MetLife 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

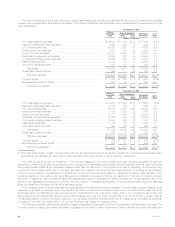

The table below provides additional detail regarding the potential loss in fair value of the Company’s interest sensitive financial instruments at

December 31, 2004 by type of asset or liability.

As of December 31, 2004

Assuming a

10% increase

Notional in the yield

Amount Fair Value curve

(Dollars in millions)

Assets

Fixed maturities *********************************************************************** $ — $176,763 $(3,651)

Mortgage loans on real estate *********************************************************** — 33,902 (534)

Equity securities*********************************************************************** — 2,188 —

Short-term investments***************************************************************** — 2,663 6

Cash and cash equivalents ************************************************************* — 4,051 —

Policy loans ************************************************************************** — 8,899 (290)

Mortgage loan commitments ************************************************************ 1,189 4 (5)

Total assets ********************************************************************** $(4,474)

Liabilities

Policyholder account balances ********************************************************** $ — $ 69,688 $ 450

Short-term debt *********************************************************************** — 1,445 —

Long-term debt *********************************************************************** — 7,818 264

Shares subject to mandatory redemption************************************************** $ — $ 365 $ 1

Payable under securities loaned transactions*********************************************** — 28,678 —

Total liabilities ********************************************************************* $ 715

Other

Derivative instruments (designated hedges or otherwise)

Swaps **************************************************************************** $22,792 $ (884) $ 95

Futures **************************************************************************** 611 (13) 8

Forwards ************************************************************************** 1,339 (52) —

Options**************************************************************************** 17,514 80 6

Total other *********************************************************************** $ 109

Net change ************************************************************************* $(3,650)

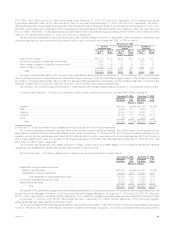

In addition to the analysis discussed above, the Company also performs an analysis of the sensitivity of its insurance and interest sensitive liabilities

to changes in interest rates as a part of its asset liability management program. As of December 31, 2004, a hypothetical instantaneous 10% decrease in

interest rates applied to the Company’s insurance and interest sensitive liabilities and their associated operating asset portfolios would reduce the fair

value of equity by $227 million. Management does not expect that this sensitivity would produce a liquidity strain on the Company.

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

None.

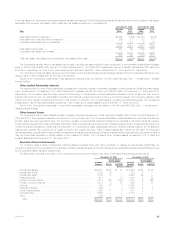

Management’s Annual Report on Internal Control Over Financial Reporting

Management of MetLife, Inc. and subsidiaries is responsible for establishing and maintaining adequate internal control over financial reporting. In

fulfilling this responsibility, estimates and judgments by management are required to assess the expected benefits and related costs of control

procedures. The objectives of internal control include providing management with reasonable, but not absolute, assurance that assets are safeguarded

against loss from unauthorized use or disposition, and that transactions are executed in accordance with management’s authorization and recorded

properly to permit the preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of

America.

Financial management has documented and evaluated the effectiveness of the internal control of the Company as of December 31, 2004 pertaining

to financial reporting in accordance with the criteria established in ‘‘Internal Control — Integrated Framework’’ issued by the Committee of Sponsoring

Organizations of the Treadway Commission.

In the opinion of management, MetLife, Inc. maintained effective internal control over financial reporting as of December 31, 2004.

Deloitte & Touche LLP, an independent registered public accounting firm, has audited the consolidated financial statements and consolidated

financial statement schedules included in the Annual Report on Form 10-K for the year ended December 31, 2004. The Report of the Independent

Registered Public Accounting Firm on their audit of management’s assessment of the Company’s internal control over financial reporting and their audit

on the effectiveness of the Company’s internal control over financial reporting is included at page F-2. The Report of the Independent Registered Public

Accounting Firm on their audit of the consolidated financial statements is included at page F-3.

MetLife, Inc.

40