MetLife 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

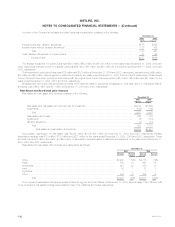

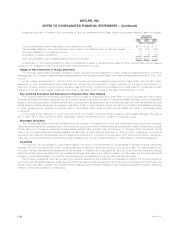

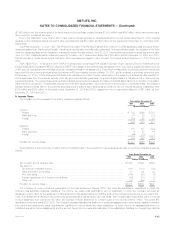

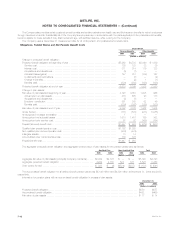

The amounts in the consolidated statements of income are presented net of reinsurance ceded. The effects of reinsurance were as follows:

Years Ended December 31,

2004 2003 2002

(Dollars in millions)

Direct premiums ************************************************************************ $20,237 $19,396 $18,439

Reinsurance assumed ******************************************************************* 4,492 3,706 2,993

Reinsurance ceded ********************************************************************* (2,413) (2,429) (2,355)

Net premiums ************************************************************************** $22,316 $20,673 $19,077

Reinsurance recoveries netted against policyholder benefits ************************************ $ 2,046 $ 2,417 $ 2,886

Reinsurance recoverables, included in premiums and other receivables, were $3,965 million and $4,014 million at December 31, 2004 and 2003,

respectively, including $1,302 million and $1,341 million, respectively, relating to reinsurance of long-term guaranteed interest contracts and structured

settlement lump sum contracts accounted for as a financing transaction. Reinsurance and ceded commissions payables, included in other liabilities,

were $78 million and $106 million at December 31, 2004 and 2003, respectively.

6. Closed Block

On April 7, 2000 (the ‘‘date of demutualization’’), Metropolitan Life established a closed block for the benefit of holders of certain individual life

insurance policies of Metropolitan Life. Assets have been allocated to the closed block in an amount that has been determined to produce cash flows

which, together with anticipated revenues from the policies included in the closed block, are reasonably expected to be sufficient to support obligations

and liabilities relating to these policies, including, but not limited to, provisions for the payment of claims and certain expenses and taxes, and to provide

for the continuation of policyholder dividend scales in effect for 1999, if the experience underlying such dividend scales continues, and for appropriate

adjustments in such scales if the experience changes. At least annually, the Company compares actual and projected experience against the experience

assumed in the then-current dividend scales. Dividend scales are adjusted periodically to give effect to changes in experience.

The closed block assets, the cash flows generated by the closed block assets and the anticipated revenues from the policies in the closed block will

benefit only the holders of the policies in the closed block. To the extent that, over time, cash flows from the assets allocated to the closed block and

claims and other experience related to the closed block are, in the aggregate, more or less favorable than what was assumed when the closed block was

established, total dividends paid to closed block policyholders in the future may be greater than or less than the total dividends that would have been paid

to these policyholders if the policyholder dividend scales in effect for 1999 had been continued. Any cash flows in excess of amounts assumed will be

available for distribution over time to closed block policyholders and will not be available to stockholders. If the closed block has insufficient funds to make

guaranteed policy benefit payments, such payments will be made from assets outside of the closed block. The closed block will continue in effect as

long as any policy in the closed block remains in-force. The expected life of the closed block is over 100 years.

The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the date

of demutualization. However, the Company establishes a policyholder dividend obligation for earnings that will be paid to policyholders as additional

dividends as described below. The excess of closed block liabilities over closed block assets at the effective date of the demutualization (adjusted to

eliminate the impact of related amounts in accumulated other comprehensive income) represents the estimated maximum future earnings from the

closed block expected to result from operations attributed to the closed block after income taxes. Earnings of the closed block are recognized in income

over the period the policies and contracts in the closed block remain in-force. Management believes that over time the actual cumulative earnings of the

closed block will approximately equal the expected cumulative earnings due to the effect of dividend changes. If, over the period the closed block

remains in existence, the actual cumulative earnings of the closed block is greater than the expected cumulative earnings of the closed block, the

Company will pay the excess of the actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders

as additional policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the expected

cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual cumulative earnings of the

closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only the actual earnings in income. However,

the Company may change policyholder dividend scales in the future, which would be intended to increase future actual earnings until the actual

cumulative earnings equal the expected cumulative earnings.

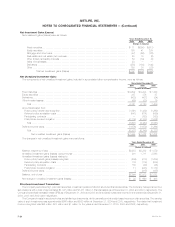

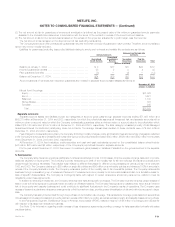

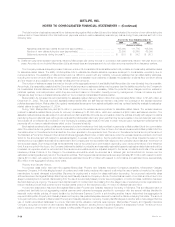

Closed block liabilities and assets designated to the closed block are as follows:

December 31,

2004 2003

(Dollars in millions)

CLOSED BLOCK LIABILITIES

Future policy benefits ************************************************************************ $42,348 $41,928

Other policyholder funds ********************************************************************* 258 260

Policyholder dividends payable **************************************************************** 690 682

Policyholder dividend obligation **************************************************************** 2,243 2,130

Payables under securities loaned transactions *************************************************** 4,287 6,418

Other liabilities ****************************************************************************** 199 180

Total closed block liabilities *********************************************************** 50,025 51,598

MetLife, Inc.

F-32