MetLife 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

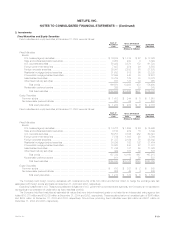

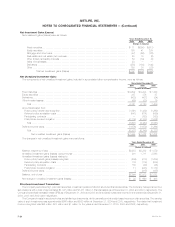

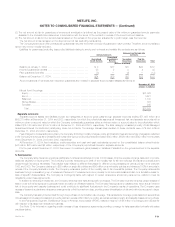

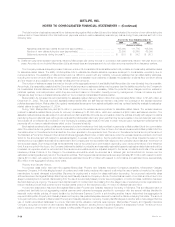

Presented below is a roll forward of the components of Other comprehensive income (loss), before income taxes, related to cash flow hedges:

Year Ended

December 31,

2004 2003 2002

(Dollars in millions)

Other comprehensive income (loss) balance at the beginning of the year************************************ $(417) $ (24) $ 71

Gains (losses) deferred in other comprehensive income (loss) on the effective portion of cash flow hedges ******* (34) (387) (142)

Amounts reclassified to net investment income ********************************************************* 2257

Amortization of transition adjustment ****************************************************************** (7) (8) (10)

Other comprehensive income (losses) balance at the end of the year ************************************** $(456) $(417) $ (24)

At December 31, 2004, approximately $34 million of the deferred net gains on derivatives accumulated in Other comprehensive income (loss) are

expected to be reclassified to earnings during the year ending December 31, 2005.

Hedges of Net Investments in Foreign Operations

The Company uses forward exchange contracts to hedge portions of its net investment in foreign operations against adverse movements in

exchange rates. The Company measures ineffectiveness based upon the change in forward rates. There was no ineffectiveness recorded in 2004, 2003

or 2002.

For the years ended December 31, 2004 and 2003, the Company recorded net unrealized foreign currency losses of $47 million and $10 million,

respectively, in Other comprehensive income (loss) related to hedges of its net investments in foreign operations. For the year ended December 31,

2004, the Company recorded a foreign currency translation loss of $10 million, in Other comprehensive income (loss) related to the disposal of certain

hedges of net investments in foreign operations. There were no disposals of such hedges for the year ended December 31, 2003.

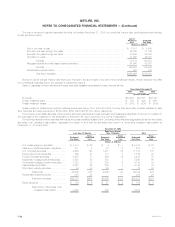

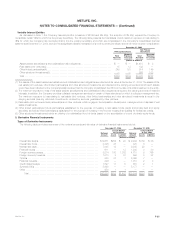

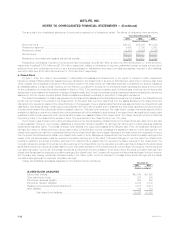

Non-qualifying Derivatives and Derivatives for Purposes Other Than Hedging

The Company enters into the following derivatives that do not qualify for hedge accounting under SFAS 133 or for purposes other than hedging:

(i) interest rate swaps, purchased caps and floors, and Treasury futures to minimize its exposure to interest rate volatility; (ii) foreign currency forwards and

swaps to minimize its exposure to adverse movements in exchange rates; (iii) swaptions to sell embedded call options in fixed rate liabilities; (iv) credit

default swaps to minimize its exposure to adverse movements in credit; (v) equity futures and equity options to economically hedge liabilities embedded

in certain variable annuity products; (vi) synthetic GICs to synthetically create traditional GICs; and (vii) RSATs and TRRs to synthetically create

investments.

For the years ended December 31, 2004, 2003 and 2002, the Company recognized as Net investment gains (losses) changes in fair value of

($177) million, ($114) million and ($172) million, respectively, related to derivatives that do not qualify for hedge accounting.

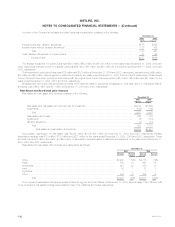

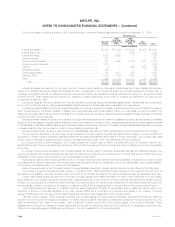

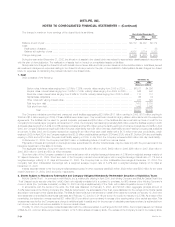

Embedded Derivatives

The Company has certain embedded derivatives which are required to be separated from their host contracts and accounted for as derivatives.

These host contracts include guaranteed rate of return contracts, guaranteed minimum withdrawal benefit contracts and modified coinsurance contracts.

The fair value of the Company’s embedded derivative assets was $46 million and $43 million at December 31, 2004 and 2003, respectively. The fair

value of the Company’s embedded derivative liabilities was $26 million and $33 million at December 31, 2004 and 2003, respectively. The amounts

recorded to Net investment gains (losses) during the years ended December 31, 2004 and 2003 were gains of $37 million and $19 million, respectively.

There were no amounts recorded to Net investment gains (losses) during the year ended December 31, 2002 related to embedded derivatives.

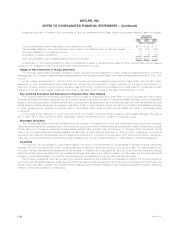

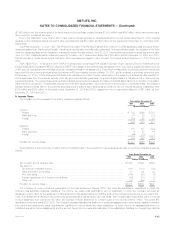

Credit Risk

The Company may be exposed to credit related losses in the event of nonperformance by counterparties to derivative financial instruments.

Generally, the current credit exposure of the Company’s derivative contracts is limited to the fair value at the reporting date. The credit exposure of the

Company’s derivative transactions is represented by the fair value of contracts with a net positive fair value at the reporting date. Because exchange

traded futures and options are effected through regulated exchanges, and positions are marked to market on a daily basis, the Company has minimal

exposure to credit related losses in the event of nonperformance by counterparties to such derivative financial instruments.

The Company manages its credit risk by entering into derivative transactions with creditworthy counterparties. In addition, the Company enters into

over-the-counter derivatives pursuant to master agreements that provide for a single net payment to be made by one counterparty to another at each due

date and upon termination. Likewise, the Company effects exchange traded futures and options through regulated exchanges and these positions are

marked to market and margined on a daily basis.

MetLife, Inc.

F-28