MetLife 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

A synthetic guaranteed investment contract (‘‘GIC’’) is a contract that simulates the performance of a traditional GIC through the use of financial

instruments. Under a synthetic GIC, the policyholder owns the underlying assets. The Company guarantees a rate return on those assets for a premium.

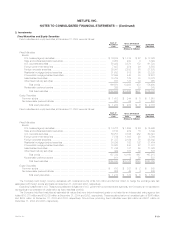

Hedging

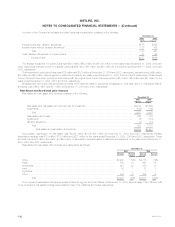

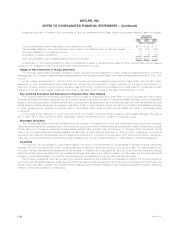

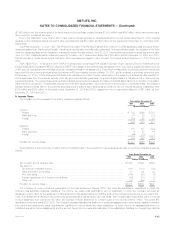

The table below provides a summary of the notional amount and fair value of derivatives by type of hedge designation at:

December 31, 2004 December 31, 2003

Fair Value Fair Value

Notional Notional

Amount Assets Liabilities Amount Assets Liabilities

(Dollars in millions)

Fair value ************************************************************ $ 4,879 $173 $ 234 $ 4,027 $ 27 $297

Cash flow *********************************************************** 8,787 41 689 13,173 59 449

Foreign operations **************************************************** 535 — 47 527 — 10

Non qualifying ******************************************************** 28,055 324 437 21,807 170 142

Total ******************************************************** $42,256 $538 $1,407 $39,534 $256 $898

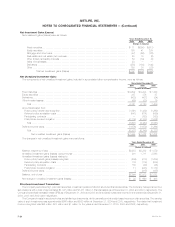

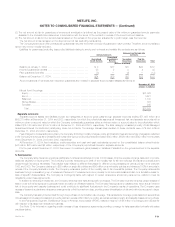

The following table provides the settlement payments recorded in income for the:

Year Ended

December 31,

2004 2003 2002

(Dollars in millions)

Qualifying hedges:

Net investment income ****************************************************************************** $(147) $(63) $ 9

Interest credited to policyholder account balances ******************************************************* 45 — —

Non-qualifying hedges:

Net investment gains (losses)************************************************************************* 51 84 32

Total**************************************************************************************** $ (51) $ 21 $41

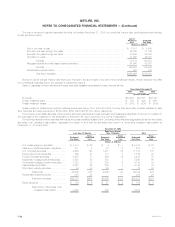

Fair Value Hedges

The Company designates and accounts for the following as fair value hedges when they have met the requirements of SFAS 133: (i) interest rate

swaps to convert fixed rate investments to floating rate investments; (ii) foreign currency swaps to hedge the foreign currency fair value exposure of

foreign currency denominated investments and liabilities; and (iii) treasury futures to hedge against changes in value of fixed rate securities.

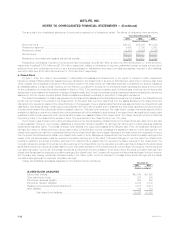

The Company recognized Net investment gains (losses) representing the ineffective portion of all fair value hedges as follows:

Years Ended

December 31,

2004 2003 2002

(Dollars in millions)

Changes in the fair value of derivatives ***************************************************************** $ 200 $(191) $(30)

Changes in the fair value of the items hedged *********************************************************** (151) 159 34

Net ineffectiveness of fair value hedging activities********************************************************* $ 49 $ (32) $ 4

All components of each derivative’s gain or loss were included in the assessment of hedge ineffectiveness. There were no instances in which the

Company discontinued fair value hedge accounting due to a hedged firm commitment no longer qualifying as a fair value hedge.

Cash Flow Hedges

The Company designates and accounts for the following as cash flow hedges, when they have met the requirements of SFAS 133: (i) interest rate

swaps to convert floating rate investments to fixed rate investments; (ii) interest rate swaps to convert floating rate liabilities into fixed rate liabilities;

(iii) foreign currency swaps to hedge the foreign currency cash flow exposure of foreign currency denominated investments and liabilities; (iv) treasury

futures to hedge against changes in value of securities to be acquired; (v) treasury futures to hedge against changes in interest rates on liabilities to be

issued; and (vi) financial forwards to gain exposure to the investment risk and return of securities not yet available.

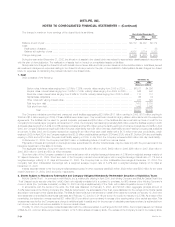

For the years ended December 31, 2004, 2003 and 2002, the Company recognized Net investment gains (losses) of ($19) million, ($69) million,

and ($3) million, respectively, which represented the ineffective portion of all cash flow hedges. All components of each derivative’s gains or loss were

included in the assessment of hedge ineffectiveness. There were no instances in which the Company discontinued cash flow hedge accounting

because the forecasted transactions did not occur on the anticipated date or in the additional time period permitted by SFAS 133. There were no hedged

forecasted transactions, other than the receipt or payment of variable interest payments.

MetLife, Inc. F-27