MetLife 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

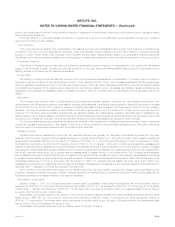

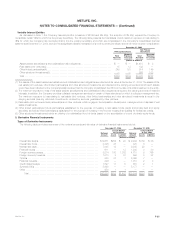

2. Investments

Fixed Maturities and Equity Securities

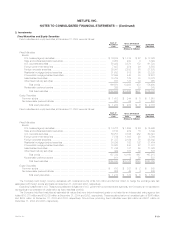

Fixed maturities and equity securities at December 31, 2004 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. treasury/agency securities ********************************************* $ 16,534 $ 1,314 $ 22 $ 17,826

State and political subdivision securities ************************************** 3,683 220 4 3,899

U.S. corporate securities ************************************************** 58,022 3,870 172 61,720

Foreign government securities ********************************************** 7,637 974 26 8,585

Foreign corporate securities ************************************************ 25,341 2,582 85 27,838

Residential mortgage-backed securities ************************************** 31,683 612 65 32,230

Commercial mortgage-backed securities ************************************* 12,099 440 38 12,501

Asset-backed securities *************************************************** 10,784 125 33 10,876

Other fixed maturity securities ********************************************** 887 131 33 985

Total bonds ********************************************************* 166,670 10,268 478 176,460

Redeemable preferred stocks ********************************************** 326 — 23 303

Total fixed maturities ************************************************** $166,996 $10,268 $501 $176,763

Equity Securities:

Common stocks *********************************************************** $ 1,412 $ 244 $ 5 $ 1,651

Nonredeemable preferred stocks ********************************************* 501 39 3 537

Total equity securities ************************************************* $ 1,913 $ 283 $ 8 $ 2,188

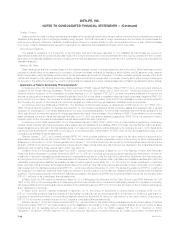

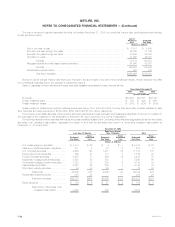

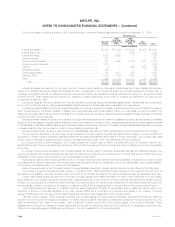

Fixed maturities and equity securities at December 31, 2003 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. treasury/agency securities ********************************************* $ 14,707 $ 1,264 $ 26 $ 15,945

State and political subdivision securities ************************************** 3,155 209 15 3,349

U.S. corporate securities ************************************************** 56,757 3,886 252 60,391

Foreign government securities ********************************************** 7,789 1,003 28 8,764

Foreign corporate securities ************************************************ 21,727 2,194 79 23,842

Residential mortgage-backed securities ************************************** 30,836 720 102 31,454

Commercial mortgage-backed securities ************************************* 10,523 530 22 11,031

Asset-backed securities *************************************************** 11,736 187 60 11,863

Other fixed maturity securities ********************************************** 492 167 83 576

Total bonds ********************************************************* 157,722 10,160 667 167,215

Redeemable preferred stocks ********************************************** 611 2 76 537

Total fixed maturities ************************************************** $158,333 $10,162 $743 $167,752

Equity Securities:

Common stocks *********************************************************** $ 613 $ 327 $ 2 $ 938

Nonredeemable preferred stocks ********************************************* 602 48 4 646

Total equity securities ************************************************* $ 1,215 $ 375 $ 6 $ 1,584

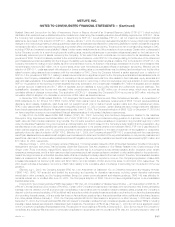

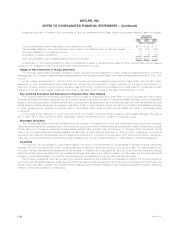

The Company held foreign currency derivatives with notional amounts of $4,720 million and $3,502 million to hedge the exchange rate risk

associated with foreign bonds and loans at December 31, 2004 and 2003, respectively.

Excluding investments in U.S. Treasury securities and obligations of U.S. government corporations and agencies, the Company is not exposed to

any significant concentration of credit risk in its fixed maturities portfolio.

The Company held fixed maturities at estimated fair values that were below investment grade or not rated by an independent rating agency that

totaled $12,370 million and $12,825 million at December 31, 2004 and 2003, respectively. These securities had a net unrealized gain of $936 million

and $888 million at December 31, 2004 and 2003, respectively. Non-income producing fixed maturities were $90 million and $371 million at

December 31, 2004 and 2003, respectively.

MetLife, Inc. F-19