MetLife 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Summary

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted above in connection with specific matters. In some of the matters referred to above, very large and/or indeterminate

amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that an adverse outcome in certain

cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known by the Company’s

management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the

large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome

in certain matters could, from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly

or annual periods.

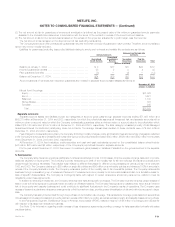

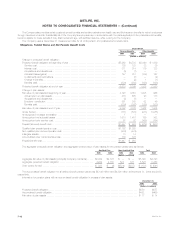

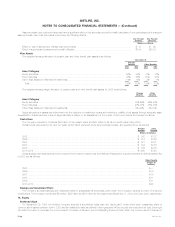

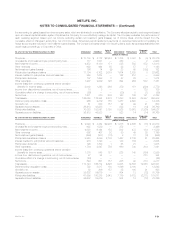

Leases

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants is contingent upon the level of the

tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, data

processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments relating to these lease agreements

were as follows:

Gross

Rental Sublease Rental

Income Income Payments

(Dollars in millions)

2005 *************************************************************************** $ 603 $19 $184

2006 *************************************************************************** $ 582 $19 $163

2007 *************************************************************************** $ 541 $13 $137

2008 *************************************************************************** $ 465 $10 $103

2009 *************************************************************************** $ 400 $ 4 $ 77

Thereafter *********************************************************************** $2,332 $12 $420

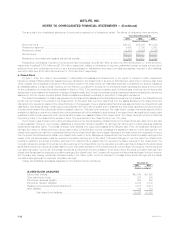

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were approximately $1,324 million and $1,380 million at December 31, 2004 and 2003, respectively. The Company anticipates that these

amounts will be invested in the partnerships over the next three to five years.

Guarantees

In the course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which it may

be required to make payments now or in the future.

In the context of acquisition, disposition, investment and other transactions, the Company has provided indemnities and guarantees, including those

related to tax, environmental and other specific liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of

representations, warranties or covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifica-

tions to counterparties in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third party lawsuits. These

obligations are often subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of law, such as

applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is subject to a contractual

limitation ranging from less than $1 million to $800 million, while in other cases such limitations are not specified or applicable. Since certain of these

obligations are not subject to limitations, the Company does not believe that it is possible to determine the maximum potential amount due under these

guarantees in the future.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies other of its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to limitation

with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount due under these

indemnities in the future.

During the year ended December 31, 2004, the Company recorded liabilities of $10 million with respect to indemnities provided in certain

dispositions. The approximate term for these liabilities ranges from 12 to 18 months. The maximum potential amount of future payments that MetLife

could be required to pay is $73 million. Due to the uncertainty in assessing changes to the liabilities over the term, the liability on the balance sheet will

remain until either expiration or settlement of the guarantee unless evidence clearly indicates that the estimates should be revised. The fair value of the

remaining indemnities, guarantees and commitments entered into during 2004 was insignificant and thus, no liabilities were recorded. The Company’s

recorded liability at December 31, 2004 and 2003 for indemnities, guarantees and commitments, excluding amounts recorded during 2004 as

described in the preceding sentences, is insignificant.

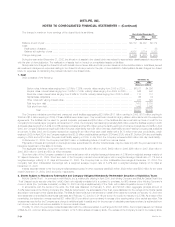

In conjunction with replication synthetic asset transactions, as described in Note 3, the Company writes credit default swap obligations requiring

payment of principal due in exchange for the reference credit obligation, depending on the nature or occurrence of specified credit events for the

referenced entities. In the event of a specified credit event, the Company’s maximum amount at risk, assuming the value of the referenced credits

become worthless, is $1.1 billion at December 31, 2004. The credit default swaps expire at various times during the next seven years.

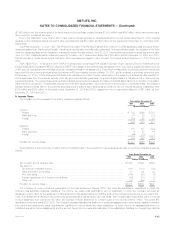

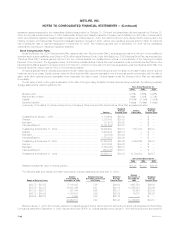

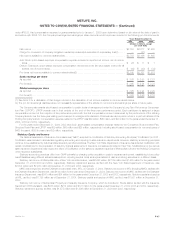

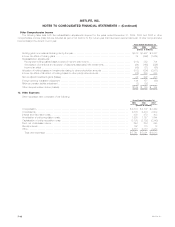

11. Employee Benefit Plans

Pension Benefit and Other Benefit Plans

The Company is both the sponsor and administrator of defined benefit pension plans covering eligible employees and sales representatives of the

Company. Retirement benefits are based upon years of credited service and final average or career average earnings history.

MetLife, Inc. F-41