MetLife 2004 Annual Report Download - page 8

Download and view the complete annual report

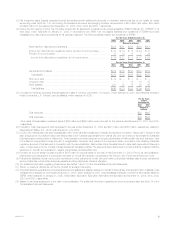

Please find page 8 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2003, a subsidiary of the Company, Reinsurance Group of America, Incorporated (‘‘RGA’’), entered into a coinsurance agreement under which it

assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of North America (‘‘Allianz Life’’). The transaction added

approximately $278 billion of life reinsurance in-force, $246 million of premium and $11 million of income before income tax expense, excluding minority

interest expense, in 2003. The effects of such transaction are included within the Reinsurance segment.

In 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion in

assets as of the date of acquisition (June 20, 2002). During the second quarter of 2003, as a part of its acquisition and integration strategy, the

International segment completed the legal merger of Hidalgo into its original Mexican subsidiary, Seguro Genesis, S.A., forming MetLife Mexico, S.A. As a

result of the merger of these companies, the Company recorded $62 million of earnings, net of income taxes, from the merger and a reduction in

policyholder liabilities resulting from a change in reserve methodology. Such benefit was recorded in the second quarter of 2003 in the International

segment.

See ‘‘— Subsequent Events’’ below.

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies and make estimates and

assumptions that affect amounts reported in the consolidated financial statements. The most critical estimates include those used in determining:

(i) investment impairments; (ii) the fair value of investments in the absence of quoted market values; (iii) application of the consolidation rules to certain

investments; (iv) the fair value of and accounting for derivatives; (v) the capitalization and amortization of deferred policy acquisition costs (‘‘DAC’’),

including value of business acquired (‘‘VOBA’’); (vi) the liability for future policyholder benefits; (vii) the liability for litigation and regulatory matters; and

(viii) accounting for reinsurance transactions and employee benefit plans. In applying these policies, management makes subjective and complex

judgments that frequently require estimates about matters that are inherently uncertain. Many of these policies, estimates and related judgments are

common in the insurance and financial services industries; others are specific to the Company’s businesses and operations. Actual results could differ

from those estimates.

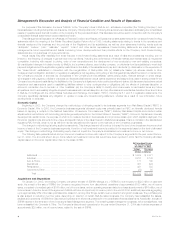

Investments

The Company’s principal investments are in fixed maturities, mortgage and other loans and real estate, all of which are exposed to three primary

sources of investment risk: credit, interest rate and market valuation. The financial statement risks are those associated with the recognition of

impairments and income, as well as the determination of fair values. The assessment of whether impairments have occurred is based on management’s

case-by-case evaluation of the underlying reasons for the decline in fair value. Management considers a wide range of factors about the security issuer

and uses its best judgment in evaluating the cause of the decline in the estimated fair value of the security and in assessing the prospects for near-term

recovery. Inherent in management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its future earnings

potential. Considerations used by the Company in the impairment evaluation process include, but are not limited to: (i) the length of time and the extent to

which the market value has been below cost or amortized cost; (ii) the potential for impairments of securities when the issuer is experiencing significant

financial difficulties; (iii) the potential for impairments in an entire industry sector or sub-sector; (iv) the potential for impairments in certain economically

depressed geographic locations; (v) the potential for impairments of securities where the issuer, series of issuers or industry has suffered a catastrophic

type of loss or has exhausted natural resources; (vi) the Company’s ability and intent to hold the security for a period of time sufficient to allow for the

recovery of its value to an amount equal to or greater than cost or amortized cost; (vii) unfavorable changes in forecasted cash flows on asset-backed

securities; and (viii) other subjective factors, including concentrations and information obtained from regulators and rating agencies. In addition, the

earnings on certain investments are dependent upon market conditions, which could result in prepayments and changes in amounts to be earned due to

changing interest rates or equity markets. The determination of fair values in the absence of quoted market values is based on: (i) valuation

methodologies; (ii) securities the Company deems to be comparable; and (iii) assumptions deemed appropriate given the circumstances. The use of

different methodologies and assumptions may have a material effect on the estimated fair value amounts. In addition, the Company enters into certain

structured investment transactions, real estate joint ventures and limited partnerships for which the Company may be deemed to be the primary

beneficiary and, therefore, may be required to consolidate such investments. The accounting rules for the determination of the primary beneficiary are

complex and require evaluation of the contractual rights and obligations associated with each party involved in the entity, an estimate of the entity’s

expected losses and expected residual returns and the allocation of such estimates to each party.

Derivatives

The Company enters into freestanding derivative transactions primarily to manage the risk associated with variability in cash flows or changes in fair

values related to the Company’s financial assets and liabilities. The Company also uses derivative instruments to hedge its currency exposure associated

with net investments in certain foreign operations. The Company also purchases investment securities, issues certain insurance policies and engages in

certain reinsurance contracts that have embedded derivatives. The associated financial statement risk is the volatility in net income which can result from

(i) changes in fair value of derivatives not qualifying as accounting hedges; (ii) ineffectiveness of designated hedges; and (iii) counterparty default. In

addition, there is a risk that embedded derivatives requiring bifurcation are not identified and reported at fair value in the consolidated financial statements.

Accounting for derivatives is complex, as evidenced by significant authoritative interpretations of the primary accounting standards which continue to

evolve, as well as the significant judgments and estimates involved in determining fair value in the absence of quoted market values. These estimates are

based on valuation methodologies and assumptions deemed appropriate in the circumstances. Such assumptions include estimated volatility and

interest rates used in the determination of fair value where quoted market values are not available. The use of different assumptions may have a material

effect on the estimated fair value amounts.

Deferred Policy Acquisition Costs

The Company incurs significant costs in connection with acquiring new and renewal insurance business. These costs, which vary with and are

primarily related to the production of that business, are deferred. The recovery of such costs is dependent upon the future profitability of the related

business. The amount of future profit is dependent principally on investment returns in excess of the amounts credited to policyholders, mortality,

morbidity, persistency, interest crediting rates, expenses to administer the business, creditworthiness of reinsurance counterparties and certain economic

variables, such as inflation. Of these factors, the Company anticipates that investment returns are most likely to impact the rate of amortization of such

costs. The aforementioned factors enter into management’s estimates of gross margins and profits, which generally are used to amortize such costs.

Revisions to estimates result in changes to the amounts expensed in the reporting period in which the revisions are made and could result in the

impairment of the asset and a charge to income if estimated future gross margins and profits are less than amounts deferred. In addition, the Company

utilizes the reversion to the mean assumption, a common industry practice, in its determination of the amortization of DAC, including VOBA. This practice

MetLife, Inc. 5