MetLife 2004 Annual Report Download - page 21

Download and view the complete annual report

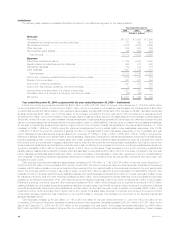

Please find page 21 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On January 31, 2005, the Holding Company completed the sale of SSRM to a third party for $328 million of cash and stock. As a result of the sale

of SSRM, the Company recognized income from discontinued operations of approximately $150 million, net of income taxes, comprised of a realized

gain of $166 million, net of income taxes, and an operating expense related to a lease abandonment of $16 million, net of income taxes. Under the terms

of the agreement, MetLife will have an opportunity to receive, prior to the end of 2006, additional payments aggregating up to approximately 25% of the

base purchase price, based on, among other things, certain revenue retention and growth measures. The purchase price is also subject to reduction

over five years, depending on retention of certain MetLife-related business. The Company has reclassified the assets, liabilities and operations of SSRM

into discontinued operations for all periods presented in the consolidated financial statements. Additionally, the sale of SSRM resulted in the elimination of

the Company’s Asset Management segment. The remaining asset management business, which is insignificant, has been reclassified into Corporate &

Other. The Company’s discontinued operations for the year ended December 31, 2004 also includes expenses of approximately $20 million, net of

income taxes, related to the sale of SSRM.

Liquidity and Capital Resources

For purposes of this discussion, the terms ‘‘MetLife’’ or the ‘‘Company’’ refer to MetLife, Inc., a Delaware corporation (the ‘‘Holding Company’’), and

its subsidiaries, including Metropolitan Life Insurance Company (‘‘Metropolitan Life’’).

The Company

Capital

RBC. Section 1322 of the New York Insurance Law requires that New York domestic life insurers report their RBC based on a formula calculated

by applying factors to various asset, premium and statutory reserve items. Similar rules apply to each of the Company’s domestic insurance subsidiaries.

The formula takes into account the risk characteristics of the insurer, including asset risk, insurance risk, interest rate risk and business risk. Section 1322

gives the New York Superintendent of Insurance (the ‘‘Superintendent’’) explicit regulatory authority to require various actions by, or to take various actions

against, insurers whose total adjusted capital does not exceed certain RBC levels. At December 31, 2004, Metropolitan Life’s and each of the Holding

Company’s domestic insurance subsidiaries’ total adjusted capital was in excess of each of the RBC levels required by each state of domicile.

The NAIC adopted the Codification of Statutory Accounting Principles (‘‘Codification’’) in 2001. Codification was intended to standardize regulatory

accounting and reporting to state insurance departments. However, statutory accounting principles continue to be established by individual state laws

and permitted practices. The New York State Department of Insurance (the ‘‘Department’’) has adopted Codification with certain modifications for the

preparation of statutory financial statements of insurance companies domiciled in New York. Modifications by the various state insurance departments

may impact the effect of Codification on the statutory capital and surplus of Metropolitan Life and the Holding Company’s other insurance subsidiaries.

Asset/Liability Management

The Company actively manages its assets using an approach that balances quality, diversification, asset/liability matching, liquidity and investment

return. The goals of the investment process are to optimize, net of income taxes, risk-adjusted investment income and risk-adjusted total return while

ensuring that the assets and liabilities are managed on a cash flow and duration basis. The asset/liability management process is the shared responsibility

of the Portfolio Management Unit, the Business Finance Asset/Liability Management Unit, and the operating business segments under the supervision of

the various product line specific Asset/Liability Management Committees (‘‘A/LM Committees’’). The A/LM Committees’ duties include reviewing and

approving target portfolios on a periodic basis, establishing investment guidelines and limits and providing oversight of the asset/liability management

process. The portfolio managers and asset sector specialists, who have responsibility on a day-to-day basis for risk management of their respective

investing activities, implement the goals and objectives established by the A/LM Committees.

The Company establishes target asset portfolios for each major insurance product, which represent the investment strategies used to profitably fund

its liabilities within acceptable levels of risk. These strategies include objectives for effective duration, yield curve sensitivity, convexity, liquidity, asset

sector concentration and credit quality. In executing these asset/liability-matching strategies, management regularly re-evaluates the estimates used in

determining the approximate amounts and timing of payments to or on behalf of policyholders for insurance liabilities. Many of these estimates are

inherently subjective and could impact the Company’s ability to achieve its asset/liability management goals and objectives.

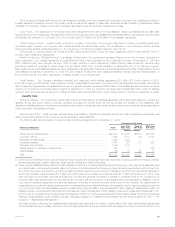

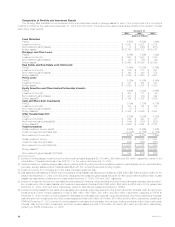

Liquidity

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. The Company’s liquidity position (cash and cash

equivalents and short-term investments, excluding securities lending) was $5.5 billion and $4.5 billion at December 31, 2004 and 2003, respectively.

Liquidity needs are determined from a rolling 12-month forecast by portfolio and are monitored daily. Asset mix and maturities are adjusted based on

forecast. Cash flow testing and stress testing provide additional perspectives on liquidity. The Company believes that it has sufficient liquidity to fund its

cash needs under various scenarios that include the potential risk of early contractholder and policyholder withdrawal. The Company includes provisions

limiting withdrawal rights on many of its products, including general account institutional pension products (generally group annuities, including

guaranteed investment contracts (‘‘GICs’’), and certain deposit funds liabilities) sold to employee benefit plan sponsors. Certain of these provisions

prevent the customer from making withdrawals prior to the maturity date of the product.

In the event of significant unanticipated cash requirements beyond normal liquidity, the Company has multiple liquidity alternatives available based on

market conditions and the amount and timing of the liquidity need. These options include cash flow from operations (insurance premiums, annuity

considerations and deposit funds), borrowings under committed credit facilities, secured borrowings, the ability to issue commercial paper, long-term

debt, capital securities, common equity and, if necessary, the sale of liquid long-term assets.

The Company’s ability to sell investment assets could be limited by accounting rules including rules relating to the intent and ability to hold impaired

securities until the market value of those securities recovers.

In extreme circumstances, all general account assets within a statutory legal entity are available to fund any obligation of the general account within

that legal entity.

Liquidity Sources

Cash Flow from Operations. The Company’s principal cash inflows from its insurance activities come from insurance premiums, annuity considera-

tions and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and policyholder withdrawal. The

Company includes provisions limiting withdrawal rights on many of its products, including general account institutional pension products (generally group

annuities, including GICs and certain deposit fund liabilities) sold to employee benefit plan sponsors.

MetLife, Inc.

18