MetLife 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

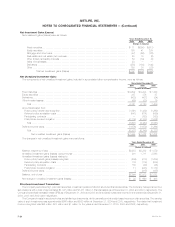

March 31, 2004 the consolidation of interests in VIEs for non-SPEs acquired prior to February 1, 2003 for which it is the primary beneficiary. As of

March 31, 2004, the Company consolidated assets and liabilities relating to real estate joint ventures of $78 million and $11 million, respectively, and

assets and liabilities relating to other limited partnerships of $29 million and less than $1 million, respectively, for VIEs for which the Company was

deemed to be the primary beneficiary. There was no impact to net income from the adoption of FIN 46.

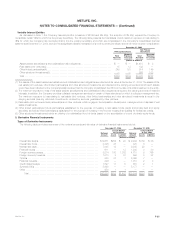

Effective January 1, 2003, the Company adopted FIN No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others (‘‘FIN 45’’). FIN 45 requires entities to establish liabilities for certain types of guarantees and expands

financial statement disclosures for others. The initial recognition and initial measurement provisions of FIN 45 were applicable on a prospective basis to

guarantees issued or modified after December 31, 2002. The adoption of FIN 45 did not have a significant impact on the Company’s consolidated

financial statements. See Note 10.

Effective January 1, 2003, the Company adopted SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities (‘‘SFAS 146’’).

SFAS 146 requires that a liability for a cost associated with an exit or disposal activity be recorded and measured initially at fair value only when the liability

is incurred rather than at the date of an entity’s commitment to an exit plan as required by EITF Issue No. 94-3, Liability Recognition for Certain Employee

Termination Benefits and Other Costs to Exit an Activity Including Certain Costs Incurred in a Restructuring (‘‘EITF 94-3’’). The Company’s activities subject

to this guidance in 2004 and 2003 were not significant.

Effective January 1, 2003, the Company adopted SFAS No. 145, Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB

Statement No. 13, and Technical Corrections (‘‘SFAS 145’’). In addition to amending or rescinding other existing authoritative pronouncements to make

various technical corrections, clarify meanings, or describe their applicability under changed conditions, SFAS 145 generally precludes companies from

recording gains and losses from the extinguishment of debt as an extraordinary item. SFAS 145 also requires sale-leaseback treatment for certain

modifications of a capital lease that result in the lease being classified as an operating lease. The adoption of SFAS 145 did not have a significant impact

on the Company’s consolidated financial statements.

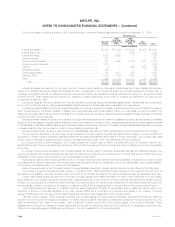

Effective January 1, 2002, the Company adopted SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (‘‘SFAS 144’’).

SFAS 144 provides a single model for accounting for long-lived assets to be disposed of by superseding SFAS No. 121, Accounting for the Impairment

of Long-Lived Assets and for Long-Lived Assets to be Disposed Of (‘‘SFAS 121’’), and the accounting and reporting provisions of APB Opinion No. 30,

Reporting the Results of Operations — Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently

Occurring Events and Transactions (‘‘APB 30’’). Under SFAS 144, discontinued operations are measured at the lower of carrying value or fair value less

costs to sell, rather than on a net realizable value basis. Future operating losses relating to discontinued operations also are no longer recognized before

they occur. SFAS 144: (i) broadens the definition of a discontinued operation to include a component of an entity (rather than a segment of a business);

(ii) requires long-lived assets to be disposed of other than by sale to be considered held and used until disposed; and (iii) retains the basic provisions of

(a) APB 30 regarding the presentation of discontinued operations in the statements of income, (b) SFAS 121 relating to recognition and measurement of

impaired long-lived assets (other than goodwill), and (c) SFAS 121 relating to the measurement of long-lived assets classified as held-for-sale. Adoption

of SFAS 144 did not have a material impact on the Company’s consolidated financial statements other than the presentation as discontinued operations

of net investment income and net investment gains related to operations of real estate on which the Company initiated disposition activities subsequent to

January 1, 2002 and the classification of such real estate as held-for-sale on the consolidated balance sheets.

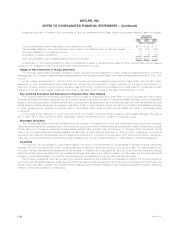

Effective January 1, 2002, the Company adopted SFAS No. 142. SFAS 142 eliminates the systematic amortization and establishes criteria for

measuring the impairment of goodwill and certain other intangible assets by reporting unit. There was no impairment of identified intangibles or significant

reclassifications between goodwill and other intangible assets at January 1, 2002. Amortization of other intangible assets was not material for the years

ended December 31, 2004, 2003 and 2002.

MetLife, Inc.

F-18