MetLife 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2004, the Holding Company has issued an aggregate principal amount of senior debt of $1.2 billion under the $5.0 billion shelf

registration statement filed with the SEC during the first quarter of 2004. The shelf registration will permit the registration and issuance of a wide range of

debt and equity securities. Approximately $44 million of registered but unissued securities remaining from the Company’s 2001 $4.0 billion shelf

registration statement was carried over to this shelf registration. The Holding Company issued senior debt in the aggregate principal amount of

$2.95 billion under the 2001 $4.0 billion shelf registration statement from November 2001 through November 2003. In addition, under this shelf

registration statement, in February 2003, the Holding Company remarketed debentures in the aggregate principal amount of $1.01 billion in accordance

with the terms of the then-outstanding equity security units.

On December 9, 2004, the Holding Company issued 350 million pounds sterling aggregate principal amount of 5.375% senior notes due

December 9, 2024. The senior notes were initially offered and sold outside the United States in reliance upon Regulation S under the Securities Act of

1933, as amended. Up to 35 million pounds sterling, or $66.8 million (translated from pounds sterling to U.S. dollars using the noon buying rate for

pound sterling on November 30, 2004 as announced by the U.S. Federal Reserve Bank of New York) of the senior notes initially offered and sold outside

the United States may be resold in the United States pursuant to the Company’s shelf registration statement.

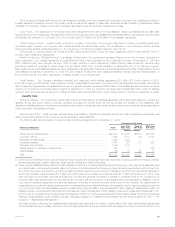

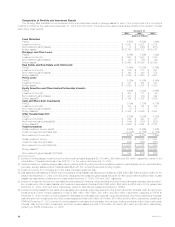

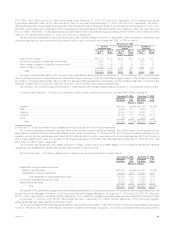

The following table summarizes the Holding Company’s senior debt issuances:

Interest

Issue Date Principal Rate Maturity

(Dollars in millions)

December 2004(1) *********************************************************** $671 5.38% 2024

June 2004(2) **************************************************************** $350 5.50% 2014

June 2004(2) **************************************************************** $750 6.38% 2034

November 2003************************************************************** $500 5.00% 2013

November 2003************************************************************** $200 5.88% 2033

December 2002 ************************************************************* $400 5.38% 2012

December 2002 ************************************************************* $600 6.50% 2032

November 2001************************************************************** $500 5.25% 2006

November 2001************************************************************** $750 6.13% 2011

(1) This amount represents the translation of 350 million pounds sterling into U.S. Dollars using the noon buying rate on December 31, 2004 of 1.916 as

announced by the U.S. Federal Reserve Bank of New York.

(2) On July 23, 2004, the Holding Company reopened its June 3, 2004 senior notes offering and increased the principal outstanding on the

5.50% notes due June 2014, from $200 million to $350 million and on the 6.38% notes due June 2034, from $400 million to $750 million.

(3) This table excludes the remarketed debentures of $1.01 billion and any premium or discount on the senior debt issuances.

Other sources of the Holding Company’s liquidity include programs for short- and long-term borrowing, as needed, arranged through Metropolitan

Life.

Credit Facilities. The Holding Company maintains committed and unsecured credit facilities aggregating $2.5 billion ($1 billion expiring in 2005 and

$1.5 billion expiring in 2009) which it shares with Metropolitan Life and MetLife Funding. Borrowings under these facilities bear interest at varying rates

stated in the agreements. These facilities are primarily used for general corporate purposes and as back-up lines of credit for the borrowers’ commercial

paper programs. At December 31, 2004, none of the Holding Company, Metropolitan Life or MetLife Funding had borrowed against these credit facilities.

Liquidity Uses

The primary uses of liquidity of the Holding Company include service on debt, cash dividends on common stock, capital contributions to

subsidiaries, payment of general operating expenses and the repurchase of the Holding Company’s common stock.

Dividends. On September 28, 2004, the Holding Company’s Board of Directors approved an annual dividend for 2004 of $0.46 per share payable

on December 13, 2004 to shareholders of record on November 5, 2004. The 2004 dividend represents a 100% increase from the 2003 annual dividend

of $0.23 per share. Future dividend decisions will be determined by the Holding Company’s Board of Directors after taking into consideration factors

such as the Holding Company’s current earnings, expected medium- and long-term earnings, financial condition, regulatory capital position, and

applicable governmental regulations and policies.

Capital Contributions to Subsidiaries. During the years ended December 31, 2004 and 2003, the Holding Company contributed an aggregate of

$761 million and $239 million to various subsidiaries, respectively.

Share Repurchase. On October 26, 2004, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase program.

This program began after the completion of the February 19, 2002 and March 28, 2001 repurchase programs, each of which authorized the repurchase

of $1 billion of common stock. Under these authorizations, the Holding Company may purchase its common stock from the MetLife Policyholder Trust, in

the open market and in privately negotiated transactions.

On December 16, 2004, the Holding Company repurchased 7,281,553 shares of its outstanding common stock at an aggregate cost of

approximately $300 million under an accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to the Holding

Company from third parties and is purchasing the shares in the open market over the next few months to return to the lenders. The Holding Company will

either pay or receive an amount based on the actual amount paid by the bank to purchase the shares. The final purchase price is expected to be

determined in April 2005 and will be settled in either cash or Holding Company stock at the Holding Company’s option. The Holding Company recorded

the initial repurchase of shares as treasury stock and will record any amount paid or received as an adjustment to the cost of the treasury stock.

MetLife, Inc. 23