MetLife 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

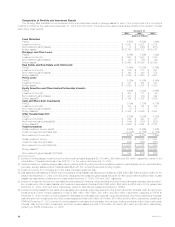

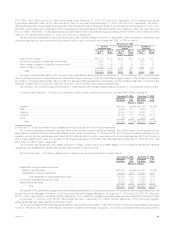

The following table summarizes the 2004, 2003 and 2002 repurchase activity, which includes the accelerated share repurchase activity in the fourth

quarter of 2004:

December 31,

2004 2003 2002

(Dollars in millions)

Shares Repurchased*************************************************** 26,373,952 2,997,200 15,244,492

Cost **************************************************************** $ 1,000 $ 97 $ 471

At December 31, 2004, the Holding Company had approximately $710 million remaining on its existing share repurchase program. As a result of the

Holding Company’s agreement to acquire Travelers from Citigroup, the Holding Company has suspended its share repurchase activity.

In the fourth quarter of 2003, RGA offered to the public 12,075,000 shares of its common stock at $36.65 per share. MetLife and its affiliates

purchased 3,000,000 shares of the common stock offered by RGA. As a result of this offering, MetLife’s ownership percentage of outstanding shares of

RGA common stock was reduced from approximately 59% at December 31, 2002 to approximately 52% at December 31, 2003. MetLife’s ownership

percentage of the outstanding shares of RGA common stock remains approximately 52% at December 31, 2004.

Letters of Credit. At December 31, 2004 and 2003, the Holding Company had outstanding $369 million and $206 million, respectively, in the

letters of credit from various banks, all of which expire within one year. Since commitments associated with letters of credit and financing arrangements

may expire unused, these amounts do not necessarily reflect the actual future cash funding requirements.

Support Agreements. In 2002, the Holding Company entered into a net worth maintenance agreement with three of its insurance subsidiaries,

MetLife Investors Insurance Company, First MetLife Investors Insurance Company and MetLife Investors Insurance Company of California. Under the

agreements, as subsequently amended, the Holding Company agreed, without limitation as to the amount, to cause each of these subsidiaries to have a

minimum capital and surplus of $10 million, total adjusted capital at a level not less than 150% of the company action level RBC, as defined by state

insurance statutes, and liquidity necessary to enable it to meet its current obligations on a timely basis. At December 31, 2004, the capital and surplus of

each of these subsidiaries is in excess of the minimum capital and surplus amounts referenced above, and their total adjusted capital was in excess of

the most recent referenced RBC-based amount calculated at December 31, 2004.

Based on management’s analysis and comparison of its current and future cash inflows from the dividends it receives from subsidiaries, including

Metropolitan Life, that are permitted to be paid without prior insurance regulatory approval and its portfolio of liquid assets and other anticipated cash

flows, management believes there will be sufficient liquidity to enable the Holding Company to make payments on debt, make cash dividend payments

on its common stock, contribute capital to its subsidiaries, pay all operating expenses, and meet its cash needs.

Subsequent Events. On January 31, 2005, the Holding Company entered into an agreement to acquire all of the outstanding shares of capital

stock of certain indirect subsidiaries of Citigroup Inc., including the majority of Travelers, and substantially all of Citigroup Inc.’s international insurance

businesses for a purchase price of $11.5 billion, subject to adjustment as described in the acquisition agreement. As a condition to closing, Citigroup Inc.

and the Holding Company will enter into ten-year agreements under which the Company will expand its distribution by making products available through

certain Citigroup distribution channels, subject to appropriate suitability and other standards. The transaction is expected to close in the summer of 2005.

Approximately $1 billion to $3 billion of the purchase price will be paid in MetLife stock with the remainder paid in cash which will be financed through a

combination of cash on hand, debt, mandatorily convertible securities and selected asset sales depending on market conditions, timing, valuation

considerations and the relative attractiveness of funding alternatives.

The Company has entered into brokerage agreements relating to the possible sale of two of its real estate investments, 200 Park Avenue and One

Madison Avenue in New York City. The Company is also contemplating other asset sales, including selling some or all of its beneficially owned shares in

RGA.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or

failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the

proportionate share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some

states permit member insurers to recover assessments paid through full or partial premium tax offsets. Assessments levied against the Company from

January 1, 2001 through December 31, 2004 aggregated $20 million. The Company maintained a liability of $73 million at December 31, 2004 for future

assessments in respect of currently impaired, insolvent or failed insurers.

In the past five years, none of the aggregate assessments levied against MetLife’s insurance subsidiaries has been material. The Company has

established liabilities for guaranty fund assessments that it considers adequate for assessments with respect to insurers that are currently subject to

insolvency proceedings.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as inflation may affect

interest rates.

Application of Recent Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (‘‘FASB’’) issued Staff Position Paper (‘‘FSP’’) 109-2, Accounting and Disclosure

Guidance for the Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004 (‘‘AJCA’’). The AJCA introduced a one-time

dividend received deduction on the repatriation of certain earnings to a U.S. taxpayer. FSP 109-2 provides companies additional time beyond the

financial reporting period of enactment to evaluate the effects of the AJCA on their plans to repatriate foreign earnings for purposes of applying SFAS 109,

Accounting for Income Taxes. The Company is currently evaluating the repatriation provision of the AJCA. If the repatriation provision is implemented by

the Company, the impact on the Company’s income tax expense and deferred income tax assets and liabilities would be immaterial.

In December 2004, the FASB issued SFAS No. 153 Exchange of Nonmonetary Assets, an amendment of Accounting Principles Board (‘‘APB’’)

Opinion No. 29 (‘‘SFAS 153’’). SFAS 153 amends prior guidance to eliminate the exception for nonmonetary exchanges of similar productive assets and

MetLife, Inc.

24