MetLife 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total revenues, excluding net investment gains (losses), increased by $822 million, or 26%, to $4,012 million for the year ended December 31,

2004 from $3,190 million for the comparable 2003 period due primarily to a $699 million increase in premiums. The premium increase during the year

ended December 31, 2004 is partially the result of RGA’s coinsurance agreement with Allianz Life under which RGA assumed 100% of Allianz Life’s

United States traditional life reinsurance business. This transaction closed during 2003, with six months of reinsurance activity recorded in 2003, as

compared to twelve months in 2004. New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business in the

United States and certain international operations also contributed to the premium growth. Premium levels are significantly influenced by large

transactions, such as the Allianz Life transaction, and reporting practices of ceding companies, and as a result, can fluctuate from period to period. Net

investment income also contributed to revenue growth, increasing $115 million, or 24%, to $588 million in 2004 from $473 million in 2003. The growth in

net investment income is the result of the growth in RGA’s operations and asset base, as well as the conversion of a large reinsurance treaty from a funds

withheld to coinsurance basis which resulted in an increase of $12 million in net investment income.

Total expenses increased by $840 million, or 27%, to $3,921 million for the year ended December 31, 2004 from $3,081 million for the comparable

2003 period. This increase is commensurate with the growth in revenues and is primarily attributable to an increase of $617 million in policyholder

benefits and claims and interest credited to policyholder account balances, primarily associated with RGA’s growth in insurance in force of approximately

$200 billion, a negotiated claim settlement in RGA’s accident and health business of $24 million, and the inclusion of only six months of results from the

Allianz Life transaction in the prior year. Also, during the fourth quarter of 2004, RGA recorded approximately $18 million in policy benefits and claims as a

result of the Indian Ocean tsunami on December 26, 2004 and claims development associated with its reinsurance of Argentine pension business. Other

expenses increased primarily due to an increase of $106 million in allowances and related expenses on assumed reinsurance associated with RGA’s

growth in premiums and insurance in force and $15 million in additional amortization of DAC from the conversion of a large reinsurance treaty from a

funds withheld to coinsurance basis. The balance of the growth in other expenses is primarily due to the aforementioned increase in minority interest

expense from $114 million in 2003 to $161 million in 2004.

Year ended December 31, 2003 compared with the year ended December 31, 2002 — Reinsurance

Net income increased by $8 million, or 10%, to $92 million for the year ended December 31, 2003 from $84 million for the comparable 2002 period.

The increase in earnings year over year is primarily attributable to new business growth, additional renewal premiums, as well as a large coinsurance

agreement with Allianz Life under which RGA assumed 100% of Allianz Life’s U.S. traditional life reinsurance business.

Total revenues, excluding net investment gains and losses, increased by $721 million, or 29%, to $3,190 million for the year ended December 31,

2003 from $2,469 million for the comparable 2002 period. This increase is primarily due to new premiums from facultative and automatic treaties and

renewal premiums on existing blocks of business, particularly in the United States and United Kingdom reinsurance operations. In addition, there was a

$252 million increase in revenues due to the transaction with Allianz Life in late 2003.

Total expenses increased by $742 million, or 32%, to $3,081 million for the year ended December 31, 2003 from $2,339 million for the comparable

2002 period. This increase is consistent with the growth in revenues and is primarily attributable to policyholder benefits and claims and allowances paid

on assumed reinsurance, particularly on certain higher commission business in the United Kingdom. The aforementioned transaction with Allianz Life

contributed $242 million to this increase.

Corporate & Other

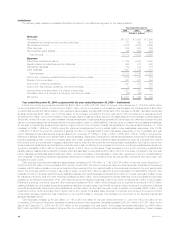

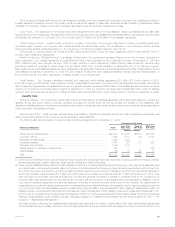

The following table presents consolidated financial information for the Corporate & Other for the years indicated:

Year Ended December 31,

2004 2003 2002

(Dollars in millions)

Revenues

Premiums ***************************************************************************** $ (9) $ (18) $ (19)

Universal life and investment-type product policy fees***************************************** 2——

Net investment income ****************************************************************** 472 184 (22)

Other revenues ************************************************************************* 73956

Net investment gains (losses) ************************************************************* (152) (6) (56)

Total revenues********************************************************************** 320 199 (41)

Expenses

Policyholder benefits and claims*********************************************************** 851 3

Other expenses ************************************************************************ 532 304 726

Total expenses ********************************************************************* 540 355 729

Income (Loss) from continuing operations before income tax benefit***************************** (220) (156) (770)

Income tax benefit ********************************************************************** (239) (193) (329)

Income (Loss) from continuing operations *************************************************** 19 37 (441)

Income from discontinued operations, net of income taxes ************************************ 123 273 161

Income (Loss) before cumulative effect of a change in accounting ****************************** 142 310 (280)

Cumulative effect of a change in accounting, net of income taxes ****************************** (1) — —

Net income (loss) *********************************************************************** $ 141 $ 310 $(280)

Year ended December 31, 2004 compared with the year ended December 31, 2003 — Corporate & Other

Income (Loss) from continuing operations decreased by $18 million, or 49%, to $19 million for the year ended December 31, 2004 from $37 million

for the comparable 2003 period. The 2004 period includes a $105 million benefit associated with the resolution of issues relating to the Internal Revenue

Service’s audit of Metropolitan Life’s and its subsidiaries’ tax returns for the years 1997-1999. Also included in the 2004 year is an expense related to a

$32 million contribution, net of income taxes, to the MetLife Foundation and a $9 million benefit from a revision of the estimate of income taxes for 2003.

The year ended December 31, 2003 includes a $92 million benefit, net of income taxes, from the reduction of a previously established liability related to

the Company’s race-conscious underwriting settlement, as well as a $36 million benefit from a revision of the estimate of income taxes for 2002.

MetLife, Inc.

16