MetLife 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

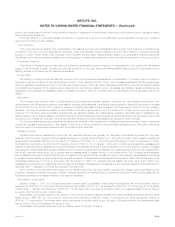

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

based on valuation methodologies and assumptions deemed appropriate in the circumstances. Such assumptions include estimated volatility and

interest rates used in the determination of fair value where quoted market values are not available. The use of different assumptions may have a material

effect on the estimated fair value amounts.

Deferred Policy Acquisition Costs

The Company incurs significant costs in connection with acquiring new and renewal insurance business. These costs, which vary with and are

primarily related to the production of that business, are deferred. The recovery of such costs is dependent upon the future profitability of the related

business. The amount of future profit is dependent principally on investment returns in excess of the amounts credited to policyholders, mortality,

morbidity, persistency, interest crediting rates, expenses to administer the business, creditworthiness of reinsurance counterparties and certain economic

variables, such as inflation. Of these factors, the Company anticipates that investment returns are most likely to impact the rate of amortization of such

costs. The aforementioned factors enter into management’s estimates of gross margins and profits, which generally are used to amortize such costs.

Revisions to estimates result in changes to the amounts expensed in the reporting period in which the revisions are made and could result in the

impairment of the asset and a charge to income if estimated future gross margins and profits are less than amounts deferred. In addition, the Company

utilizes the reversion to the mean assumption, a common industry practice, in its determination of the amortization of DAC, including VOBA. This practice

assumes that the expectation for long-term appreciation in equity markets is not changed by minor short-term market fluctuations, but that it does change

when large interim deviations have occurred.

Liability for Future Policy Benefits and Unpaid Claims and Claim Expenses

The Company establishes liabilities for amounts payable under insurance policies, including traditional life insurance, traditional annuities and non-

medical health insurance. Generally, amounts are payable over an extended period of time and liabilities are established based on methods and

underlying assumptions in accordance with GAAP and applicable actuarial standards. Principal assumptions used in the establishment of liabilities for

future policy benefits are mortality, morbidity, expenses, persistency, investment returns and inflation.

The Company also establishes liabilities for unpaid claims and claim expenses for property and casualty claim insurance which represent the amount

estimated for claims that have been reported but not settled and claims incurred but not reported. Liabilities for unpaid claims are estimated based upon

the Company’s historical experience and other actuarial assumptions that consider the effects of current developments, anticipated trends and risk

management programs, reduced for anticipated salvage and subrogation.

Differences between actual experience and the assumptions used in pricing these policies and in the establishment of liabilities result in variances in

profit and could result in losses. The effects of changes in such estimated reserves are included in the results of operations in the period in which the

changes occur.

Reinsurance

The Company enters into reinsurance transactions as both a provider and a purchaser of reinsurance. Accounting for reinsurance requires extensive

use of assumptions and estimates, particularly related to the future performance of the underlying business and the potential impact of counterparty credit

risks. The Company periodically reviews actual and anticipated experience compared to the aforementioned assumptions used to establish assets and

liabilities relating to ceded and assumed reinsurance and evaluates the financial strength of counterparties to its reinsurance agreements using criteria

similar to that evaluated in the security impairment process discussed previously. Additionally, for each of its reinsurance contracts, the Company must

determine if the contract provides indemnification against loss or liability relating to insurance risk, in accordance with applicable accounting standards.

The Company must review all contractual features, particularly those that may limit the amount of insurance risk to which the reinsurer is subject or

features that delay the timely reimbursement of claims. If the Company determines that a reinsurance contract does not expose the reinsurer to a

reasonable possibility of a significant loss from insurance risk, the Company records the contract using the deposit method of accounting.

Litigation

The Company is a party to a number of legal actions and regulatory investigations. Given the inherent unpredictability of these matters, it is difficult to

estimate the impact on the Company’s consolidated financial position. Liabilities are established when it is probable that a loss has been incurred and the

amount of the loss can be reasonably estimated. Liabilities related to certain lawsuits, including the Company’s asbestos-related liability, are especially

difficult to estimate due to the limitation of available data and uncertainty regarding numerous variables used to determine amounts recorded. The data

and variables that impact the assumptions used to estimate the Company’s asbestos-related liability include the number of future claims, the cost to

resolve claims, the disease mix and severity of disease, the jurisdiction of claims filed, tort reform efforts and the impact of any possible future adverse

verdicts and their amounts. On a quarterly and annual basis the Company reviews relevant information with respect to liabilities for litigation, regulatory

investigations and litigation-related contingencies to be reflected in the Company’s consolidated financial statements. The review includes senior legal

and financial personnel. It is possible that an adverse outcome in certain of the Company’s litigation and regulatory investigations, including asbestos-

related cases, or the use of different assumptions in the determination of amounts recorded could have a material effect upon the Company’s

consolidated net income or cash flows in particular quarterly or annual periods.

Employee Benefit Plans

The Company sponsors pension and other retirement plans in various forms covering employees who meet specified eligibility requirements. The

reported expense and liability associated with these plans requires an extensive use of assumptions which include the discount rate, expected return on

plan assets and rate of future compensation increases as determined by the Company. Management determines these assumptions based upon

currently available market and industry data, historical performance of the plan and its assets, and consultation with an independent consulting actuarial

firm. These assumptions used by the Company may differ materially from actual results due to changing market and economic conditions, higher or lower

withdrawal rates or longer or shorter life spans of the participants. These differences may have a significant effect on the Company’s consolidated

financial statements and liquidity.

MetLife, Inc.

F-10