MetLife 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

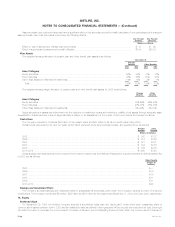

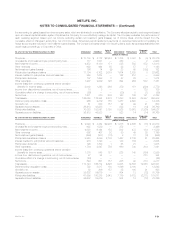

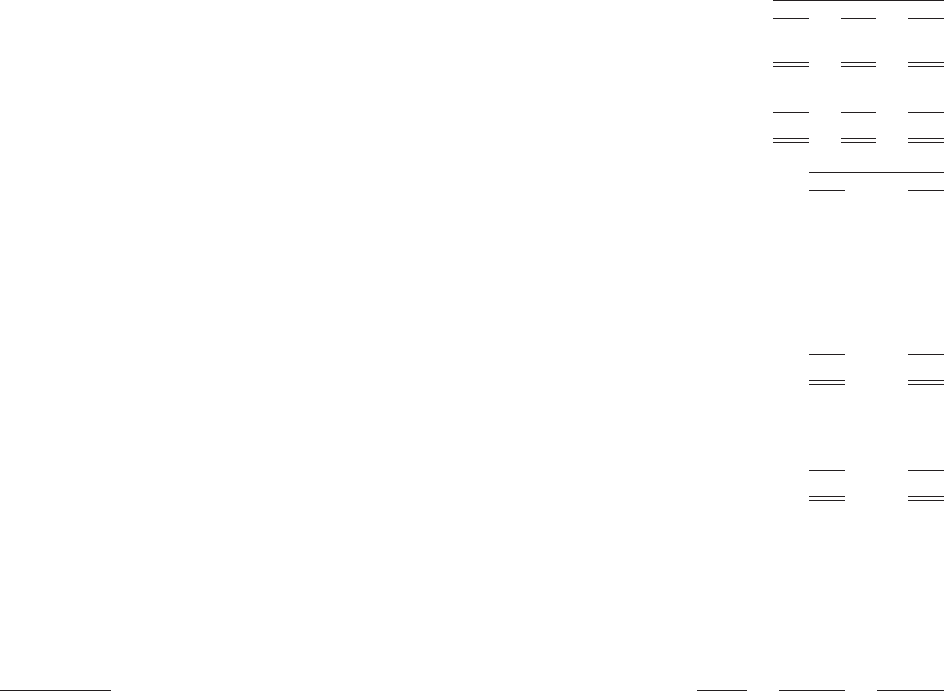

operations as these transactions will continue after the sale of SSRM. The following tables present the amounts related to operations of SSRM that have

been combined with the discontinued real estate operations in the consolidated income statements:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

Revenues from discontinued operations************************************************************* $328 $231 $239

Income from discontinued operations before provision for income taxes ********************************** $32 $34 $14

Provision for income taxes ************************************************************************ 13 13 6

Income from discontinued operations, net of income taxes ************************************* $19 $21 $ 8

December 31,

2004 2003

(Dollars in millions)

Equity securities ************************************************************************************* $49 $14

Real estate and real estate joint ventures **************************************************************** 96 3

Short term investments ******************************************************************************* 33 17

Other invested assets ******************************************************************************** 20 8

Cash and cash equivalents**************************************************************************** 55 50

Premiums and other receivables************************************************************************ 38 23

Other assets **************************************************************************************** 88 68

Total assets held-for-sale********************************************************************** $379 $183

Short-term debt ************************************************************************************* $19 $ —

Current income taxes payable ************************************************************************* 11

Deferred income taxes payable ************************************************************************ 12

Other liabilities*************************************************************************************** 219 67

Total liabilities held-for-sale ******************************************************************** $240 $ 70

See Note 17 for further discussion of the disposition of SSRM.

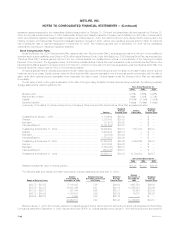

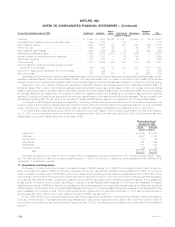

19. Fair Value Information

The estimated fair values of financial instruments have been determined by using available market information and the valuation methodologies

described below. Considerable judgment is often required in interpreting market data to develop estimates of fair value. Accordingly, the estimates

presented herein may not necessarily be indicative of amounts that could be realized in a current market exchange. The use of different assumptions or

valuation methodologies may have a material effect on the estimated fair value amounts.

Amounts related to the Company’s financial instruments were as follows:

Notional Carrying Estimated

December 31, 2004 Amount Value Fair Value

(Dollars in millions)

Assets:

Fixed maturities********************************************************************** $176,763 $176,763

Equity securities ********************************************************************* $ 2,188 $ 2,188

Mortgage and other loans ************************************************************* $ 32,406 $ 33,902

Policy loans************************************************************************* $ 8,899 $ 8,899

Short-term investments *************************************************************** $ 2,663 $ 2,663

Cash and cash equivalents************************************************************ $ 4,051 $ 4,051

Mortgage loan commitments*********************************************************** $1,189 $ — $ 4

Commitments to fund partnership investments ******************************************** $1,324 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 70,777 $ 69,688

Short-term debt ********************************************************************* $ 1,445 $ 1,445

Long-term debt********************************************************************** $ 7,412 $ 7,818

Shares subject to mandatory redemption ************************************************ $ 278 $ 365

Payable under securities loaned transactions ********************************************* $ 28,678 $ 28,678

MetLife, Inc.

F-54