MetLife 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s principal cash inflows from its investment activities come from repayments of principal, proceeds from maturities and sales of

invested assets and investment income. The primary liquidity concerns with respect to these cash inflows are the risk of default by debtors and market

volatilities. The Company closely monitors and manages these risks through its credit risk management process.

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash, cash

equivalents, short-term investments, marketable fixed maturity and equity securities. Liquid assets exclude assets relating to securities lending and dollar

roll activities. At December 31, 2004 and 2003, the Company had $136 billion and $125 billion in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short- and long-term instruments, including repurchase agreements,

commercial paper, medium- and long-term debt, capital securities and stockholders’ equity. The diversification of the Company’s funding sources

enhances funding flexibility, limits dependence on any one source of funds and generally lowers the cost of funds.

At December 31, 2004 and 2003, the Company had $1.4 billion and $3.6 billion in short-term debt outstanding, and $7.4 billion and $5.7 billion in

long-term debt outstanding, respectively.

MetLife Funding, Inc. (‘‘MetLife Funding’’), a subsidiary of Metropolitan Life, serves as a centralized finance unit for the Company. Pursuant to a

support agreement, the Company has agreed to cause MetLife Funding to have a tangible net worth of at least one dollar. At December 31, 2004 and

2003, MetLife Funding had a tangible net worth of $10.9 million and $10.8 million, respectively. MetLife Funding raises funds from various funding

sources and uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of Metropolitan Life, to the Holding Company,

Metropolitan Life and other affiliates. MetLife Funding manages its funding sources to enhance the financial flexibility and liquidity of Metropolitan Life and

other affiliated companies. At December 31, 2004 and 2003, MetLife Funding had total outstanding liabilities, including accrued interest payable, of

$1,448 million and $1,042 million, respectively, consisting primarily of commercial paper.

Credit Facilities. The Company maintains committed and unsecured credit facilities aggregating $2.8 billion ($1.1 billion expiring in 2005,

$175 million expiring in 2006 and $1.5 billion expiring in 2009). If these facilities were drawn upon, they would bear interest at varying rates in accordance

with the respective agreements. The facilities can be used for general corporate purposes and $2.5 billion of the facilities also serve as back-up lines of

credit for the Company’s commercial paper programs. At December 31, 2004, the Company had drawn approximately $56 million under the facilities

expiring in 2005 at interest rates ranging from 5.44% to 6.38% and approximately $50 million under a facility expiring in 2006 at an interest rate of 2.99%.

Liquidity Uses

Insurance Liabilities. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance, property and

casualty, annuity and group pension products, operating expenses and income taxes, as well as principal and interest on its outstanding debt

obligations. Liabilities arising from its insurance activities primarily relate to benefit payments under the aforementioned products, as well as payments for

policy surrenders, withdrawals and loans.

Investment and Other. Additional cash outflows include those related to obligations of securities lending and dollar roll activities, investments in real

estate, limited partnerships and joint ventures, as well as litigation-related liabilities.

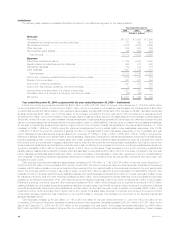

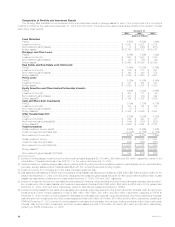

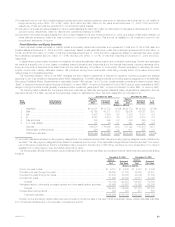

The following table summarizes the Company’s major contractual obligations as of December 31, 2004:

Payments Due By Period

Less Than Three to More than

Contractual Obligations Total Three Years Five Years Five Years

(Dollars in millions)

Other long-term liabilities(1)(2) *************************************************** $80,167 $ 9,408 $8,901 $61,858

Long-term debt(3) ************************************************************ 7,368 2,110 104 5,154

Partnership investments(4) ***************************************************** 1,324 1,324 — —

Operating leases(5) *********************************************************** 1,084 347 317 420

Mortgage commitments******************************************************** 1,189 1,189 — —

Shares subject to mandatory redemption(3) *************************************** 350 — — 350

Capital leases **************************************************************** 66 18 35 13

Total************************************************************************ $91,548 $14,396 $9,357 $67,795

(1) Other long-term liabilities include various investment-type products with contractually scheduled maturities, including guaranteed interest contracts,

structured settlements, pension closeouts, certain annuity policies and certain indemnities.

(2) Other long-term liabilities include benefit and claim liabilities for which the Company believes the amount and timing of the payment is essentially fixed

and determinable. Such amounts generally relate to (i) policies or contracts where the Company is currently making payments and will continue to do

so until the occurrence of a specific event, such as death and (ii) life insurance and property and casualty incurred and reported claims. Liabilities for

future policy benefits of approximately $71.5 billion and policyholder account balances of approximately $77.8 billion at December 31, 2004, have

been excluded from this table. Amounts excluded from the table are generally comprised of policies or contracts where (i) the Company is not

currently making payments and will not make payments in the future until the occurrence of an insurable event, such as death or disability or (ii) the

occurrence of a payment triggering event, such as a surrender of a policy or contract, is outside of the control of the Company. The determination of

these liability amounts and the timing of payment are not reasonably fixed and determinable since the insurable event or payment triggering event has

not yet occurred. Such excluded liabilities primarily represent future policy benefits of approximately $60.3 billion relating to traditional life, health and

disability insurance products and policyholder account balances of approximately $29.3 billion relating to deferred annuities, approximately $21.8 bil-

lion for group and universal life products and approximately $13.8 billion for funding agreements without fixed maturity dates. Significant uncertainties

relating to these liabilities include mortality, morbidity, expenses, persistency, investment returns, inflation and the timing of payments. See ‘‘— The

Company — Asset/Liability Management.’’

Amounts included in other long-term liabilities reflect estimated cash payments to be made to policyholders. Such cash outflows reflect adjustments

for the estimated timing of mortality, retirement, and other appropriate factors, but are undiscounted with respect to interest. The amount shown in the

MetLife, Inc. 19