channels and by enhancing MetLife’s competitive portfolio of life and annuity products to meet our clients’ needs. In 2004, Individual

Business launched a new guaranteed withdrawal benefit rider for all of the company’s individual variable annuities and grew the number

of MetLife career agents for the first time since 1999. MetLife is committed to growing its career agency distribution channel by recruiting

high quality, talented professionals.

MetLife Auto & Home posted its third consecutive record year as net income for the segment grew 32% to $208 million. This was an

impressive achievement considering that this earnings growth was attained in a year when the southeast U.S. experienced one of the

worst hurricane seasons in history. MetLife Auto & Home has also significantly reduced its combined ratio.

In addition to generating strong, top-line results during the year, MetLife International also grew its customer base by one million to

nine million customers at December 31, 2004 as this segment continues to focus on growing and investing in key emerging markets

outside of the United States. Since its launch in March 2004, Sino-U.S. MetLife Insurance Company has been focused on recruiting

talented individuals to join our professional agency force in Beijing, China. In addition, in September 2004, MetLife purchased a 49.9%

equity stake in BancoEstado Corredora de Seguros, a wholly-owned brokerage company of BancoEstado, one of the largest banks in

Chile. Moving forward, International will continue to be a growth engine for MetLife.

MetLife Bank more than doubled deposits during the year—growing from $1.3 billion at the end of 2003 to $2.7 billion at the end of

2004. Not only did MetLife Bank continue to bring in substantial deposit growth, it also achieved profitability one year ahead of plan. With

the strong MetLife brand and competitive savings products, MetLife Bank continues to demonstrate its ability to compete in the

aggressive retail banking marketplace.

HDelivering on Strategy

Though it was announced in January 2005, it is certainly important for me to highlight MetLife’s pending acquisition of the majority of

The Travelers Insurance Company and substantially all of Citigroup Inc.’s international insurance businesses. This transaction will be a

defining one for MetLife. Once completed, the acquisition will make MetLife the largest seller of individual life insurance in the United

States, the second largest seller of annuities and will substantially increase MetLife’s international footprint. Equally important, it will

expand the distribution reach of our organization through ten-year agreements we will sign with Citigroup. Not only is this transaction a

strategic fit, it will also increase our customer base, bringing MetLife closer to achieving its goal of 100 million customers by 2010.

In keeping with our core business strategy, in 2004 we made the decision to sell SSRM Holdings, Inc., the holding company of State

Street Research & Management Company and SSR Realty Advisors, Inc., to BlackRock, Inc.—one of the largest publicly-traded